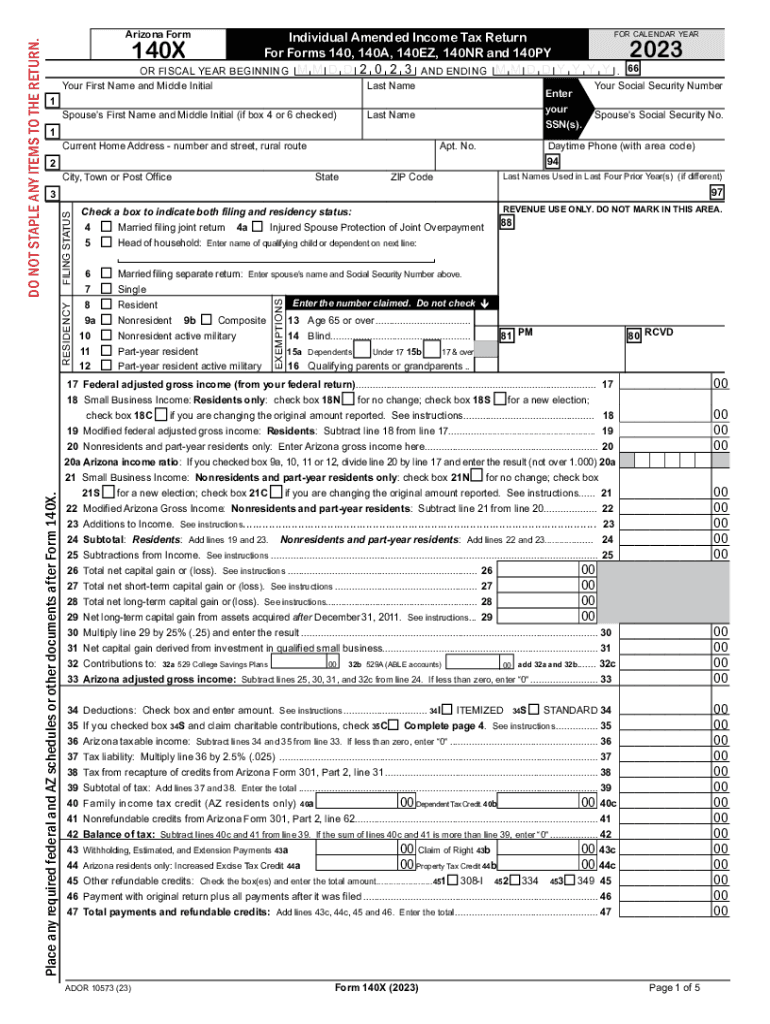

Arizona Form 140X 2023

What is the Arizona Form 140X

The Arizona Form 140X is a tax amendment form used by individuals to correct or amend their previously filed Arizona individual income tax returns. This form is essential for taxpayers who need to make changes to their original Form 140, such as correcting income, deductions, or credits. The 2023 version of this form reflects the latest tax regulations and requirements set forth by the Arizona Department of Revenue.

How to use the Arizona Form 140X

To use the Arizona Form 140X, taxpayers must first ensure that they have their original tax return and any supporting documentation ready. The form allows for various types of amendments, including changes to filing status, income adjustments, and updates to tax credits. After completing the form, it must be submitted to the Arizona Department of Revenue for processing.

Steps to complete the Arizona Form 140X

Completing the Arizona Form 140X involves several key steps:

- Obtain the latest version of the form from the Arizona Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the changes you are making.

- Attach any necessary documentation that supports your amendments.

- Review the form for accuracy before submitting it.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when filing the Arizona Form 140X. Generally, the form must be submitted within three years of the original filing date. However, if the amendment results in a refund, it is advisable to file as soon as possible to ensure timely processing. Key dates include:

- Original return due date

- Deadline for filing amendments for the 2023 tax year

Required Documents

When filing the Arizona Form 140X, certain documents may be required to support the amendments being made. These documents can include:

- Copy of the original tax return

- W-2 forms or 1099s

- Receipts or documentation for any additional deductions or credits

Form Submission Methods

The Arizona Form 140X can be submitted in several ways, providing flexibility for taxpayers. The submission methods include:

- Online through the Arizona Department of Revenue's e-filing system

- By mail to the designated address provided on the form

- In-person at local Arizona Department of Revenue offices

Quick guide on how to complete arizona form 140x

Complete Arizona Form 140X seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the essential tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Arizona Form 140X on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest method to modify and electronically sign Arizona Form 140X effortlessly

- Find Arizona Form 140X and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Arizona Form 140X and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 140x

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 form 140x and how can airSlate SignNow help?

The 2023 form 140x is a crucial document for certain tax amendments. airSlate SignNow streamlines the eSigning process, allowing users to complete and submit the 2023 form 140x quickly and securely, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for the 2023 form 140x?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you're a small business or a larger enterprise, you can access features to manage and eSign the 2023 form 140x without incurring hefty fees, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the 2023 form 140x?

With airSlate SignNow, users can easily create, manage, and electronically sign the 2023 form 140x. Key features include customizable templates, collaboration tools, and secure cloud storage to ensure that your documents are always accessible and safe.

-

Can I integrate airSlate SignNow with my existing software for the 2023 form 140x?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, project management tools, and cloud storage services. This allows you to enhance your workflow when preparing and signing the 2023 form 140x without leaving your familiar software environment.

-

What are the benefits of using airSlate SignNow for the 2023 form 140x?

Using airSlate SignNow for the 2023 form 140x provides numerous benefits including improved efficiency, reduced paperwork, and enhanced security. You can ensure that your documents are signed quickly and stored safely, which saves you time and reduces the risk of errors.

-

Is airSlate SignNow secure for signing the 2023 form 140x?

Absolutely! airSlate SignNow complies with industry standards for data security and uses encryption to protect your documents. This means you can confidently eSign the 2023 form 140x, knowing that your information is safeguarded.

-

What devices can I use to access airSlate SignNow for the 2023 form 140x?

You can access airSlate SignNow from any device that has internet access, including desktops, tablets, and smartphones. This flexibility ensures you can prepare and sign the 2023 form 140x on the go, making it convenient for busy professionals.

Get more for Arizona Form 140X

- A 0546 gf immigration diversit et inclusion qubec form

- Formulaire dengagement renseignements gnraux immigration

- Ciao mondobirra castello form

- Imm 5556 e document checklist worker in itscanadatime form

- Imm 5467 e document checklist atlantic intermediate canadaca form

- Flr 6b 2009 2019 form

- Physiotherapy bill format in word 2015 2019

- Rqe fillable 2010 2018 form

Find out other Arizona Form 140X

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement