Tax Due on Sales Subject to 2 2020

What is the Tax Due On Sales Subject To 2

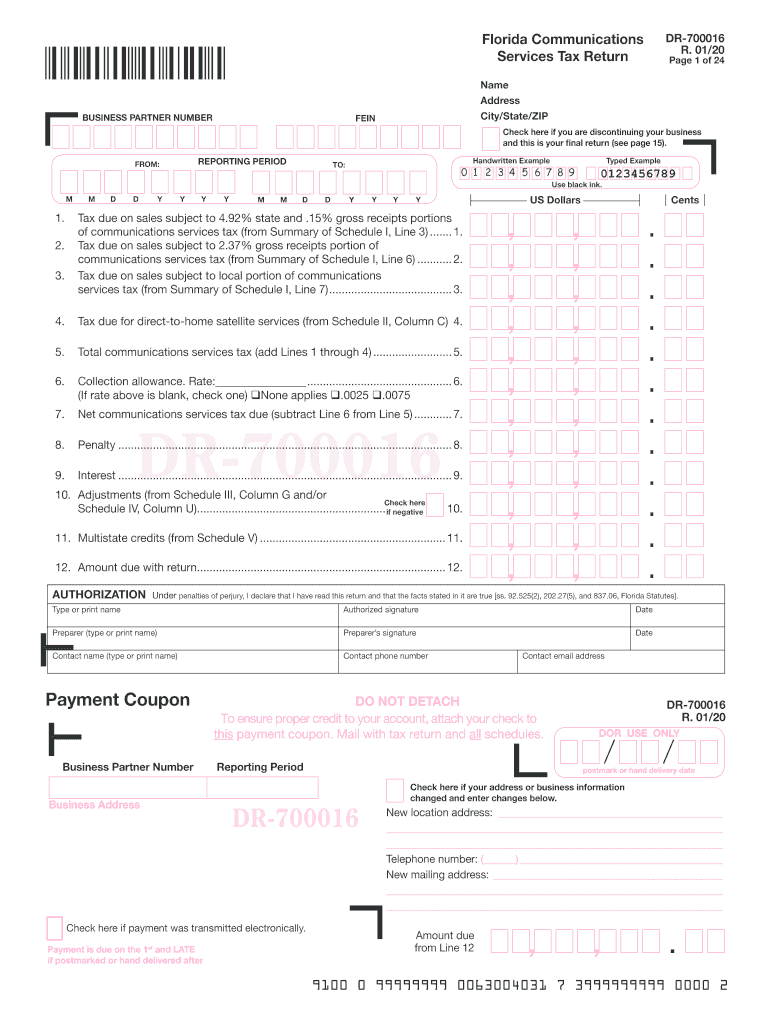

The Tax Due On Sales Subject To 2 refers to the specific tax obligations that businesses must fulfill when selling certain goods or services within the state of Florida. This tax is a crucial component of the state's revenue system and applies to various transactions. Understanding this tax is essential for businesses to ensure compliance and avoid potential penalties.

How to Use the Tax Due On Sales Subject To 2

Using the Tax Due On Sales Subject To 2 involves calculating the appropriate tax amount based on the sales made during a specific period. Businesses must accurately track sales, apply the correct tax rate, and report these figures on the appropriate forms. Proper usage ensures that businesses remain compliant with state regulations and can avoid any issues during audits.

Steps to Complete the Tax Due On Sales Subject To 2

Completing the Tax Due On Sales Subject To 2 involves several key steps:

- Gather all sales records for the reporting period.

- Determine the applicable tax rate for the products or services sold.

- Calculate the total sales tax due by multiplying the total sales by the tax rate.

- Complete the required form, ensuring all information is accurate.

- Submit the form by the designated deadline, either online or by mail.

Legal Use of the Tax Due On Sales Subject To 2

Legal use of the Tax Due On Sales Subject To 2 means adhering to state laws and regulations governing sales tax collection and reporting. Businesses must ensure that they are correctly registered to collect sales tax and that they remit the collected taxes to the state in a timely manner. Failure to comply with these legal requirements can result in fines and other penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Due On Sales Subject To 2 are crucial for businesses to note. Generally, businesses must file their sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume. It is essential to be aware of these deadlines to avoid late fees and maintain good standing with state tax authorities.

Required Documents

To complete the Tax Due On Sales Subject To 2, businesses typically need several documents, including:

- Sales records for the reporting period.

- Invoices issued to customers.

- Any relevant tax exemption certificates.

- The completed tax form for submission.

Penalties for Non-Compliance

Non-compliance with the Tax Due On Sales Subject To 2 can lead to significant penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. It is important for businesses to understand the consequences of failing to file or pay the required taxes to avoid these potential issues.

Quick guide on how to complete tax due on sales subject to 2

Easily Prepare Tax Due On Sales Subject To 2 on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Tax Due On Sales Subject To 2 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

Effortlessly Modify and eSign Tax Due On Sales Subject To 2

- Find Tax Due On Sales Subject To 2 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, the hassle of searching through forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Tax Due On Sales Subject To 2 while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax due on sales subject to 2

Create this form in 5 minutes!

How to create an eSignature for the tax due on sales subject to 2

How to make an eSignature for your Tax Due On Sales Subject To 2 in the online mode

How to make an eSignature for your Tax Due On Sales Subject To 2 in Chrome

How to create an eSignature for signing the Tax Due On Sales Subject To 2 in Gmail

How to make an electronic signature for the Tax Due On Sales Subject To 2 straight from your smart phone

How to make an electronic signature for the Tax Due On Sales Subject To 2 on iOS

How to create an eSignature for the Tax Due On Sales Subject To 2 on Android OS

People also ask

-

What is the Tax Due On Sales Subject To 2 and how does it affect my business?

The Tax Due On Sales Subject To 2 refers to the specific tax obligations applicable to certain sales transactions. Understanding this tax is crucial for compliance and can influence your overall pricing strategy. By utilizing airSlate SignNow, businesses can easily manage and document transactions, ensuring all tax-related paperwork is in order.

-

How can airSlate SignNow help in managing Tax Due On Sales Subject To 2?

airSlate SignNow streamlines the process of sending and signing documents related to the Tax Due On Sales Subject To 2. With our platform, you can create, send, and securely sign tax documents, making it easier to keep track of your tax obligations. This ensures that all parties are informed and compliant with tax regulations.

-

Is airSlate SignNow cost-effective for handling Tax Due On Sales Subject To 2 documents?

Yes, airSlate SignNow offers a cost-effective solution for managing documents related to the Tax Due On Sales Subject To 2. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can efficiently manage your tax documentation without breaking the bank. You'll save time and money by automating your document workflows.

-

Can I integrate airSlate SignNow with my accounting software for better management of Tax Due On Sales Subject To 2?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to help you manage the Tax Due On Sales Subject To 2 effectively. This integration allows for automatic updates and tracking of tax documents, ensuring you have all necessary information at your fingertips. Simplifying your workflow has never been easier.

-

What features does airSlate SignNow offer to assist with Tax Due On Sales Subject To 2 compliance?

airSlate SignNow includes features like customizable templates, secure electronic signatures, and document storage specifically designed to support compliance with the Tax Due On Sales Subject To 2. These capabilities help ensure that your documents are legally binding and easily retrievable, simplifying your compliance process.

-

How does airSlate SignNow ensure the security of documents related to Tax Due On Sales Subject To 2?

Security is a top priority at airSlate SignNow, especially for sensitive documents related to the Tax Due On Sales Subject To 2. We use advanced encryption protocols and secure cloud storage to protect your documents from unauthorized access. This means you can trust that your tax-related information is safe and confidential.

-

What support does airSlate SignNow provide for questions about Tax Due On Sales Subject To 2?

airSlate SignNow offers comprehensive support for users with questions about the Tax Due On Sales Subject To 2. Our customer service team is available through various channels, including email and live chat, to assist with any inquiries. We also provide a resource center with articles and guides to help you navigate tax-related documentation.

Get more for Tax Due On Sales Subject To 2

Find out other Tax Due On Sales Subject To 2

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement