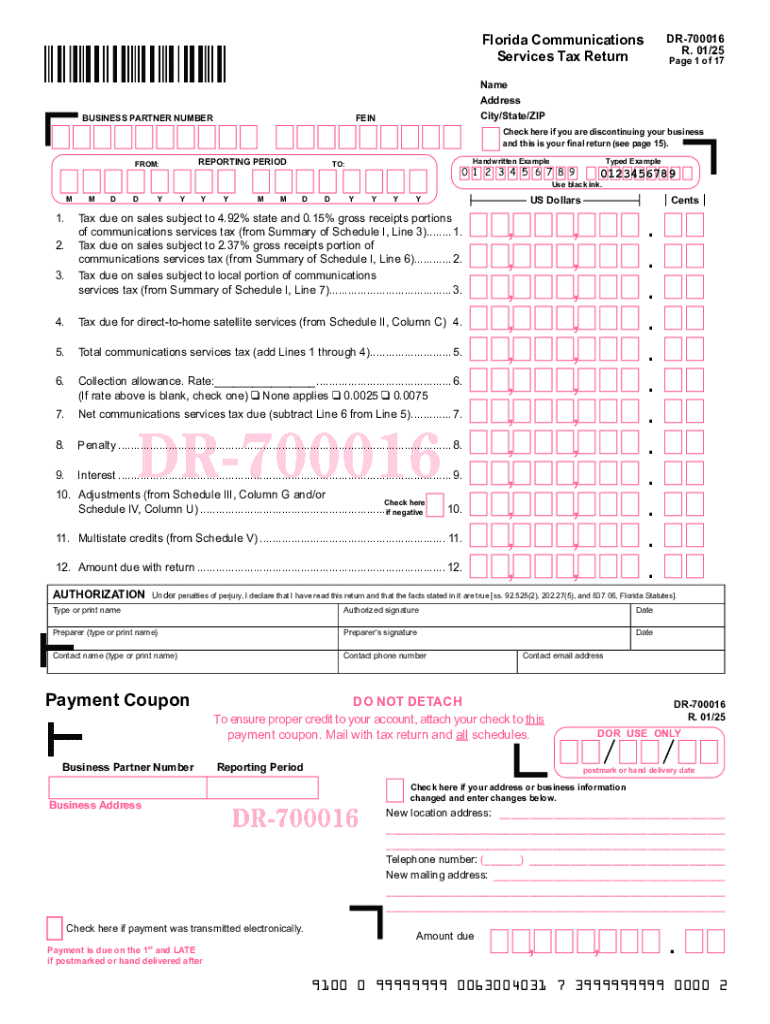

Florida Communications Services Tax Return BUSINES 2025-2026

What is the Florida Communications Services Tax Return?

The Florida Communications Services Tax Return is a form used by businesses to report and remit taxes on communication services provided in the state. This tax applies to various services, including telephone, cable, and other communication services. The return helps the Florida Department of Revenue track tax obligations and ensure compliance with state tax laws.

Steps to Complete the Florida Communications Services Tax Return

Completing the Florida Communications Services Tax Return involves several key steps:

- Gather all relevant financial records related to communication services.

- Determine the total taxable revenue for the reporting period.

- Calculate the tax owed based on the applicable tax rate for your services.

- Fill out the return form accurately, ensuring all fields are completed.

- Review the completed form for any errors before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Florida Communications Services Tax Return. Typically, returns are due on the first day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the return is due on February 1. Late submissions may incur penalties, so timely filing is essential.

Required Documents

To complete the Florida Communications Services Tax Return, certain documents are necessary:

- Financial statements detailing revenue from communication services.

- Previous tax returns for reference.

- Any correspondence from the Florida Department of Revenue.

- Records of any exemptions or deductions applicable to your business.

Form Submission Methods

The Florida Communications Services Tax Return can be submitted through various methods:

- Online submission via the Florida Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Penalties for Non-Compliance

Failure to file the Florida Communications Services Tax Return on time or inaccuracies in reporting can result in penalties. These may include:

- Late filing penalties, which increase based on how overdue the return is.

- Interest on unpaid taxes that accrues over time.

- Potential audits or further scrutiny from the Florida Department of Revenue.

Create this form in 5 minutes or less

Find and fill out the correct florida communications services tax return busines

Create this form in 5 minutes!

How to create an eSignature for the florida communications services tax return busines

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida communication services tax?

The Florida communication services tax is a tax imposed on various communication services provided in the state. This includes services such as telephone, telegraph, and other communication services. Understanding this tax is essential for businesses operating in Florida to ensure compliance and accurate billing.

-

How does airSlate SignNow help with Florida communication services tax compliance?

airSlate SignNow provides businesses with tools to manage their documentation efficiently, which can include tax-related documents. By using our eSignature solutions, businesses can ensure that all necessary forms related to the Florida communication services tax are signed and stored securely. This streamlines compliance and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that businesses can manage their documentation without overspending. Each plan includes features that can assist with compliance related to the Florida communication services tax.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These features help businesses manage their documents efficiently, including those related to the Florida communication services tax. Our platform is designed to simplify the eSigning process and enhance productivity.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various software applications, including those used for tax management. This allows businesses to streamline their processes and ensure that all documentation related to the Florida communication services tax is easily accessible. Integrations enhance the overall efficiency of your operations.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows businesses to quickly sign and send documents, which is particularly beneficial for managing compliance with the Florida communication services tax. This leads to faster turnaround times and improved customer satisfaction.

-

Is airSlate SignNow suitable for small businesses in Florida?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses in Florida. Our solutions can help small businesses manage their documentation, including those related to the Florida communication services tax, without the need for extensive resources.

Get more for Florida Communications Services Tax Return BUSINES

- Al inspection form

- Mv 40 form

- Application for motor vehicle title and registration form

- Arkansas purchase trailer form

- Az medical examination report form

- Physician examination report physician examination report azdot form

- Vehicle removal written authorization form

- Caregiver contract template 22221186 form

Find out other Florida Communications Services Tax Return BUSINES

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter