Nebraska Sales Tax Exempt Fillable Form 2009

What is the Nebraska Sales Tax Exempt Fillable Form

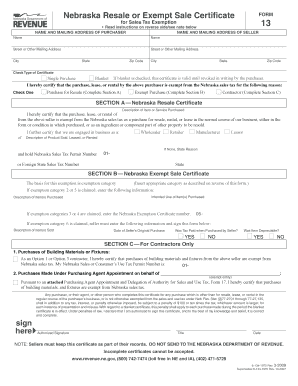

The Nebraska Sales Tax Exempt Fillable Form is a document used by individuals and organizations to claim exemption from sales tax on certain purchases. This form is essential for qualifying entities, such as non-profit organizations, government agencies, and educational institutions, allowing them to make tax-exempt purchases in Nebraska. By completing this form, eligible buyers can avoid paying sales tax on items that are exempt under Nebraska law.

How to use the Nebraska Sales Tax Exempt Fillable Form

Using the Nebraska Sales Tax Exempt Fillable Form involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, obtain the fillable form from a reliable source. Fill out the required fields accurately, including your name, address, and the reason for the exemption. After completing the form, it should be presented to the seller at the time of purchase. Retain a copy for your records, as it may be required for future reference or audits.

Steps to complete the Nebraska Sales Tax Exempt Fillable Form

Completing the Nebraska Sales Tax Exempt Fillable Form requires attention to detail. Follow these steps:

- Download the fillable form from a trusted source.

- Fill in your organization’s name and address in the designated fields.

- Provide your Nebraska tax identification number, if applicable.

- Indicate the type of exemption you are claiming.

- Sign and date the form to confirm its accuracy.

- Submit the completed form to the vendor at the time of purchase.

Legal use of the Nebraska Sales Tax Exempt Fillable Form

The legal use of the Nebraska Sales Tax Exempt Fillable Form is governed by state regulations. To ensure compliance, it is crucial to only use the form for eligible purchases. Misuse of the form can lead to penalties, including back taxes and fines. The form must be filled out accurately and signed by an authorized representative of the exempt organization. Retaining a copy of the form is also important for record-keeping and potential audits.

Key elements of the Nebraska Sales Tax Exempt Fillable Form

Several key elements must be included in the Nebraska Sales Tax Exempt Fillable Form for it to be valid:

- Organization name and address

- Tax identification number

- Type of exemption claimed

- Signature of an authorized representative

- Date of the form completion

Eligibility Criteria

To qualify for using the Nebraska Sales Tax Exempt Fillable Form, entities must meet specific eligibility criteria. Generally, this includes being a non-profit organization, a government entity, or an educational institution. The organization must also be registered with the Nebraska Department of Revenue and possess a valid tax identification number. It is essential to verify that the purchases being made fall under the categories eligible for tax exemption.

Quick guide on how to complete nebraska sales tax exempt fillable form

Effortlessly prepare Nebraska Sales Tax Exempt Fillable Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Manage Nebraska Sales Tax Exempt Fillable Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Nebraska Sales Tax Exempt Fillable Form with ease

- Locate Nebraska Sales Tax Exempt Fillable Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nebraska Sales Tax Exempt Fillable Form to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska sales tax exempt fillable form

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Sales Tax Exempt Fillable Form?

The Nebraska Sales Tax Exempt Fillable Form is a digital document that allows businesses and individuals to signNow their sales tax-exempt status in Nebraska. This form is designed to streamline the process of claiming tax exemptions, making it easier for users to fill out and submit their information electronically.

-

How can I access the Nebraska Sales Tax Exempt Fillable Form?

You can easily access the Nebraska Sales Tax Exempt Fillable Form through the airSlate SignNow platform. Once you're signed in, simply navigate to the forms section, where you'll find the fillable version ready for you to complete and eSign.

-

Is the Nebraska Sales Tax Exempt Fillable Form customizable?

Yes, the Nebraska Sales Tax Exempt Fillable Form on airSlate SignNow can be customized to fit your specific needs. You can add your business logo, modify fields, and make adjustments that cater to your requirements while maintaining compliance with Nebraska tax regulations.

-

What are the costs associated with using the Nebraska Sales Tax Exempt Fillable Form?

Using the Nebraska Sales Tax Exempt Fillable Form via airSlate SignNow is part of our subscription plans. We offer flexible pricing options to suit different business sizes, ensuring you get a cost-effective solution for your document needs, including eSigning and managing tax-exempt forms.

-

What features does airSlate SignNow offer for managing the Nebraska Sales Tax Exempt Fillable Form?

airSlate SignNow provides a range of features to effectively manage the Nebraska Sales Tax Exempt Fillable Form, including editable fields, eSignature capabilities, document tracking, and cloud storage. These features help ensure a seamless transaction process and enhance your document workflow.

-

Can I integrate the Nebraska Sales Tax Exempt Fillable Form with other software?

Absolutely! airSlate SignNow supports various integrations, allowing you to connect the Nebraska Sales Tax Exempt Fillable Form with popular applications such as CRM systems and accounting software. These integrations help streamline your workflow and facilitate data sharing across platforms.

-

How does the Nebraska Sales Tax Exempt Fillable Form benefit my business?

Using the Nebraska Sales Tax Exempt Fillable Form can signNowly benefit your business by simplifying the sales tax exemption process. It reduces the time spent on paperwork and enhances accuracy, enabling your team to focus on core business activities rather than administrative tasks.

Get more for Nebraska Sales Tax Exempt Fillable Form

- Scaling the response to climate changerequest pdf form

- Dtsc hazardous waste generator requirements fact sheet department of toxic substances control form

- Et 0547 report of transfermultiple enrollment form

- Alabama application competency form

- Iowa 2848 form

- Gas meter fix form

- 418 dispositional ca form

- Nd pers designation group form

Find out other Nebraska Sales Tax Exempt Fillable Form

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship