Instructions for Form CST 240 "West Virginia Claim for Refund or Credit 2022-2026

Understanding the Instructions for Form CST 240

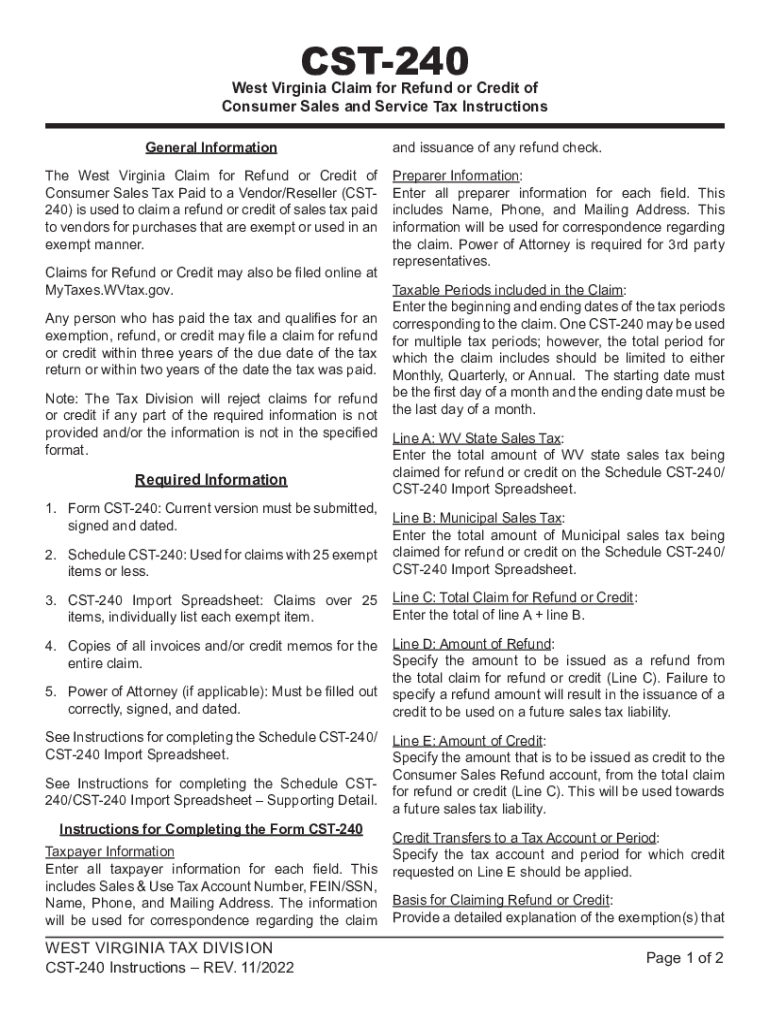

The Instructions for Form CST 240, known as the West Virginia Claim for Refund or Credit, provide essential guidance for individuals and businesses seeking to reclaim overpaid sales taxes. This form is specifically designed for taxpayers in West Virginia who believe they are entitled to a refund due to various reasons, such as overpayment or erroneous transactions. Understanding these instructions is crucial for ensuring compliance with state tax regulations and for successfully navigating the refund process.

Steps to Complete the Instructions for Form CST 240

Completing the CST 240 form requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary documentation, including receipts and proof of payment.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check calculations to avoid errors that could delay processing.

- Sign and date the form to validate your submission.

- Submit the form via the preferred method, whether online, by mail, or in person.

Key Elements of the Instructions for Form CST 240

Several critical components are outlined in the CST 240 instructions that taxpayers must understand:

- Eligibility Criteria: Taxpayers must determine if they qualify for a refund based on their sales tax payments.

- Required Documents: Specific documentation is necessary to support the refund claim, including invoices and payment records.

- Submission Methods: The form can typically be submitted online or through traditional mail, depending on the taxpayer's preference.

- Filing Deadlines: Adhering to deadlines is crucial to ensure that claims are processed in a timely manner.

Legal Use of the Instructions for Form CST 240

Understanding the legal implications of the CST 240 form is vital for taxpayers. The form serves as an official request for a refund, and its completion must comply with West Virginia tax laws. Failure to adhere to these regulations could result in penalties or denial of the refund claim. Utilizing the form correctly ensures that taxpayers protect their rights and fulfill their obligations under state law.

Obtaining the Instructions for Form CST 240

Taxpayers can obtain the CST 240 instructions through several avenues. The West Virginia State Tax Department's official website provides downloadable versions of the form and its accompanying instructions. Additionally, physical copies may be available at local tax offices or through authorized tax professionals. Ensuring access to the most current version of the instructions is essential for accurate completion.

Examples of Using the Instructions for Form CST 240

Practical examples can help clarify how to apply the CST 240 instructions in real-world scenarios. For instance, a business that mistakenly paid sales tax on exempt items can use the form to reclaim those funds. Another example includes individual taxpayers who discover they overpaid sales tax during a purchase. In both cases, following the instructions closely will facilitate a smoother refund process.

Quick guide on how to complete instructions for form cst 240 ampquotwest virginia claim for refund or credit

Complete Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit smoothly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents rapidly without delays. Manage Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit on any device with airSlate SignNow’s Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit effortlessly

- Find Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit and click Get Form to get going.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive data using tools provided by airSlate SignNow specifically for that purpose.

- Craft your eSignature with the Sign tool, which takes mere seconds and carries the same legal legitimacy as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to distribute your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and eSign Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form cst 240 ampquotwest virginia claim for refund or credit

Create this form in 5 minutes!

People also ask

-

What is the west virginia cst 240 requirement for businesses?

The west virginia cst 240 is a signNow compliance standard that businesses operating in Virginia must adhere to when handling electronic signatures. This ensures that all eSigned documents maintain legal validity and security, crucial for business operations. airSlate SignNow helps businesses meet these requirements easily and efficiently.

-

How does airSlate SignNow support the west virginia cst 240 compliance?

airSlate SignNow provides robust features that align with the west virginia cst 240 compliance, ensuring that your electronic signatures are legally binding. Our platform offers detailed audit trails and secure document storage, which are essential for meeting compliance standards. This allows businesses to confidently manage their electronic signature processes.

-

What are the pricing options for airSlate SignNow in relation to west virginia cst 240?

AirSlate SignNow offers flexible pricing plans tailored for different business needs, including compliance with west virginia cst 240. Depending on the features and volume of usage, you can choose a plan that maximizes value while ensuring compliance. Visit our pricing page to find a plan that suits your business requirements.

-

What features does airSlate SignNow offer that relate to west virginia cst 240?

Key features of airSlate SignNow that support the west virginia cst 240 include secure eSigning, comprehensive audit trails, and customizable workflows. These features ensure that all documents are managed effectively and comply with state requirements. Additionally, our user-friendly interface makes it easy for businesses to implement these features.

-

Can airSlate SignNow integrate with other software for west virginia cst 240 compliance?

Yes, airSlate SignNow offers seamless integrations with various business applications to enhance your workflow while complying with the west virginia cst 240. This includes popular tools like CRMs, document storage solutions, and more. Integrating these applications with airSlate SignNow simplifies compliance management and boosts productivity.

-

What are the benefits of using airSlate SignNow for the west virginia cst 240?

Using airSlate SignNow for west virginia cst 240 compliance provides multiple benefits, such as increased efficiency, cost-effectiveness, and enhanced security for your documents. Our platform allows businesses to streamline their signing processes while ensuring full compliance with state regulations. This ultimately leads to improved client satisfaction and faster turnaround times.

-

Is airSlate SignNow secure for west virginia cst 240 compliance?

Absolutely! airSlate SignNow employs state-of-the-art security measures to protect your documents and ensure compliance with west virginia cst 240. Our platform uses encryption, secure servers, and regular audits to safeguard your eSigned documents. You can trust airSlate SignNow to handle your sensitive information securely.

Get more for Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit

- Bankrupty nd form

- Bill of sale with warranty by individual seller north dakota form

- Bill of sale with warranty for corporate seller north dakota form

- Bill of sale without warranty by individual seller north dakota form

- Bill of sale without warranty by corporate seller north dakota form

- North dakota agreement 497317663 form

- Verification of matrix pro se north dakota form

- Verification of creditors matrix north dakota form

Find out other Instructions For Form CST 240 "West Virginia Claim For Refund Or Credit

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple