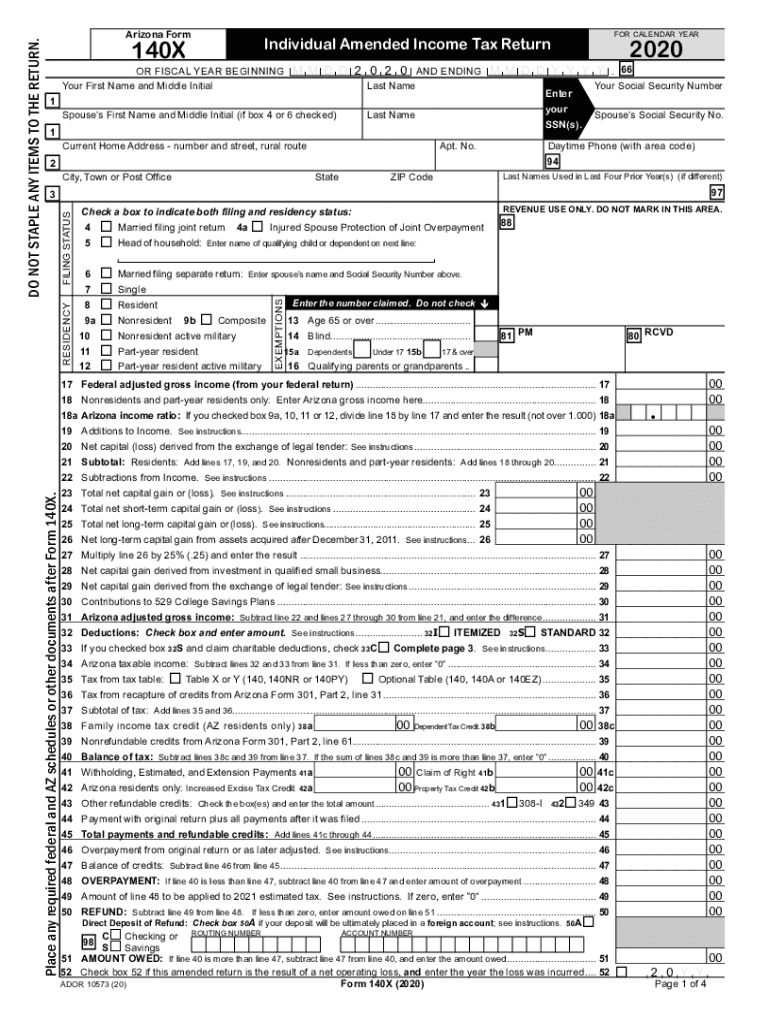

4 Married Filing Joint Return 4a Injured Spouse Protection of Joint Overpayment 2020

Understanding the 4 Married Filing Joint Return and Injured Spouse Protection

The 4 Married Filing Joint Return, specifically the 4a Injured Spouse Protection, is designed to protect a spouse from having their portion of a joint tax refund taken to pay for the other spouse's debts, such as student loans or child support. This provision is crucial for couples who file jointly but may have financial obligations that could jeopardize their tax refund. Understanding this form ensures that both spouses are aware of their rights and protections under tax law.

Steps to Complete the 4 Married Filing Joint Return 4a Injured Spouse Protection

Completing the 4 Married Filing Joint Return with the Injured Spouse Protection involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the joint return accurately, ensuring that both spouses' information is included.

- Complete the 4a form by providing details about the income and tax payments made by both spouses.

- Indicate the portion of the refund that belongs to the injured spouse.

- Review the completed forms for accuracy before submission.

Eligibility Criteria for the 4 Married Filing Joint Return 4a Injured Spouse Protection

To qualify for the Injured Spouse Protection, certain criteria must be met:

- Both spouses must file a joint tax return.

- The injured spouse must have income that is subject to tax.

- The refund being claimed must be due to the injured spouse's income and tax payments.

- The other spouse must have a debt that is eligible for offset, such as federal tax debts or child support obligations.

Required Documents for Filing the 4 Married Filing Joint Return 4a Injured Spouse Protection

When filing the 4 Married Filing Joint Return with the Injured Spouse Protection, specific documents are required:

- Completed joint tax return (Form 1040 or equivalent).

- Form 4a, which details the injured spouse's claim.

- W-2 forms and other income documentation for both spouses.

- Any notices received regarding the offset of the tax refund.

Filing Deadlines for the 4 Married Filing Joint Return 4a Injured Spouse Protection

It is essential to be aware of the filing deadlines to ensure timely submission of the 4 Married Filing Joint Return and the Injured Spouse Protection form. Generally, the deadline for filing a joint return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if an extension is filed, the deadline can be extended to October 15, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods for the 4 Married Filing Joint Return 4a Injured Spouse Protection

The 4 Married Filing Joint Return and the Injured Spouse Protection form can be submitted through various methods:

- Electronically via tax preparation software, which often includes e-filing options.

- By mail, sending the completed forms to the appropriate IRS address based on your state.

- In-person at designated IRS offices, though this option may be limited due to location and availability.

Quick guide on how to complete 4 married filing joint return 4a injured spouse protection of joint overpayment

Complete 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment with ease

- Locate 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4 married filing joint return 4a injured spouse protection of joint overpayment

Create this form in 5 minutes!

How to create an eSignature for the 4 married filing joint return 4a injured spouse protection of joint overpayment

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What are Arizona state income tax forms 2020, and who needs them?

Arizona state income tax forms 2020 are official documents required for residents and businesses to report income and calculate their tax obligations for the year 2020. Individuals earning taxable income need to complete these forms to comply with state tax regulations and ensure accurate reporting.

-

Where can I find Arizona state income tax forms 2020?

You can find Arizona state income tax forms 2020 on the Arizona Department of Revenue's official website. They provide downloadable PDFs that you can fill out and submit, ensuring you have the correct documents for your 2020 tax filing.

-

How can airSlate SignNow help me with Arizona state income tax forms 2020?

airSlate SignNow allows you to easily send, sign, and store your Arizona state income tax forms 2020 electronically. This solution simplifies the process, making it secure and efficient, which is beneficial during tax season.

-

Are there any costs associated with using airSlate SignNow for Arizona state income tax forms 2020?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you're an individual user or a larger organization, you'll find a cost-effective option that allows you to manage your Arizona state income tax forms 2020 seamlessly.

-

What features does airSlate SignNow offer for managing Arizona state income tax forms 2020?

AirSlate SignNow features include customizable templates for Arizona state income tax forms 2020, eSignature capabilities, and document tracking. These tools enhance efficiency and ensure your forms are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software for filing Arizona state income tax forms 2020?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to automate workflows associated with Arizona state income tax forms 2020. This makes organizing and managing your tax documents easier across platforms.

-

What are the benefits of using airSlate SignNow for Arizona state income tax forms 2020?

Using airSlate SignNow for Arizona state income tax forms 2020 offers improved security, time savings, and ease of use. You can complete and send your tax forms without the hassle of printing and mailing, making it a smarter choice for modern tax management.

Get more for 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment

Find out other 4 Married Filing Joint Return 4a Injured Spouse Protection Of Joint Overpayment

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer