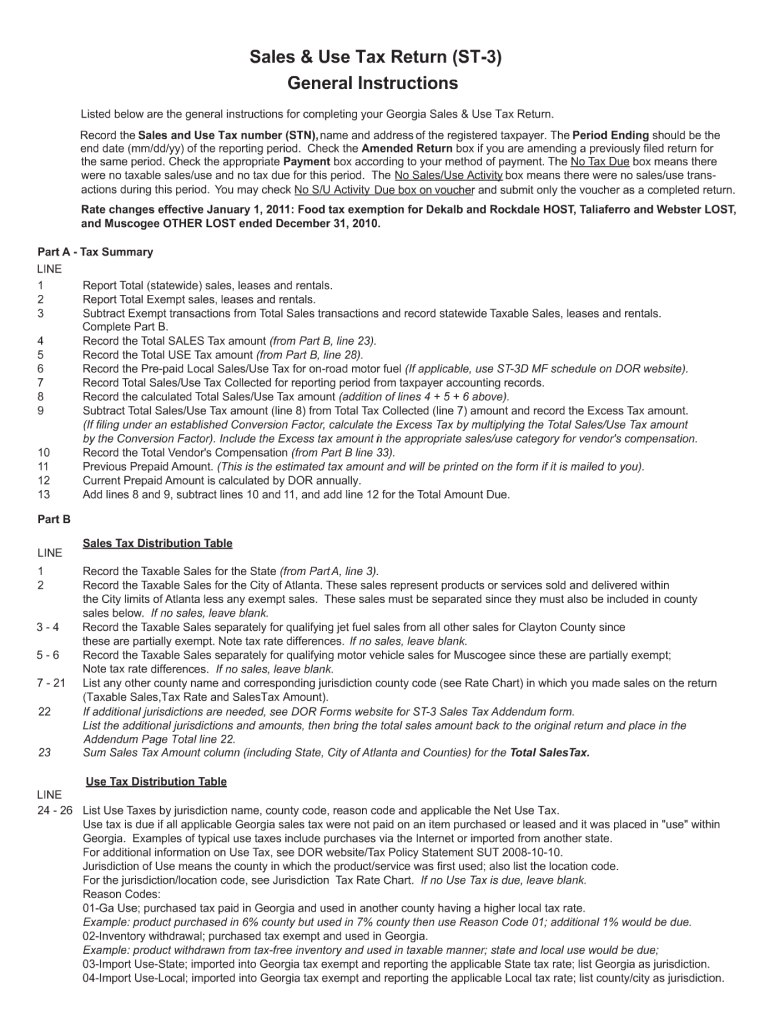

Georgia Sales and Use Tax Form St 3 2018

What is the Georgia Sales And Use Tax Form St 3

The Georgia Sales and Use Tax Form St 3 is a crucial document used by businesses in Georgia to claim exemption from sales tax on specific purchases. This form is primarily utilized by organizations that qualify for tax exemptions under state law, allowing them to purchase items without incurring sales tax. The St 3 form is essential for maintaining compliance with Georgia's tax regulations and ensuring that eligible entities can benefit from tax savings.

How to use the Georgia Sales And Use Tax Form St 3

To effectively use the Georgia Sales and Use Tax Form St 3, businesses must complete the form accurately and submit it to their vendors at the time of purchase. This form serves as proof of the tax-exempt status of the purchaser. It is important to ensure that all required fields are filled out correctly, including the purchaser's name, address, and the reason for the exemption. Vendors are required to keep this form on file for their records, as it validates the tax-exempt sale.

Steps to complete the Georgia Sales And Use Tax Form St 3

Completing the Georgia Sales and Use Tax Form St 3 involves several straightforward steps:

- Begin by downloading the form from the Georgia Department of Revenue website or obtaining a physical copy.

- Fill in your business name and address in the designated fields.

- Provide the reason for the tax exemption, ensuring it aligns with the categories specified by Georgia law.

- Sign and date the form to validate its authenticity.

- Submit the completed form to your vendor at the point of purchase.

Key elements of the Georgia Sales And Use Tax Form St 3

The Georgia Sales and Use Tax Form St 3 includes several key elements that are essential for its validity:

- Purchaser Information: This includes the name and address of the business claiming the exemption.

- Exemption Reason: A clear explanation of why the exemption is being claimed, such as for resale or for use in manufacturing.

- Signature: The signature of an authorized representative of the business is required to validate the form.

- Date: The date of completion must be included to ensure the form is current.

Legal use of the Georgia Sales And Use Tax Form St 3

The legal use of the Georgia Sales and Use Tax Form St 3 is governed by state tax laws. It is important for businesses to understand that misuse of this form, such as claiming exemptions without proper justification, can lead to penalties. The form must only be used for purchases that genuinely qualify for tax-exempt status under Georgia law. Vendors must also ensure compliance by keeping the form on file and verifying its authenticity.

Form Submission Methods (Online / Mail / In-Person)

The Georgia Sales and Use Tax Form St 3 is typically submitted directly to the vendor at the time of purchase rather than being filed with the Georgia Department of Revenue. However, businesses may need to keep a copy for their records. For any related submissions or inquiries, businesses can contact the Georgia Department of Revenue via mail or in-person visits at their local offices. Online submissions are not applicable for this specific form.

Quick guide on how to complete georgia sales and use tax form st 3 2011

Complete Georgia Sales And Use Tax Form St 3 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Georgia Sales And Use Tax Form St 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Georgia Sales And Use Tax Form St 3 with ease

- Locate Georgia Sales And Use Tax Form St 3 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Georgia Sales And Use Tax Form St 3 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia sales and use tax form st 3 2011

Create this form in 5 minutes!

How to create an eSignature for the georgia sales and use tax form st 3 2011

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Georgia sales tax ST 3 and how does it affect document signing?

Georgia sales tax ST 3 refers to the specific sales tax rate applicable in Georgia for certain transactions. When using airSlate SignNow, understanding Georgia sales tax ST 3 is essential for businesses that handle sales within the state, ensuring compliance and accuracy in electronic documentation.

-

How does airSlate SignNow help with Georgia sales tax ST 3 compliance?

airSlate SignNow offers features that streamline the documentation process for businesses operating under Georgia sales tax ST 3. By integrating fields for tax calculations, businesses can ensure that their electronic documents reflect the correct sales tax and adhere to state regulations.

-

What are the pricing options for airSlate SignNow if I need to manage Georgia sales tax ST 3 documents?

airSlate SignNow provides several pricing tiers to accommodate various business sizes and needs. Whether you require basic document signing or advanced features for managing Georgia sales tax ST 3 documents, we offer competitive rates that can fit your budget.

-

Are there any specific features of airSlate SignNow that aid in handling Georgia sales tax ST 3?

Yes, airSlate SignNow includes customizable templates and automated workflows that make it easier to handle documents requiring Georgia sales tax ST 3 compliance. These features allow users to create, edit, and send documents while ensuring all tax obligations are met.

-

Can airSlate SignNow integrate with accounting software to manage Georgia sales tax ST 3?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enabling efficient management of Georgia sales tax ST 3. This integration helps businesses effortlessly track tax calculations and ensure accurate financial reporting.

-

What benefits does airSlate SignNow offer for businesses addressing Georgia sales tax ST 3?

Using airSlate SignNow can signNowly cut down paperwork processing time while ensuring compliance with Georgia sales tax ST 3. The ability to eSign documents quickly and securely allows businesses to focus more on their operations rather than on administrative tasks.

-

Is airSlate SignNow suitable for small businesses dealing with Georgia sales tax ST 3?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises managing Georgia sales tax ST 3. With its user-friendly interface and cost-effective pricing, small businesses can efficiently handle their document signing needs.

Get more for Georgia Sales And Use Tax Form St 3

Find out other Georgia Sales And Use Tax Form St 3

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure