I 804 Form 804 Claim for Decedent's Wisconsin Income Tax Refund Fillable 2021-2026

Understanding the I-804 Form for Decedent's Wisconsin Income Tax Refund

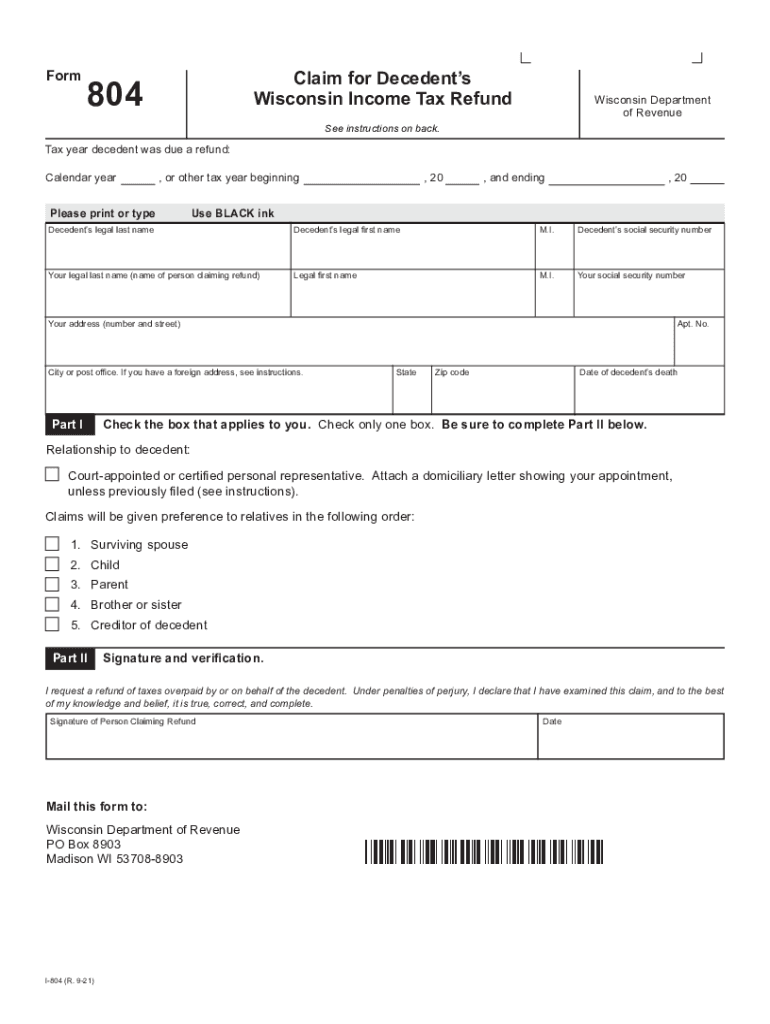

The I-804 form, officially known as the Claim for Decedent's Wisconsin Income Tax Refund, is specifically designed for individuals seeking to claim a tax refund on behalf of a deceased taxpayer. This form is essential for ensuring that any eligible refunds are processed correctly and efficiently. It is important to understand that this form is used exclusively for decedents, meaning it cannot be utilized by living taxpayers for their own refunds. The I-804 form facilitates the legal transfer of any tax refunds owed to the estate of the deceased individual.

Steps to Complete the I-804 Form

Completing the I-804 form requires careful attention to detail to ensure accuracy and compliance with Wisconsin tax laws. Here are the essential steps to follow:

- Gather necessary documentation, including the deceased's tax returns, death certificate, and any relevant financial records.

- Fill out the I-804 form, ensuring that all required fields are completed, including the decedent's personal information and the details of the refund claim.

- Sign the form, acknowledging that you have the authority to act on behalf of the decedent's estate.

- Submit the completed form along with the required documentation to the Wisconsin Department of Revenue.

It is advisable to keep copies of all submitted documents for your records.

Required Documents for the I-804 Form

When filing the I-804 form, certain documents are necessary to support the claim. These include:

- The death certificate of the decedent.

- A copy of the decedent's last filed tax return.

- Any additional documentation that may support the claim, such as proof of income or deductions.

Having these documents ready will streamline the process and help ensure that your claim is processed without unnecessary delays.

Filing Deadlines for the I-804 Form

Timely submission of the I-804 form is crucial to avoid potential penalties or loss of the refund. The standard deadline for filing this form aligns with the Wisconsin tax return deadlines, which typically fall on April 15 of the year following the tax year in question. However, if the decedent passed away during the tax year, the filing deadline may differ. It is essential to verify the specific deadlines applicable to the decedent's situation to ensure compliance.

Legal Use of the I-804 Form

The I-804 form is legally recognized for claiming refunds on behalf of deceased taxpayers. To ensure its validity, the form must be filled out accurately and submitted with the required documentation. Compliance with Wisconsin tax laws is necessary for the claim to be processed. The form serves as a formal request for any tax refunds owed to the decedent's estate, and its proper use protects the rights of the beneficiaries.

Obtaining the I-804 Form

The I-804 form can be obtained through the Wisconsin Department of Revenue's official website or by contacting their office directly. It is available in a fillable format, making it easier for users to complete the necessary information electronically. Accessing the form online ensures that you have the most current version, which is essential for compliance with any updates to tax regulations.

Quick guide on how to complete 2021 i 804 form 804 claim for decedents wisconsin income tax refund fillable

Effortlessly Prepare I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable with Ease

- Locate I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable and select Get Form to begin.

- Take advantage of the available tools to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 i 804 form 804 claim for decedents wisconsin income tax refund fillable

Create this form in 5 minutes!

People also ask

-

What is the Wisconsin Form 804 used for?

The Wisconsin Form 804 is utilized for specific business and legal purposes in the state of Wisconsin. This form often requires signatures and approvals that can be efficiently managed through airSlate SignNow. Using our platform, you can easily fill out and electronically sign the Wisconsin Form 804, streamlining your document management process.

-

How can airSlate SignNow help with the Wisconsin Form 804?

airSlate SignNow provides a user-friendly interface to help you complete and sign the Wisconsin Form 804. With features like templates, cloud storage, and easy sharing options, you can manage your documents more effectively. The secure electronic signature capabilities also ensure that your form is legally binding and compliant.

-

Is airSlate SignNow cost-effective for managing the Wisconsin Form 804?

Yes, airSlate SignNow offers competitive pricing plans that suit businesses of all sizes, making it a cost-effective choice for managing the Wisconsin Form 804. By eliminating the need for paper and physical signatures, you can save on printing and mailing costs. Our subscription options provide flexibility to meet your specific needs without breaking your budget.

-

Can I integrate airSlate SignNow with other applications while working on the Wisconsin Form 804?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow while handling the Wisconsin Form 804. Whether you use CRM systems, cloud storage services, or project management tools, our integrations make it easy to import and export data, ensuring efficient document management.

-

What features does airSlate SignNow offer for completing the Wisconsin Form 804?

airSlate SignNow offers a range of features to assist in completing the Wisconsin Form 804, including customizable templates, secure electronic signatures, and real-time collaboration. These tools allow multiple users to sign and edit the document simultaneously, which expedites the workflow and reduces delays in processing important forms.

-

How secure is airSlate SignNow when handling the Wisconsin Form 804?

Security is a top priority at airSlate SignNow. When managing the Wisconsin Form 804, your documents are protected with end-to-end encryption, ensuring that sensitive information remains confidential. Additionally, our platform complies with industry regulations to provide a safe environment for electronic signing and document management.

-

Can I access the Wisconsin Form 804 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage the Wisconsin Form 804 from your smartphone or tablet. Our mobile application provides the flexibility to sign documents on-the-go, making it easier to complete your tasks anytime, anywhere. This convenience is especially beneficial for those who need to act quickly.

Get more for I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

- Request for itemized and verified account of lien claim individual form

- Quitclaim deed by two individuals to husband and wife north dakota form

- Warranty deed from two individuals to husband and wife north dakota form

- Transfer death deed 497317466 form

- Of the st ate of idaho form

- Renunciation and disclaimer of joint tenant or tenancy interest north dakota form

- Tactical considerations in fighting foreclosure msfraud form

- Quitclaim deed by two individuals to llc north dakota form

Find out other I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe