Nebraska Certificate of Exemption for Mobility Enhancing FORM Equipment 2022-2026

Understanding the Nebraska Certificate of Exemption for Mobility Enhancing Equipment

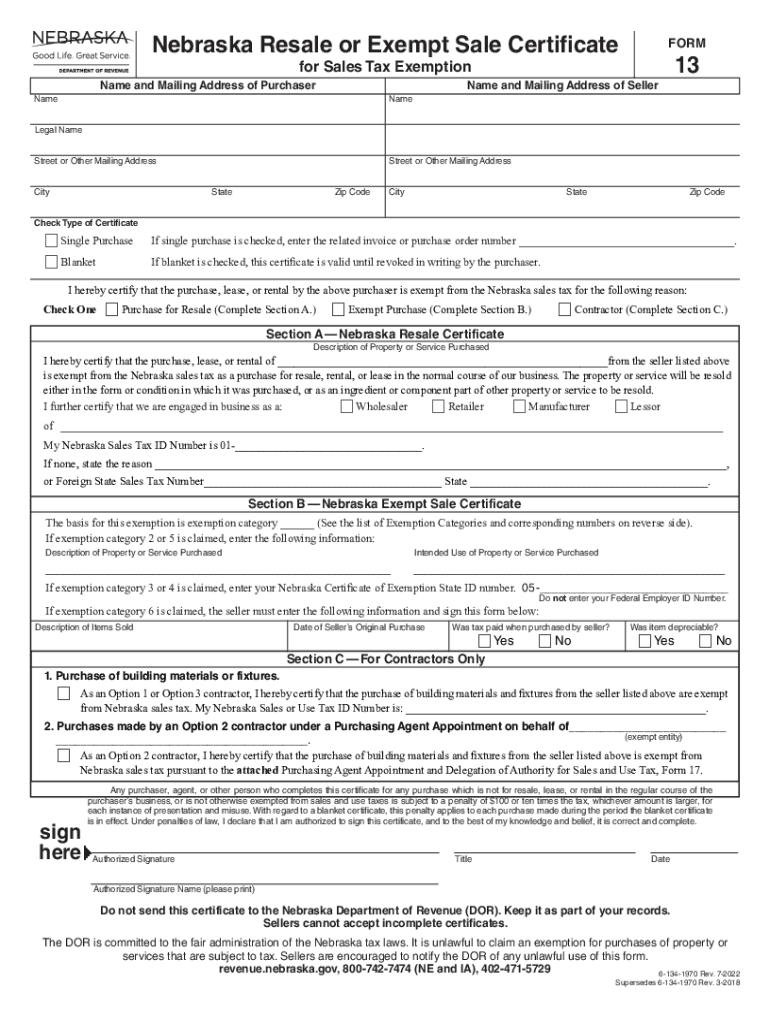

The Nebraska Certificate of Exemption for Mobility Enhancing Equipment is a crucial document that allows eligible individuals to purchase specific mobility-enhancing devices without incurring sales tax. This certificate is designed for those who require equipment that aids in mobility due to a medical condition or disability. The form serves as proof that the equipment qualifies for tax exemption under Nebraska law, ensuring that individuals can access necessary devices without the added financial burden of sales tax.

Steps to Complete the Nebraska Certificate of Exemption for Mobility Enhancing Equipment

Completing the Nebraska Certificate of Exemption involves several key steps to ensure compliance and accuracy. First, gather all necessary information, including your personal details and the specific equipment being purchased. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, it is essential to sign and date it, as this verifies your eligibility for the exemption. Finally, present the completed form to the seller at the time of purchase to benefit from the tax exemption.

Eligibility Criteria for the Nebraska Certificate of Exemption for Mobility Enhancing Equipment

To qualify for the Nebraska Certificate of Exemption, applicants must meet specific eligibility criteria. Primarily, the individual must have a medical condition or disability that necessitates the use of mobility-enhancing equipment. Additionally, the equipment must be prescribed by a licensed healthcare provider, affirming its necessity for the individual's mobility. It is vital to ensure that the equipment falls under the categories defined by Nebraska law to qualify for the exemption.

Required Documents for the Nebraska Certificate of Exemption for Mobility Enhancing Equipment

When applying for the Nebraska Certificate of Exemption, certain documents are required to support your application. These typically include a valid prescription from a licensed healthcare provider, which outlines the need for the mobility-enhancing equipment. Additionally, proof of identity, such as a driver's license or state ID, may be necessary. Having these documents ready will streamline the process and help ensure that your application is processed efficiently.

Legal Use of the Nebraska Certificate of Exemption for Mobility Enhancing Equipment

The legal use of the Nebraska Certificate of Exemption is governed by state tax laws, which outline the parameters for tax-exempt purchases. This certificate must be presented at the time of purchase to the seller, who is responsible for maintaining a copy for their records. Misuse of the certificate, such as using it for ineligible purchases, can result in penalties or fines. Therefore, it is important to understand the legal implications and ensure that the certificate is used appropriately.

Form Submission Methods for the Nebraska Certificate of Exemption

The Nebraska Certificate of Exemption can be submitted through various methods, depending on the seller's policies. Typically, the form is presented in person at the time of purchase. However, some sellers may allow for electronic submission or faxing of the completed certificate. It is advisable to check with the seller regarding their preferred submission method to ensure compliance and to avoid any potential issues during the transaction.

Quick guide on how to complete nebraska certificate of exemption for mobility enhancing form equipment

Prepare Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment with ease on any device

Online document handling has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any interruptions. Manage Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment without stress

- Find Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you prefer to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska certificate of exemption for mobility enhancing form equipment

Create this form in 5 minutes!

People also ask

-

What is a Nebraska exempt form and how do I use it with airSlate SignNow?

A Nebraska exempt form is a specific document used in Nebraska to claim an exemption from certain taxation rules. You can easily create, sign, and send your Nebraska exempt form using airSlate SignNow's intuitive platform, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing Nebraska exempt forms?

airSlate SignNow provides a variety of features designed for streamlined document management, including easy eSigning, templates for Nebraska exempt forms, and real-time tracking. These tools help you to efficiently handle your forms while maintaining compliance.

-

Is airSlate SignNow cost-effective for businesses needing Nebraska exempt forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, making it a cost-effective solution for handling Nebraska exempt forms. You can choose a plan that fits your budget while gaining access to powerful features.

-

Can I integrate airSlate SignNow with other applications to handle Nebraska exempt forms?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow when managing Nebraska exempt forms, making it easier to access and send necessary documents.

-

How secure is airSlate SignNow for managing Nebraska exempt forms?

Security is a top priority for airSlate SignNow. All documents, including Nebraska exempt forms, are protected with advanced encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I customize my Nebraska exempt form using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Nebraska exempt form by adding fields, text, and checkboxes as needed. This flexibility ensures your document meets all necessary requirements while reflecting your unique brand.

-

Is there customer support available for airSlate SignNow users with Nebraska exempt forms?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to Nebraska exempt forms. Our support team is available through various channels, including chat and email, to ensure you have the help you need.

Get more for Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment

- Final notice of forfeiture and request to vacate property under contract for deed north carolina form

- Buyers request for accounting from seller under contract for deed north carolina form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed north carolina form

- General notice of default for contract for deed north carolina form

- Sellers disclosure of forfeiture rights for contract for deed north carolina form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497316758 form

- North carolina contract deed form

- Notice of default for past due payments in connection with contract for deed north carolina form

Find out other Nebraska Certificate Of Exemption For Mobility Enhancing FORM Equipment

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe