Form 16 See Rule 311a YADA Business Solution

What is the Form 16 see Rule 311a YADA Business Solution

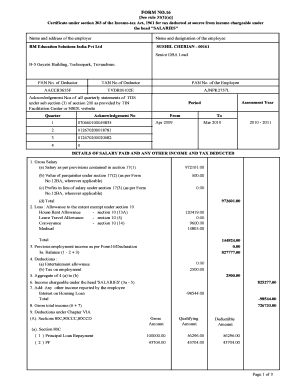

The Form 16 see Rule 311a YADA Business Solution is a specific document used primarily in business contexts, particularly for tax and compliance purposes. It serves as a declaration of income and tax deductions for employees and businesses, ensuring transparency and adherence to regulatory standards. This form is essential for maintaining accurate financial records and fulfilling legal obligations.

How to use the Form 16 see Rule 311a YADA Business Solution

Using the Form 16 see Rule 311a YADA Business Solution involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form accurately, providing details about your income and deductions. Once completed, review the form for any errors before submitting it to the appropriate tax authority or business entity.

Steps to complete the Form 16 see Rule 311a YADA Business Solution

Completing the Form 16 see Rule 311a YADA Business Solution requires careful attention to detail. Follow these steps:

- Gather required documents, including income statements and deduction records.

- Fill in personal and business information as required.

- Detail your income sources and applicable deductions.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Form 16 see Rule 311a YADA Business Solution

The legal use of the Form 16 see Rule 311a YADA Business Solution hinges on compliance with relevant tax laws and regulations. This form must be filled out truthfully and submitted within designated timelines to avoid penalties. Proper use ensures that businesses and individuals meet their tax obligations and maintain good standing with tax authorities.

Key elements of the Form 16 see Rule 311a YADA Business Solution

Key elements of the Form 16 see Rule 311a YADA Business Solution include:

- Personal identification information, such as name and address.

- Details of income earned during the tax year.

- Applicable deductions and credits that reduce taxable income.

- Signature of the individual or authorized representative.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 16 see Rule 311a YADA Business Solution. These guidelines outline the necessary information required, submission deadlines, and compliance requirements to ensure that the form is legally valid. Adhering to these guidelines helps prevent issues with tax filings and ensures accurate reporting.

Quick guide on how to complete form 16 see rule 311a yada business solution

Prepare Form 16 see Rule 311a YADA Business Solution effortlessly on any device

The management of online documents has gained popularity among organizations and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed papers, as you can easily obtain the correct form and securely store it online. airSlate SignNow offers all the resources you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Form 16 see Rule 311a YADA Business Solution on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-centered tasks today.

How to modify and electronically sign Form 16 see Rule 311a YADA Business Solution with ease

- Locate Form 16 see Rule 311a YADA Business Solution and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your selecting. Modify and electronically sign Form 16 see Rule 311a YADA Business Solution and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 16 see rule 311a yada business solution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 16 see Rule 311a YADA Business Solution?

Form 16 see Rule 311a YADA Business Solution is a digital document designed to provide a comprehensive overview of tax deductions on salaries. It simplifies the process of documentation for employers and employees, ensuring transparency and accuracy in financial reporting.

-

How does airSlate SignNow facilitate the use of Form 16 see Rule 311a YADA Business Solution?

airSlate SignNow enables businesses to seamlessly send and eSign Form 16 see Rule 311a YADA Business Solution. Its user-friendly interface allows for quick uploads and easy management of documents, streamlining the eSignature process for all parties involved.

-

What are the pricing options for airSlate SignNow that includes Form 16 see Rule 311a YADA Business Solution?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs, including options specifically for handling Form 16 see Rule 311a YADA Business Solution. You can choose from monthly or annual subscriptions, ensuring you find a solution that aligns with your budget.

-

What features of airSlate SignNow enhance the use of Form 16 see Rule 311a YADA Business Solution?

Key features include an intuitive drag-and-drop document editor, customizable templates for Form 16 see Rule 311a YADA Business Solution, and real-time tracking of document statuses. These features help businesses improve efficiency and reduce the time spent on paperwork.

-

What benefits can businesses expect from using Form 16 see Rule 311a YADA Business Solution with airSlate SignNow?

By using Form 16 see Rule 311a YADA Business Solution via airSlate SignNow, businesses can ensure compliance with tax regulations, enhance document security, and improve turnaround times for eSigned documents. This leads to better productivity and organizational efficiency.

-

Can Form 16 see Rule 311a YADA Business Solution be integrated with other tools?

Yes, airSlate SignNow allows for seamless integration with various business applications, enabling smoother workflows and enhanced data management when dealing with Form 16 see Rule 311a YADA Business Solution. This ensures that all your tools work together efficiently.

-

Is airSlate SignNow suitable for both small and large businesses using Form 16 see Rule 311a YADA Business Solution?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large enterprise, you can leverage Form 16 see Rule 311a YADA Business Solution effectively to meet your documentation and eSignature needs.

Get more for Form 16 see Rule 311a YADA Business Solution

Find out other Form 16 see Rule 311a YADA Business Solution

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form