ARIZONA DEPARTMENT of REVENUE Gao State Az Us 2022

Understanding the Arizona A4 Form

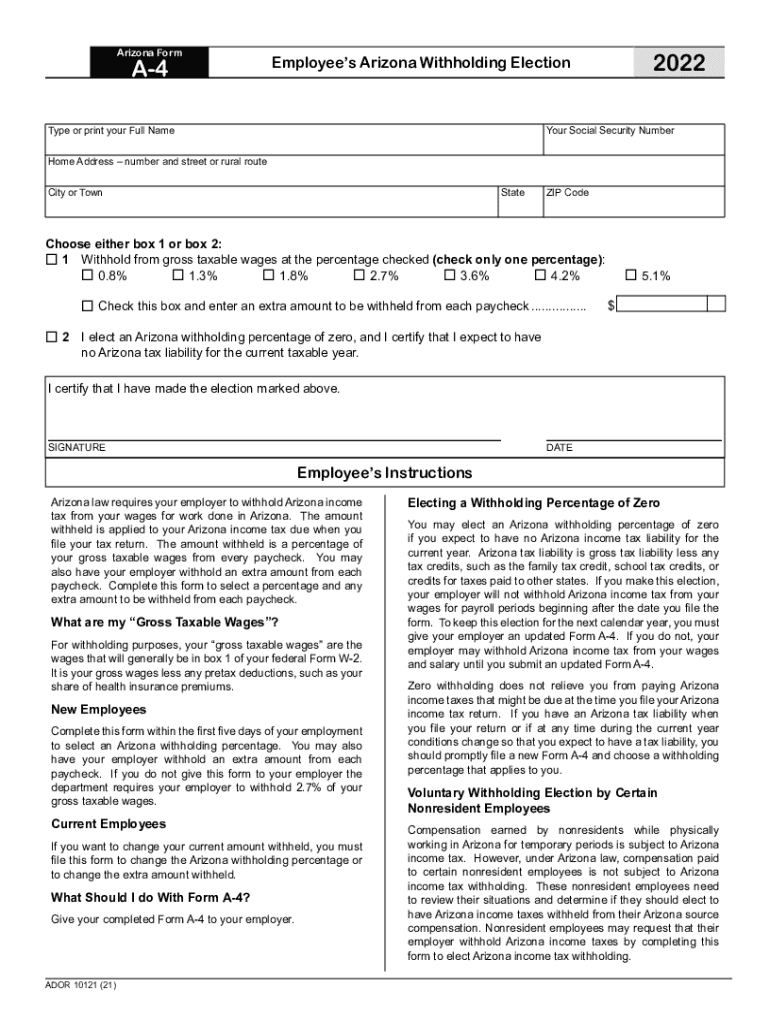

The Arizona A4 form is a crucial document utilized for state income tax withholding. It is primarily used by employers to determine the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with Arizona tax regulations and helps both employers and employees manage their tax obligations effectively.

Steps to Complete the Arizona A4 Form

Completing the Arizona A4 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the number of allowances you are claiming. This will affect the amount withheld from your paycheck.

- Review the instructions provided on the form to ensure accuracy in your entries.

- Sign and date the form to validate your submission.

Legal Use of the Arizona A4 Form

The Arizona A4 form is legally binding when filled out correctly and submitted to the employer. It complies with state tax laws and regulations, ensuring that the correct amount of tax is withheld from employees' wages. Employers must retain this form for their records, as it serves as proof of the employee's withholding preferences.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Arizona A4 form. Typically, employees should submit their A4 form to their employer before the first paycheck of the year to ensure that the correct withholding amounts are applied. Employers are responsible for remitting the withheld taxes to the Arizona Department of Revenue on a regular basis, usually quarterly or annually, depending on their tax obligations.

Form Submission Methods

The Arizona A4 form can be submitted through various methods, providing flexibility for both employees and employers. Common submission methods include:

- Online submission through the employer's payroll system.

- Mailing a hard copy of the completed form to the employer's payroll department.

- In-person delivery to the employer's office.

Key Elements of the Arizona A4 Form

Several key elements are essential to the Arizona A4 form, including:

- Personal information of the employee, such as name and Social Security number.

- Filing status options, which determine tax withholding rates.

- Number of allowances claimed, influencing the amount withheld.

- Signature and date, confirming the accuracy of the information provided.

Quick guide on how to complete arizona department of revenue gaostateazus

Access ARIZONA DEPARTMENT OF REVENUE Gao state az us effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage ARIZONA DEPARTMENT OF REVENUE Gao state az us on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest method to alter and eSign ARIZONA DEPARTMENT OF REVENUE Gao state az us with ease

- Search for ARIZONA DEPARTMENT OF REVENUE Gao state az us and then click Obtain Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Complete button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your selection. Modify and eSign ARIZONA DEPARTMENT OF REVENUE Gao state az us and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona department of revenue gaostateazus

Create this form in 5 minutes!

People also ask

-

What is the Arizona A4 form?

The Arizona A4 form is a state-specific tax form used for employee withholding in Arizona. It's crucial for employers to collect this form from employees to ensure the correct state income tax is withheld from their wages.

-

How can airSlate SignNow help with the Arizona A4 form?

airSlate SignNow allows you to easily create, send, and eSign the Arizona A4 form digitally. This makes the process more efficient and ensures that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Arizona A4 form?

Yes, airSlate SignNow offers various pricing plans that include features for managing forms like the Arizona A4 form. You can choose a plan that fits your business needs and budget, ensuring you get the best value.

-

What are the benefits of using airSlate SignNow for the Arizona A4 form?

Using airSlate SignNow for the Arizona A4 form provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. It also facilitates faster processing times for employee onboarding.

-

Can I integrate airSlate SignNow with other tools for managing the Arizona A4 form?

Absolutely! airSlate SignNow offers integrations with various software tools, allowing for seamless management of the Arizona A4 form within your existing workflows. This helps streamline processes and improve productivity.

-

Is the Arizona A4 form legally valid when signed electronically?

Yes, the Arizona A4 form is legally valid when signed using airSlate SignNow's electronic signature functionality. This complies with electronic signature laws, ensuring your documents are enforceable.

-

How secure is the information on the Arizona A4 form when using airSlate SignNow?

airSlate SignNow uses advanced encryption and security protocols to protect the information on your Arizona A4 form. Your data is kept safe from unauthorized access and is securely stored in compliance with regulations.

Get more for ARIZONA DEPARTMENT OF REVENUE Gao state az us

- Flooring contractor package montana form

- Trim carpentry contractor package montana form

- Fencing contractor package montana form

- Hvac contractor package montana form

- Landscaping contractor package montana form

- Commercial contractor package montana form

- Excavation contractor package montana form

- Renovation contractor package montana form

Find out other ARIZONA DEPARTMENT OF REVENUE Gao state az us

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT