CST 240 WV State Tax Department WV Gov 2015

What is the CST 240 WV State Tax Department WV gov

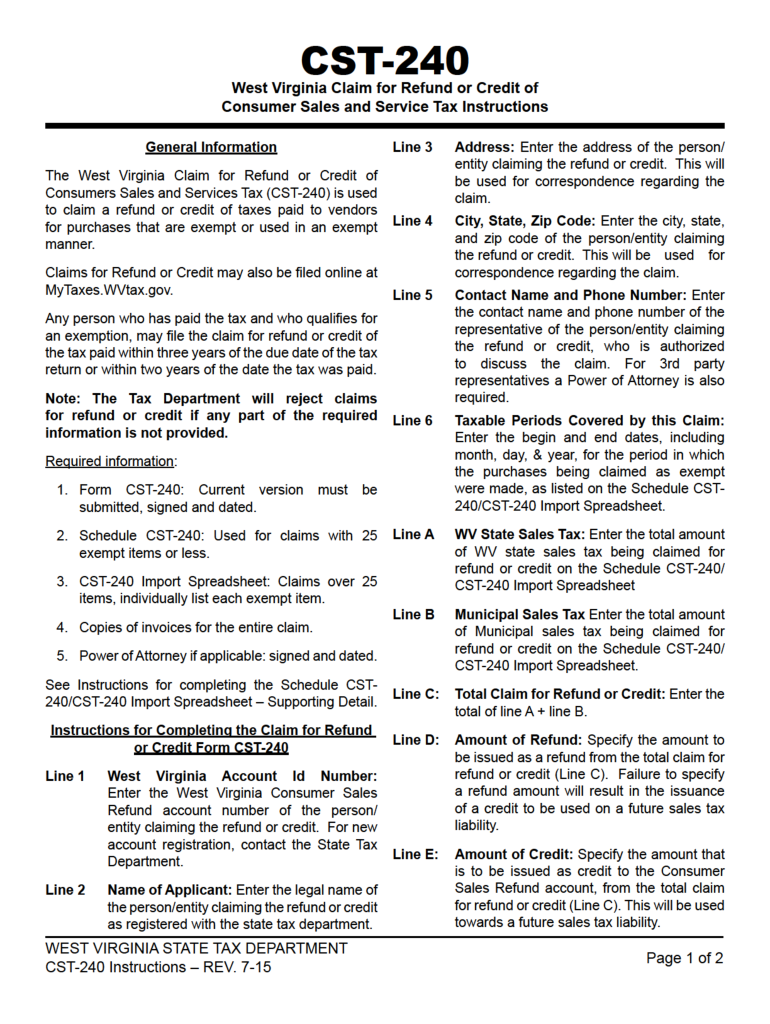

The CST 240 form is a specific document issued by the West Virginia State Tax Department. It is primarily used for tax-related purposes, allowing individuals or businesses to report certain financial information to the state. This form is essential for compliance with state tax regulations and helps ensure accurate tax reporting. Understanding the purpose and requirements of the CST 240 is crucial for taxpayers in West Virginia to avoid potential penalties and ensure proper filing.

How to use the CST 240 WV State Tax Department WV gov

Using the CST 240 form involves several key steps. First, gather all necessary financial documents and information required for completion. This may include income statements, deductions, and other relevant data. Next, access the CST 240 form through the West Virginia State Tax Department's official website or other authorized platforms. Complete the form by filling in the required fields accurately. Finally, review the completed form for any errors before submission to ensure compliance with state regulations.

Steps to complete the CST 240 WV State Tax Department WV gov

Completing the CST 240 form involves a systematic approach:

- Gather all relevant financial information, including income and deductions.

- Access the CST 240 form online or obtain a physical copy.

- Fill out the form carefully, ensuring all required fields are completed.

- Double-check the information for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form by the designated deadline, either online, by mail, or in person.

Legal use of the CST 240 WV State Tax Department WV gov

The CST 240 form is legally recognized as a valid document for tax reporting within the state of West Virginia. It must be completed in accordance with state laws and regulations to ensure its legality. Proper use of the form includes accurate reporting of financial information and adherence to submission deadlines. Failure to comply with these requirements may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the CST 240 form are crucial for taxpayers to observe. Typically, the form must be submitted by the state’s tax filing deadline, which may vary based on individual circumstances. It is important to stay informed about any changes to deadlines, especially during tax season. Missing the filing deadline can lead to penalties and interest on unpaid taxes, making timely submission essential.

Form Submission Methods (Online / Mail / In-Person)

The CST 240 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the West Virginia State Tax Department's website, ensuring a quicker processing time.

- Mail: The form can be printed and mailed to the appropriate tax office. Ensure that it is sent well before the deadline to allow for processing time.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices, which can provide immediate confirmation of receipt.

Quick guide on how to complete cst 240 wv state tax department wvgov

Your assistance manual on how to prepare your CST 240 WV State Tax Department WV gov

If you’re looking to learn how to generate and dispatch your CST 240 WV State Tax Department WV gov, here are some brief guidelines on how to make tax submissions much more manageable.

To begin, you only need to register your airSlate SignNow profile to transform how you handle documentation online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms easily. By utilizing its editing tool, you can toggle between text, check boxes, and electronic signatures, and go back to adjust answers when necessary. Streamline your tax management with advanced PDF editing, electronic signing, and user-friendly sharing.

Follow the instructions below to finalize your CST 240 WV State Tax Department WV gov in just a few minutes:

- Create your account and begin editing PDFs within minutes.

- Access our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to open your CST 240 WV State Tax Department WV gov in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding electronic signature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Please bear in mind that submitting on paper can lead to more return errors and delay refunds. Obviously, before e-filing your taxes, verify the IRS website for declaration rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct cst 240 wv state tax department wvgov

Create this form in 5 minutes!

How to create an eSignature for the cst 240 wv state tax department wvgov

How to generate an electronic signature for your Cst 240 Wv State Tax Department Wvgov in the online mode

How to create an eSignature for your Cst 240 Wv State Tax Department Wvgov in Chrome

How to generate an eSignature for putting it on the Cst 240 Wv State Tax Department Wvgov in Gmail

How to make an electronic signature for the Cst 240 Wv State Tax Department Wvgov right from your smart phone

How to generate an eSignature for the Cst 240 Wv State Tax Department Wvgov on iOS

How to make an eSignature for the Cst 240 Wv State Tax Department Wvgov on Android

People also ask

-

What is CST 240 at the WV State Tax Department?

CST 240 refers to a specific tax form required by the WV State Tax Department for certain business filings. It is essential for ensuring compliance with state tax regulations. Understanding CST 240 can help businesses avoid penalties and maintain good standing with the WV gov.

-

How can airSlate SignNow improve my document signing experience with CST 240?

airSlate SignNow simplifies the process of signing and submitting CST 240 documents required by the WV State Tax Department. With its user-friendly interface, you can quickly eSign documents anytime, ensuring timely submissions to the WV gov. This streamlines your workflow and enhances compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs, making it an affordable choice for managing CST 240 forms for the WV State Tax Department. The plans include features that empower you to efficiently send, eSign, and track your documents at competitive rates. Discounts may be available for annual subscriptions.

-

What features does airSlate SignNow offer to assist with CST 240 submissions?

Features like document templates, automated workflows, and comprehensive tracking help streamline CST 240 submissions to the WV State Tax Department. Additionally, airSlate SignNow allows for secure storage, making it easy to access past forms for reference when dealing with the WV gov.

-

How secure is airSlate SignNow for handling CST 240 documents?

airSlate SignNow employs advanced security measures to protect your CST 240 documents, ensuring compliance with the WV State Tax Department and other regulations. With encrypted storage and secure sharing options, you can confidently manage your documents while submitting to the WV gov.

-

Can airSlate SignNow integrate with other software I use for managing tax documents?

Yes, airSlate SignNow seamlessly integrates with various software platforms that can assist in managing tax documents, which includes preparing CST 240 forms for the WV State Tax Department. This integration capability allows you to streamline your accounting processes while efficiently utilizing resources when dealing with the WV gov.

-

What are the benefits of using airSlate SignNow for small businesses dealing with CST 240?

For small businesses, airSlate SignNow offers a cost-effective solution for managing CST 240 forms with the WV State Tax Department. The benefits include increased efficiency, reduced paperwork, and enhanced tracking of submissions to the WV gov, ultimately leading to better compliance and less stress during tax season.

Get more for CST 240 WV State Tax Department WV gov

Find out other CST 240 WV State Tax Department WV gov

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT