Arizona Department of Revenue AZDORState of Arizona Department of RevenueArizona Department of Revenue AZDOR 2023-2026

Understanding the Arizona Department of Revenue

The Arizona Department of Revenue (AZDOR) is the state agency responsible for administering tax laws and collecting state revenue. It plays a crucial role in ensuring compliance with tax regulations and providing services to taxpayers. The AZDOR oversees various tax types, including income tax, sales tax, and property tax, among others. Understanding its functions can help taxpayers navigate their obligations more effectively.

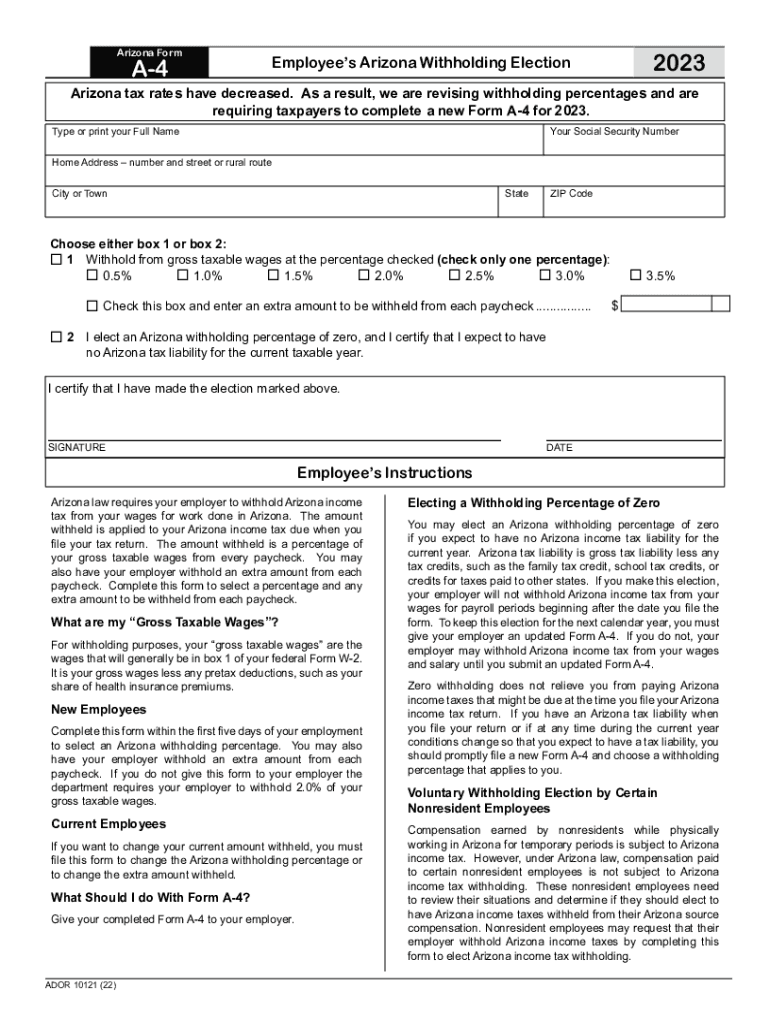

Steps to Complete the A4 2025 Form

Filling out the A4 2025 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your personal details, income information, and any applicable deductions.

- Access the A4 2025 form through the Arizona Department of Revenue's website or authorized platforms.

- Complete the form by entering the required information accurately in each section.

- Review the completed form for any errors or omissions before submitting.

- Submit the form electronically or via mail, ensuring you follow the specific submission guidelines provided by AZDOR.

Filing Deadlines for the A4 2025 Form

It is important to be aware of the filing deadlines for the A4 2025 form to avoid penalties. Generally, the deadline for submitting this form coincides with the annual tax return deadline. For most taxpayers, this is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check the Arizona Department of Revenue's announcements for any updates or changes to deadlines.

Required Documents for the A4 2025 Form

When completing the A4 2025 form, certain documents are necessary to support your claims and ensure accurate reporting. These typically include:

- Your Social Security number or taxpayer identification number.

- W-2 forms from employers showing your income.

- 1099 forms for any additional income sources.

- Documentation for deductions or credits you plan to claim.

Having these documents ready will streamline the process and help prevent delays in processing your form.

Penalties for Non-Compliance with the A4 2025 Form

Failure to file the A4 2025 form on time or inaccuracies in the information provided can result in penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential audits by the Arizona Department of Revenue, leading to further scrutiny of your tax situation.

To avoid these issues, it is advisable to file your form accurately and on time.

Digital vs. Paper Version of the A4 2025 Form

Taxpayers have the option to complete the A4 2025 form either digitally or on paper. The digital version offers several advantages, including:

- Faster processing times, as electronic submissions are typically handled more quickly.

- Reduced risk of errors, with built-in checks and prompts guiding users through the process.

- Convenience, allowing taxpayers to fill out and submit their forms from anywhere with internet access.

While the paper version is still available, opting for the digital format can enhance efficiency and accuracy in tax filing.

Quick guide on how to complete arizona department of revenue azdorstate of arizona department of revenuearizona department of revenue azdor

Complete Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR effortlessly on any gadget

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, amend, and eSign your documents quickly without interruptions. Manage Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to alter and eSign Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR effortlessly

- Locate Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona department of revenue azdorstate of arizona department of revenuearizona department of revenue azdor

Create this form in 5 minutes!

How to create an eSignature for the arizona department of revenue azdorstate of arizona department of revenuearizona department of revenue azdor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work for businesses in Arizona?

airSlate SignNow is a digital solution that allows businesses in Arizona to send, sign, and manage documents electronically. It streamlines the signing process, making it easier for teams to collaborate. With its user-friendly interface and robust features, airSlate SignNow helps organizations optimize their workflow, saving both time and money.

-

What are the pricing plans available for airSlate SignNow in Arizona?

airSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes in Arizona. There are several options ranging from basic to advanced features, allowing businesses to choose what best fits their needs. Additionally, you can enjoy a free trial to explore the platform before committing to a paid plan.

-

What features does airSlate SignNow offer that benefit businesses in Arizona?

airSlate SignNow provides essential features such as customizable templates, real-time tracking, and automated workflows, which are particularly beneficial for Arizona businesses. These tools enhance efficiency and ensure that your documents are managed seamlessly. The software also supports various file formats, making it versatile for different business needs.

-

Can airSlate SignNow integrate with other software used by companies in Arizona?

Yes, airSlate SignNow offers integrations with popular software applications that businesses in Arizona commonly use, such as CRM and project management tools. This allows for smoother operations and increased productivity. By integrating with your existing systems, you can streamline document management and enhance collaboration.

-

How does airSlate SignNow ensure the security of documents for Arizona users?

Security is a top priority for airSlate SignNow, especially for businesses in Arizona handling sensitive documents. The platform employs advanced encryption methods and adheres to strict compliance regulations, ensuring your documents remain confidential and protected. Regular updates and security audits further enhance the safety of your information.

-

Is airSlate SignNow suitable for legal documents in Arizona?

Absolutely! airSlate SignNow is an ideal solution for managing legal documents for businesses in Arizona. It complies with electronic signature laws and provides the necessary tools to ensure that your legal agreements are valid and enforceable. Legal professionals find it particularly useful for streamlining contract management and approvals.

-

What are the benefits of using airSlate SignNow over traditional signing methods in Arizona?

Using airSlate SignNow over traditional signing methods offers numerous benefits for businesses in Arizona, including faster turnaround times and reduced administrative costs. Digital signing minimizes paper usage and maximizes efficiency, allowing teams to focus on what matters most. Additionally, the platform's accessibility enables signing from anywhere at any time.

Get more for Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR

Find out other Arizona Department Of Revenue AZDORState Of Arizona Department Of RevenueArizona Department Of Revenue AZDOR

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile