Form or LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

What is the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

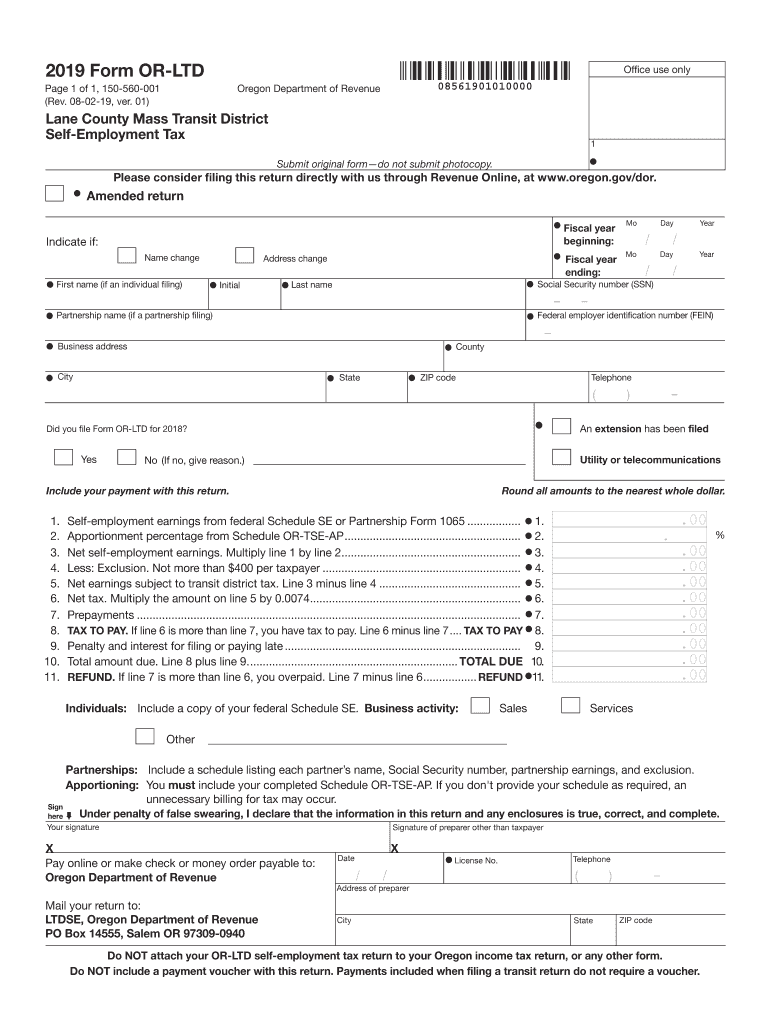

The Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 is a specific tax form utilized by self-employed individuals operating within the Lane County Mass Transit District in Oregon. This form is designed to assess and collect self-employment taxes that contribute to the funding of local transit services. It is essential for those who earn income through self-employment to accurately complete and submit this form to ensure compliance with local tax regulations.

How to use the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

Using the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 involves several straightforward steps. First, gather all necessary financial documentation, including income statements and expense records. Next, accurately fill out the form by reporting your total self-employment income and any applicable deductions. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. This ensures that you meet your tax obligations while also taking advantage of any eligible deductions.

Steps to complete the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

Completing the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including records of income and expenses.

- Fill in your personal information, such as your name, address, and taxpayer identification number.

- Report your total self-employment income for the tax year.

- Include any eligible deductions related to your business operations.

- Calculate the total self-employment tax owed based on the provided guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

The legal use of the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 is crucial for self-employed individuals. This form must be completed accurately and submitted to comply with local tax laws. Failure to use the form correctly can result in fines or additional tax liabilities. It is important to understand the legal implications of self-employment taxes and to ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 are typically aligned with federal tax deadlines. Self-employed individuals should be aware of the following important dates:

- Tax year end: December 31

- Filing deadline: April 15 of the following year

- Extensions may be available, but must be requested prior to the deadline.

Who Issues the Form

The Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 is issued by the Lane County Mass Transit District. This local government entity is responsible for managing transit services and collecting the necessary taxes to fund these operations. It is important for self-employed individuals to obtain the form directly from the district to ensure they are using the most current version and complying with local requirements.

Quick guide on how to complete 2019 form or ltd lane county mass transit district self employment tax 150 560 001

Prepare Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 with ease

- Find Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides expressly for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form or ltd lane county mass transit district self employment tax 150 560 001

Create this form in 5 minutes!

People also ask

-

What is Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001?

Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 is a tax form that self-employed individuals in Lane County must complete to report their income and ensure compliance with local tax regulations. This form helps to calculate the owed self-employment tax for accurate reporting.

-

How can airSlate SignNow help with Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001?

airSlate SignNow provides an efficient platform for sending and eSigning documents related to Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. Users can easily create, upload, and send their tax forms securely, ensuring a streamlined filing process.

-

What features does airSlate SignNow offer for eSigning tax documents?

airSlate SignNow includes features such as customizable templates, mobile access, and advanced security options that enhance the eSigning experience for tax documents like Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. These tools ensure that users can efficiently complete and lodge their forms.

-

Is airSlate SignNow cost-effective for handling tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. With various pricing plans available, users can select options that best fit their needs without compromising on features.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows for seamless integration with various applications, enhancing the workflow for managing Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 and other documents. This capability ensures you can work within your preferred software ecosystem.

-

What are the benefits of using airSlate SignNow for tax forms?

Utilizing airSlate SignNow for tax forms offers numerous advantages, such as increased efficiency, enhanced security, and easy collaboration. For documents related to Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001, the platform makes it simpler to gather signatures and track progress.

-

How secure is the data submitted through airSlate SignNow?

The data submitted through airSlate SignNow is highly secure, employing encryption and strict compliance standards. This security is crucial for sensitive information regarding tax documents like Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001.

Get more for Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

- Request hearing order form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out montana form

- Montana law dissolution form

- Notice of entry of decree montana 497316320 form

- Property manager agreement montana form

- Petition for dissolution with minor children montana form

- Agreement for delayed or partial rent payments montana form

- Montana parenting plan form

Find out other Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement