Irsprob Comquestion Answer Notice of FederalQuestion & Answer Notice of Federal Tax LienIRSPROB COM 2022-2026

Understanding the Tennessee Vehicle Division

The Tennessee Vehicle Division is responsible for overseeing vehicle registration, titling, and related services within the state. This division operates under the Department of Revenue and ensures compliance with state laws regarding vehicle ownership and operation. It provides essential services to residents, including the issuance of titles, registration renewals, and the processing of various vehicle forms.

Key Tennessee Vehicle Forms

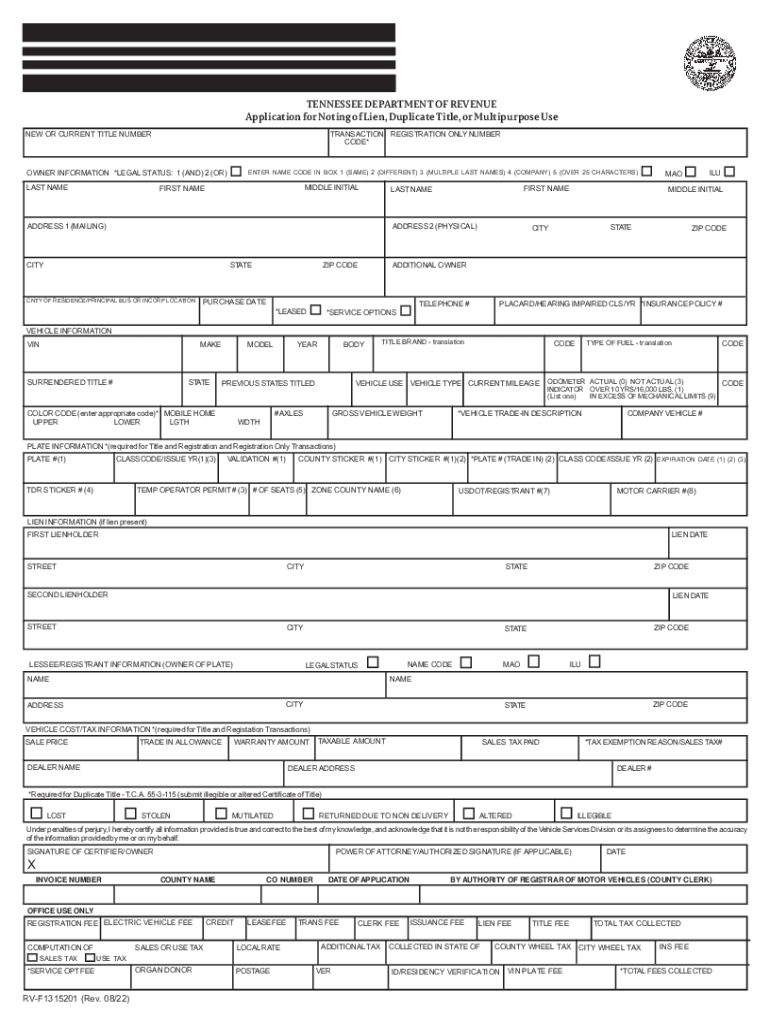

Several forms are crucial for vehicle-related transactions in Tennessee. These include:

- Tennessee Vehicle Title Application Form: Used to apply for a new title when purchasing a vehicle.

- Form RV F1315201: A multi-purpose application that can be used for various vehicle-related requests.

- TN Multipurpose Form: This form covers multiple vehicle transactions, streamlining the process for users.

Steps to Complete the Tennessee Vehicle Title Application

To successfully complete the Tennessee Vehicle Title Application, follow these steps:

- Gather necessary documents, including proof of ownership and identification.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application along with any applicable fees to the local county clerk's office.

Legal Considerations for Tennessee Vehicle Forms

When filling out Tennessee vehicle forms, it is essential to understand the legal implications. Forms must be completed accurately to avoid delays or legal issues. Digital signatures are accepted, provided they comply with state laws, ensuring that the forms are legally binding.

Submitting Tennessee Vehicle Forms

Tennessee vehicle forms can be submitted through various methods:

- Online Submission: Many forms can be completed and submitted digitally, offering convenience and efficiency.

- Mail Submission: Forms can also be printed and mailed to the appropriate office.

- In-Person Submission: Residents may choose to visit their local vehicle division office for assistance.

Compliance and Penalties for Non-Compliance

Failure to comply with Tennessee vehicle division regulations can lead to penalties. Common issues include late registration fees and potential legal action for unregistered vehicles. It is crucial to stay informed about deadlines and ensure all forms are submitted correctly and on time.

Quick guide on how to complete irsprobcomquestion answer notice of federalquestion ampamp answer notice of federal tax lienirsprobcom

Effortlessly Prepare Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM with Ease

- Locate Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether through email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irsprobcomquestion answer notice of federalquestion ampamp answer notice of federal tax lienirsprobcom

Create this form in 5 minutes!

People also ask

-

What services does the Tennessee vehicle division provide?

The Tennessee vehicle division offers a range of services including vehicle registration, title issuance, and license plate services. They also handle vehicle inspections and provide resources for understanding state vehicle regulations. Utilizing airSlate SignNow can streamline the document signing process needed for these services.

-

How can airSlate SignNow help with vehicle registration in Tennessee?

AirSlate SignNow simplifies vehicle registration processes by enabling users to securely sign and send necessary documents electronically. This means you can handle registration requirements quickly without the hassle of physical paperwork. It's especially beneficial for businesses that frequently deal with vehicle registrations in the Tennessee vehicle division.

-

What are the costs associated with using airSlate SignNow for vehicle documentation?

AirSlate SignNow offers cost-effective pricing plans that are competitive in the market, allowing businesses to choose a plan that fits their needs. The platform provides various features that help reduce paperwork costs and improves efficiency, making it an excellent choice for frequent transactions with the Tennessee vehicle division.

-

Are there any integrations available with airSlate SignNow that assist with the Tennessee vehicle division?

AirSlate SignNow integrates with various applications to streamline workflows, which can be especially useful when dealing with the Tennessee vehicle division. You can connect it with tools like CRM systems, project management applications, and cloud storage services to create a seamless document management experience.

-

What are the benefits of using airSlate SignNow for eSigning vehicle documents?

Using airSlate SignNow for eSigning vehicle documents enhances efficiency by reducing time spent on paperwork. With legally binding electronic signatures, you can engage with the Tennessee vehicle division faster and more securely. This helps prevent delays in processing documentation related to vehicle transactions.

-

Is airSlate SignNow compliant with Tennessee vehicle division regulations?

Yes, airSlate SignNow is compliant with all relevant regulations, including those set forth by the Tennessee vehicle division. The platform maintains high security standards to protect sensitive information and ensure all signed documents meet legal requirements in Tennessee.

-

How user-friendly is airSlate SignNow for dealing with the Tennessee vehicle division?

AirSlate SignNow is designed to be user-friendly, making it easy for individuals and businesses to handle documentation related to the Tennessee vehicle division. The intuitive interface allows users to navigate the signing process without prior technical knowledge, ensuring a smooth experience.

Get more for Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM

- Unconditional waiver and release of lien upon final payment north carolina form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property north carolina form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497316977 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property north carolina form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential north carolina form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property north carolina form

- North carolina property form

- Nc claim lien form

Find out other Irsprob comquestion answer notice of federalQuestion & Answer Notice Of Federal Tax LienIRSPROB COM

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney