Dor Georgia Gov St 3 Sales and Use Tax ReturnsST 3 Sales and Use Tax Returns and Addendums Georgia 2022-2026

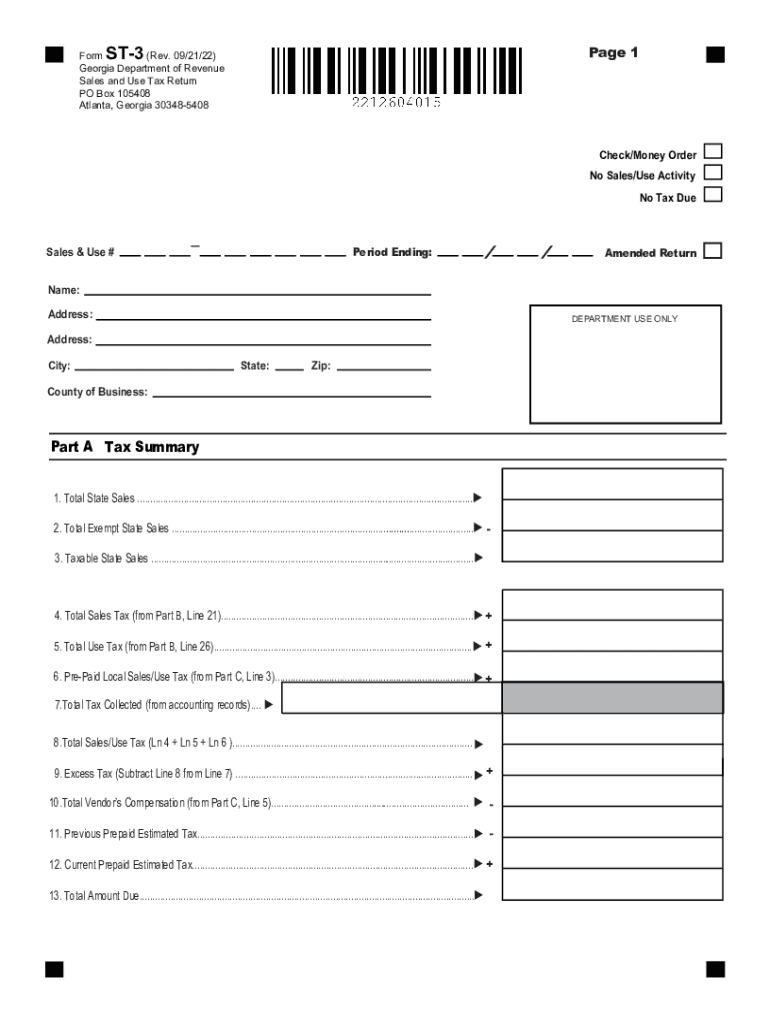

Understanding the Georgia ST-3 Sales and Use Tax Form

The Georgia ST-3 form is essential for businesses in Georgia that engage in purchasing goods or services that are subject to sales tax. This form allows businesses to claim an exemption from sales tax on certain purchases, provided they meet specific criteria. The form is primarily used by resellers and certain exempt organizations to document their tax-exempt status. Understanding its purpose and proper use is vital for compliance with Georgia tax regulations.

Steps to Complete the Georgia ST-3 Form

Completing the Georgia ST-3 form involves several key steps:

- Obtain the form from the Georgia Department of Revenue website or through authorized channels.

- Fill in your business information, including the name, address, and sales tax number.

- Indicate the type of exemption you are claiming by checking the appropriate box.

- Provide details about the items being purchased, including descriptions and quantities.

- Sign and date the form to certify its accuracy.

Ensure that all information is accurate and complete to avoid delays or issues with tax compliance.

Legal Use of the Georgia ST-3 Form

The Georgia ST-3 form is legally binding when filled out correctly and used in compliance with state laws. It is crucial for businesses to ensure they qualify for the exemptions they claim on the form. Misuse of the ST-3 form can lead to penalties, including back taxes and fines. Consequently, businesses should maintain proper records and documentation to support their claims.

Filing Deadlines and Important Dates

While the Georgia ST-3 form itself does not have a specific filing deadline, businesses must be mindful of the overall sales tax filing deadlines established by the Georgia Department of Revenue. Typically, sales tax returns are due on the 20th of the month following the reporting period. Keeping track of these deadlines is essential to avoid late fees and ensure compliance.

Examples of Using the Georgia ST-3 Form

Businesses may use the Georgia ST-3 form in various scenarios, such as:

- A retail store purchasing inventory for resale.

- A non-profit organization acquiring supplies for exempt purposes.

- A manufacturer purchasing raw materials that will be used in the production of taxable goods.

Each of these examples highlights the importance of correctly applying for sales tax exemptions to benefit from potential savings.

Required Documents for the Georgia ST-3 Form

When submitting the Georgia ST-3 form, businesses should have the following documents ready:

- Proof of business registration, such as a business license.

- A valid Georgia sales tax number.

- Documentation supporting the exemption claim, such as a resale certificate or non-profit status verification.

Having these documents on hand can streamline the process and ensure compliance with state regulations.

Quick guide on how to complete dorgeorgiagov st 3 sales and use tax returnsst 3 sales and use tax returns and addendums georgia

Complete Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia effortlessly on any device

Digital document handling has become increasingly favored among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed files, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to alter and eSign Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia without hassle

- Locate Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Alter and eSign Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorgeorgiagov st 3 sales and use tax returnsst 3 sales and use tax returns and addendums georgia

Create this form in 5 minutes!

People also ask

-

What is a printable ST 3 form GA?

The printable ST 3 form GA is a tax exemption certificate used in Georgia to claim exemption from sales tax. This form is crucial for businesses making qualifying purchases that are exempt from sales tax, helping streamline the tax-exempt process. Understanding how to properly fill out and submit the printable ST 3 form GA can save businesses time and money.

-

How can airSlate SignNow help with the printable ST 3 form GA?

airSlate SignNow provides a user-friendly platform where you can easily fill out, sign, and send the printable ST 3 form GA. The platform simplifies the eSigning process, enabling you to complete and manage your forms quickly. With airSlate SignNow, you can ensure that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the printable ST 3 form GA?

Yes, airSlate SignNow offers several pricing plans to suit various business needs when dealing with the printable ST 3 form GA and other documents. These plans are designed to be cost-effective, allowing you to choose an option that fits your budget while enjoying full access to essential eSigning features. Explore our plans to find the best pricing for your business.

-

What features are included with airSlate SignNow for handling printable ST 3 forms GA?

With airSlate SignNow, you'll gain access to features such as templates, secure eSigning, automatic notifications, and easy document management for printable ST 3 forms GA. These features help you easily prepare, send, and track your documents, enhancing your overall workflow. Additionally, you can customize your forms to fit specific business requirements.

-

Can I integrate airSlate SignNow with other software for managing the printable ST 3 form GA?

Absolutely! airSlate SignNow offers seamless integration capabilities with various software and applications, enhancing how you manage the printable ST 3 form GA. You can connect with tools like CRM and project management software for a more streamlined workflow. This integration helps you save time and maintain organization across your document processes.

-

What are the benefits of using airSlate SignNow for the printable ST 3 form GA?

Using airSlate SignNow for the printable ST 3 form GA simplifies the signing process, allows for quick document completion, and ensures security. Enhanced collaboration features let multiple parties review and sign documents without delays. Ultimately, this leads to faster transactions and improved efficiency for your business.

-

Is it easy to get started with airSlate SignNow for the printable ST 3 form GA?

Yes, getting started with airSlate SignNow for the printable ST 3 form GA is exceptionally easy. The platform offers an intuitive interface that guides you through the process of uploading and managing your documents. You can sign up, navigate the dashboard, and begin working on your forms within minutes.

Get more for Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia

- Construction contract cost plus or fixed fee north dakota form

- Painting contract for contractor north dakota form

- Trim carpenter contract for contractor north dakota form

- Fencing contract for contractor north dakota form

- Hvac contract for contractor north dakota form

- Landscape contract for contractor north dakota form

- Commercial contract for contractor north dakota form

- Excavator contract for contractor north dakota form

Find out other Dor georgia gov St 3 sales and use tax returnsST 3 Sales And Use Tax Returns And Addendums Georgia

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now