AZ Form 140 Fill Out Tax Template Online US Legal Forms 2022

Understanding the AZ Form 140

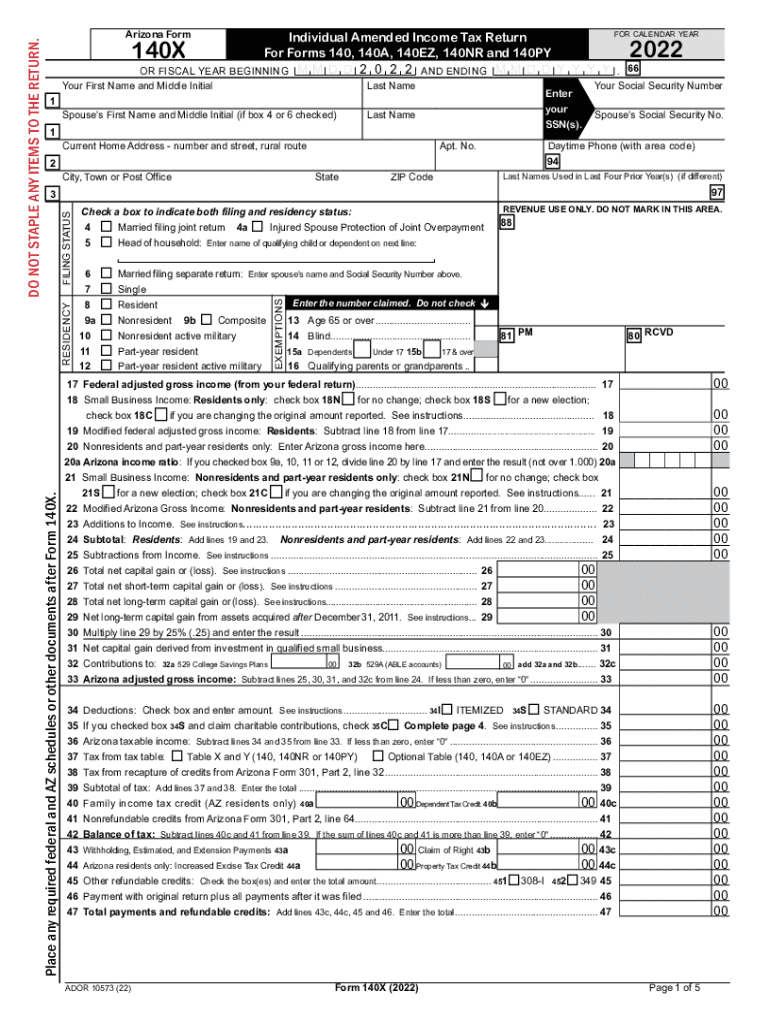

The AZ Form 140 is a critical document for Arizona residents, primarily used for individual income tax filing. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. It is essential for ensuring compliance with state tax laws and for accurately determining the amount owed or the refund due. Understanding the purpose and requirements of the AZ Form 140 is vital for effective tax management.

Steps to Complete the AZ Form 140

Completing the AZ Form 140 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering personal information, income details, and applicable deductions. It is crucial to follow the instructions carefully to avoid errors. After completing the form, review it for accuracy, sign it, and prepare it for submission. Finally, choose your submission method: online, by mail, or in person.

Required Documents for the AZ Form 140

To successfully complete the AZ Form 140, certain documents are required. These include:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of deductible expenses, such as medical costs or charitable contributions

- Any other relevant financial documents

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Legal Use of the AZ Form 140

The AZ Form 140 must be used in compliance with Arizona state tax laws. It serves as a legal declaration of an individual’s income and tax obligations. Properly completing and submitting this form is essential to avoid penalties or legal issues. Additionally, eSignatures are accepted, making it easier to sign and submit the form electronically, provided that the eSignature meets the legal requirements set forth by state regulations.

Filing Deadlines for the AZ Form 140

Filing deadlines for the AZ Form 140 are crucial to avoid late fees and penalties. Typically, the form must be submitted by April 15 of each year. However, if the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing additional time for submission under specific circumstances.

Penalties for Non-Compliance with the AZ Form 140

Failure to file the AZ Form 140 on time or inaccuracies in the submitted information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for taxpayers to understand these consequences and ensure that they meet all filing requirements to maintain compliance with state tax laws.

Quick guide on how to complete az form 140 2020 2022 fill out tax template online us legal forms

Effortlessly Complete AZ Form 140 Fill Out Tax Template Online US Legal Forms on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without any hold-ups. Manage AZ Form 140 Fill Out Tax Template Online US Legal Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to modify and eSign AZ Form 140 Fill Out Tax Template Online US Legal Forms with ease

- Find AZ Form 140 Fill Out Tax Template Online US Legal Forms and click on Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign AZ Form 140 Fill Out Tax Template Online US Legal Forms and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct az form 140 2020 2022 fill out tax template online us legal forms

Create this form in 5 minutes!

People also ask

-

What is the arizona azdor 140x?

The arizona azdor 140x is a versatile digital signature solution that allows businesses to easily send and eSign documents. With its user-friendly interface and robust features, it empowers teams to improve their document workflow efficiently.

-

How does the pricing for the arizona azdor 140x work?

Pricing for the arizona azdor 140x is designed to be flexible and cost-effective. Various plans are available to suit the needs of businesses of all sizes, allowing you to choose the option that best fits your volume of document signing.

-

What are the key features of the arizona azdor 140x?

The arizona azdor 140x includes features such as advanced eSignature capabilities, document templates, and seamless integration with popular tools. It enables businesses to streamline their processes and enhance productivity with ease.

-

What benefits can I expect from the arizona azdor 140x?

Using the arizona azdor 140x offers multiple benefits, including reduced turnaround times for documents, improved security for electronic signatures, and enhanced customer satisfaction. These advantages lead to a smoother transaction process for both businesses and clients.

-

Can the arizona azdor 140x integrate with other software?

Yes, the arizona azdor 140x supports integration with various platforms, making it easy to incorporate into your existing software ecosystem. This ensures a seamless transition and a more cohesive workflow across your business applications.

-

Is the arizona azdor 140x suitable for small businesses?

Absolutely! The arizona azdor 140x is designed to be scalable and incredibly user-friendly, making it an ideal choice for small businesses. Its cost-effective solutions cater specifically to the needs of smaller teams looking to enhance their document signing processes.

-

How secure is the arizona azdor 140x for eSigning?

Security is a top priority for the arizona azdor 140x, which employs advanced encryption and compliance with industry standards. This ensures that your documents and signatures are protected, providing peace of mind for businesses and clients alike.

Get more for AZ Form 140 Fill Out Tax Template Online US Legal Forms

Find out other AZ Form 140 Fill Out Tax Template Online US Legal Forms

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now