PDF to WORD Convert PDF to Word Online for ILovePDF 2022

Understanding the Business Partner Number in Florida

The business partner number in Florida is a unique identifier assigned to businesses registered with the Florida Department of Revenue. This number is essential for various tax-related activities, including filing tax returns and ensuring compliance with state regulations. It serves as a reference for the Florida communication tax and is crucial for businesses operating within the state.

Steps to Obtain Your Florida Business Partner Number

To obtain a business partner number in Florida, follow these steps:

- Visit the Florida Department of Revenue website.

- Complete the necessary registration forms, providing details about your business entity type, such as LLC, Corporation, or Partnership.

- Submit the forms either online or via mail, ensuring all required documentation is included.

- Once processed, you will receive your business partner number, which should be kept secure for future reference.

Legal Use of the Business Partner Number

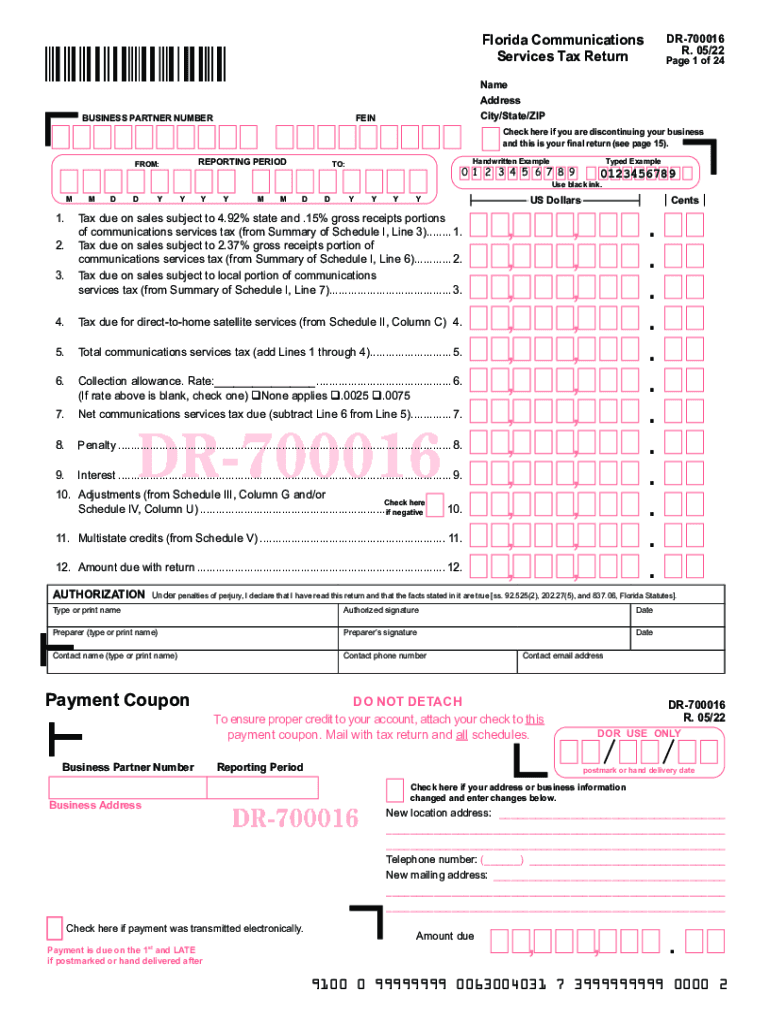

The business partner number is not just for identification; it plays a significant role in legal compliance. Businesses must use this number when filing the Florida DR-700016 form, which is related to the Florida services tax return. Ensuring the correct use of this number can help avoid penalties and streamline the tax filing process.

Filing Deadlines for Florida Business Taxes

Timely filing is crucial for maintaining compliance. In Florida, the deadlines for submitting tax returns using your business partner number can vary based on the type of tax being filed. Generally, businesses should be aware of the following:

- Quarterly tax returns are typically due on the first day of the month following the end of each quarter.

- Annual tax returns must be filed by April fifteenth of the following year.

Required Documents for Filing

When preparing to file taxes with your business partner number, ensure you have the following documents ready:

- Completed DR-700016 form.

- Financial statements, including income statements and balance sheets.

- Records of all taxable sales and purchases.

Penalties for Non-Compliance

Failure to comply with tax regulations associated with your business partner number can result in significant penalties. Common consequences include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for continued non-compliance.

Quick guide on how to complete pdf to word convert pdf to word online for free ilovepdf

Complete PDF To WORD Convert PDF To Word Online For ILovePDF effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage PDF To WORD Convert PDF To Word Online For ILovePDF on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to alter and electronically sign PDF To WORD Convert PDF To Word Online For ILovePDF without difficulty

- Find PDF To WORD Convert PDF To Word Online For ILovePDF and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign PDF To WORD Convert PDF To Word Online For ILovePDF to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf to word convert pdf to word online for free ilovepdf

Create this form in 5 minutes!

People also ask

-

What is a business partner number Florida?

A business partner number Florida is a unique identification number assigned to businesses in Florida for various purposes, including tax reporting and compliance. This number is essential for legal and operational activities, allowing businesses to efficiently navigate the regulatory landscape.

-

How can I obtain a business partner number Florida?

To obtain a business partner number Florida, you can apply through the Florida Department of Revenue's online portal or file an application by mail. It is crucial to provide the necessary documentation, such as your business license and tax information, during the application process.

-

What are the benefits of having a business partner number Florida?

Having a business partner number Florida allows your business to operate legally and simplify tax reporting. It facilitates smoother business transactions and helps you establish credibility and trust with vendors and customers in the state.

-

Is there a cost associated with obtaining a business partner number Florida?

Obtaining a business partner number Florida usually does not incur a direct fee. However, there may be costs related to filing other necessary paperwork or permits required for your specific business type.

-

Can I change my business partner number Florida if needed?

In most cases, once a business partner number Florida is assigned, it cannot be changed. However, if you close your business or change its structure, you may need to apply for a new number based on the current business setup.

-

How does airSlate SignNow integrate with my business partner number Florida?

AirSlate SignNow seamlessly integrates with your business partner number Florida, allowing you to eSign documents and send them easily. It helps ensure that all your forms and agreements are compliant and tied to your registered business identity.

-

What features of airSlate SignNow enhance document management for businesses in Florida?

AirSlate SignNow offers features like customizable templates, secure cloud storage, and collaboration tools that streamline document management for businesses in Florida. These features are designed to align with the operational needs of businesses needing a business partner number Florida.

Get more for PDF To WORD Convert PDF To Word Online For ILovePDF

- Letter tenant form 497316916

- North carolina letter demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles north carolina form

- Letter from tenant to landlord about landlords failure to make repairs north carolina form

- Nc landlord rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession north carolina form

- Letter from tenant to landlord about illegal entry by landlord north carolina form

- Letter from landlord to tenant about time of intent to enter premises north carolina form

Find out other PDF To WORD Convert PDF To Word Online For ILovePDF

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity