Nebraska Resale or Exempt Sale Certificate FORM for Sales Tax Exemption 13 2022-2026

Understanding the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

The Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13 is a crucial document used by businesses in Nebraska to claim sales tax exemptions on certain purchases. This form allows eligible buyers to purchase items without paying sales tax, provided they meet specific criteria. The certificate is typically utilized by wholesalers, retailers, and other entities that resell goods or services. Understanding the purpose and requirements of this form is essential for businesses looking to optimize their tax obligations.

Steps to Complete the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

Completing the Nebraska Resale or Exempt Sale Certificate Form involves several key steps to ensure accuracy and compliance. Start by entering your business information, including the name, address, and sales tax identification number. Next, specify the type of exemption being claimed, whether for resale or another qualifying reason. It is important to provide a detailed description of the goods or services being purchased. Finally, sign and date the form, certifying that the information provided is accurate and that the purchase meets the exemption criteria.

Legal Use of the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

The legal use of the Nebraska Resale or Exempt Sale Certificate Form is governed by state tax laws. Businesses must ensure that they only use the form for qualifying purchases. Misuse of the certificate can lead to penalties, including back taxes and fines. It is essential for businesses to maintain accurate records of transactions involving the use of this form to demonstrate compliance during audits or inspections by state tax authorities.

Eligibility Criteria for the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

To be eligible for using the Nebraska Resale or Exempt Sale Certificate Form, businesses must meet specific criteria. Generally, only those engaged in the resale of tangible personal property or certain services qualify for the exemption. Additionally, the purchaser must possess a valid Nebraska sales tax permit. It is advisable for businesses to review the state guidelines to confirm eligibility before utilizing the form.

Examples of Using the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

There are various scenarios in which the Nebraska Resale or Exempt Sale Certificate Form can be effectively used. For instance, a retailer purchasing inventory for resale can present this form to suppliers to avoid paying sales tax on those items. Similarly, a contractor purchasing materials for a project that will be billed to a client may also use the form to claim an exemption. Understanding these examples can help businesses maximize their tax savings while remaining compliant with state regulations.

Form Submission Methods for the Nebraska Resale or Exempt Sale Certificate Form for Sales Tax Exemption 13

The Nebraska Resale or Exempt Sale Certificate Form can be submitted in several ways. Businesses may present the completed form directly to the seller at the time of purchase, ensuring that the seller retains a copy for their records. Alternatively, businesses may choose to send the form via mail or electronically, depending on the seller's preferences. It is important to confirm with the seller regarding their accepted submission methods to ensure proper processing.

Quick guide on how to complete nebraska resale or exempt sale certificate form for sales tax exemption 13

Effortlessly Prepare Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13 with Ease

- Find Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device. Modify and eSign Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13 and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska resale or exempt sale certificate form for sales tax exemption 13

Create this form in 5 minutes!

People also ask

-

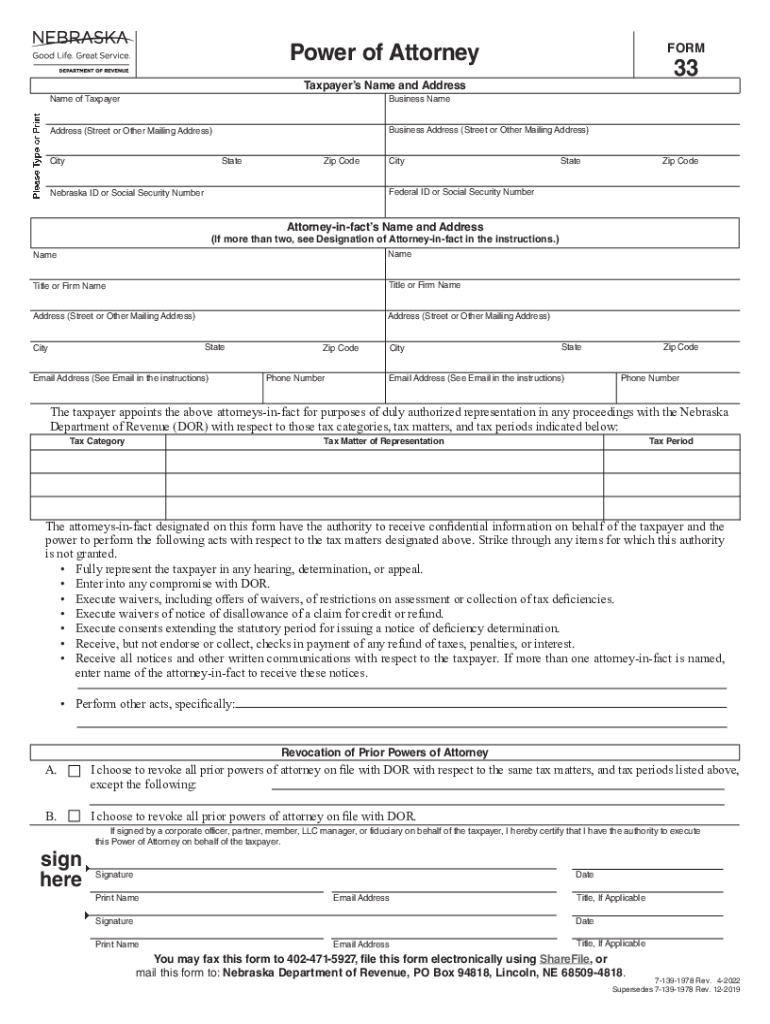

What is Nebraska Form 33, and how can it be used?

Nebraska Form 33 is a crucial document for registering certain financial transactions in Nebraska. Using airSlate SignNow, you can easily fill out and eSign Nebraska Form 33, streamlining your paperwork process and ensuring compliance with state regulations.

-

How does airSlate SignNow simplify the signing process for Nebraska Form 33?

airSlate SignNow simplifies the signing process for Nebraska Form 33 by providing an intuitive platform where multiple parties can securely eSign the document from anywhere. Our customizable templates and real-time notifications ensure that your Nebraska Form 33 gets signed quickly and efficiently.

-

What features does airSlate SignNow offer for managing Nebraska Form 33?

With airSlate SignNow, you can manage Nebraska Form 33 with features such as automated reminders, document tracking, and cloud storage. These tools help you stay organized and keep your documents accessible, making the management of Nebraska Form 33 a breeze.

-

What are the pricing options for airSlate SignNow when dealing with Nebraska Form 33?

airSlate SignNow offers various pricing plans to accommodate different needs, including options that are cost-effective for businesses frequently using Nebraska Form 33. You can choose a plan that best fits your budget and gain access to powerful features designed to make signing documents easy.

-

Can airSlate SignNow integrate with other tools for Nebraska Form 33?

Yes, airSlate SignNow seamlessly integrates with a range of applications, allowing you to manage Nebraska Form 33 alongside your favorite tools. This integration saves time and enhances productivity by ensuring your documents are organized across platforms.

-

What benefits can I expect when using airSlate SignNow for Nebraska Form 33?

By using airSlate SignNow for Nebraska Form 33, you can expect benefits such as enhanced security, faster turnaround times, and reduced paperwork. This user-friendly solution helps businesses streamline their documentation process while maintaining compliance with Nebraska regulations.

-

Is airSlate SignNow mobile-friendly for signing Nebraska Form 33?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to eSign Nebraska Form 33 from your smartphone or tablet. This flexibility enables you to manage your documents on-the-go, making the signing process more convenient.

Get more for Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13

Find out other Nebraska Resale Or Exempt Sale Certificate FORM For Sales Tax Exemption 13

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure