Lee County Tourist Tax Login Form

What is the Lee County Tourist Tax Login

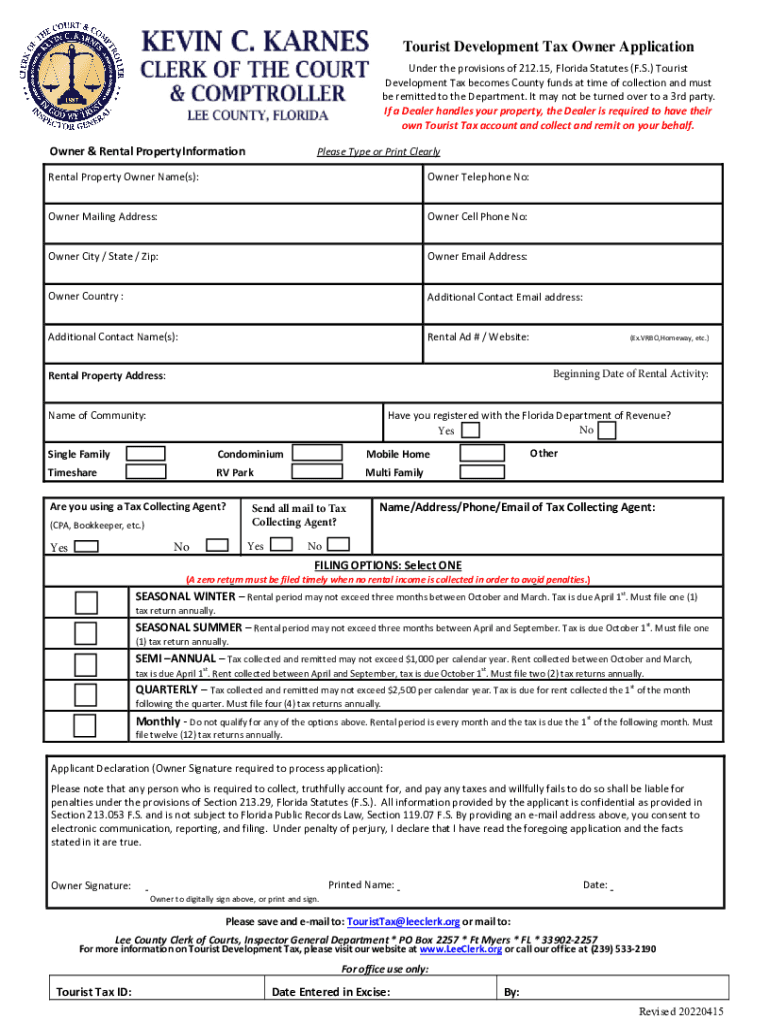

The Lee County Tourist Tax Login is a digital platform designed for businesses and individuals to manage their tourist development tax obligations in Lee County, Florida. This tax is levied on short-term rentals and accommodations, contributing to local tourism initiatives. The login system allows users to access their accounts, view tax obligations, and submit necessary documentation efficiently. By utilizing this online portal, users can streamline their tax management processes, ensuring compliance with local regulations.

How to use the Lee County Tourist Tax Login

To use the Lee County Tourist Tax Login, users must first navigate to the official login page. Here, they will enter their credentials, which typically include a username and password. Once logged in, users can access various features, including viewing their tax balance, filing returns, and making payments. It is essential to keep login information secure and to update passwords regularly to protect sensitive financial data.

Steps to complete the Lee County Tourist Tax Login

Completing the Lee County Tourist Tax Login involves several key steps:

- Visit the official Lee County Tourist Tax Login page.

- Enter your username and password in the designated fields.

- Click on the 'Login' button to access your account.

- Navigate through the dashboard to find the necessary options for filing or managing your tax.

- Log out securely after completing your tasks to protect your account.

Legal use of the Lee County Tourist Tax Login

The legal use of the Lee County Tourist Tax Login is governed by local tax laws and regulations. Users must ensure that they provide accurate information when filing their tax returns. Misrepresentation or failure to comply with tax obligations can lead to penalties and legal repercussions. The platform is designed to facilitate compliance by providing necessary resources and guidance for users.

Required Documents

When accessing the Lee County Tourist Tax Login, users may need to prepare specific documents to ensure a smooth filing process. Commonly required documents include:

- Proof of rental income, such as invoices or rental agreements.

- Previous tax returns related to tourist development tax.

- Identification documents, such as a driver's license or tax identification number.

Having these documents ready can expedite the filing process and help ensure compliance with local laws.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Lee County Tourist Tax Login can result in various penalties. These may include:

- Monetary fines for late or inaccurate filings.

- Interest charges on overdue tax payments.

- Potential legal action for persistent non-compliance.

It is essential for users to stay informed about their tax obligations to avoid these consequences.

Quick guide on how to complete lee county tourist tax login

Complete Lee County Tourist Tax Login effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without holdups. Handle Lee County Tourist Tax Login on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and electronically sign Lee County Tourist Tax Login with ease

- Find Lee County Tourist Tax Login and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools supplied by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Lee County Tourist Tax Login and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the lee county tourist tax login process?

The lee county tourist tax login process is designed to be efficient and user-friendly. Users can access the portal by visiting the official website and entering their credentials. Once logged in, users can manage their tourist tax submissions and access important documents with ease.

-

How can airSlate SignNow assist with the lee county tourist tax login?

airSlate SignNow provides a streamlined solution to manage the documentation required for lee county tourist tax login. With our eSigning capabilities, you can securely sign and send necessary forms electronically. This ensures a quicker turnaround and helps you stay compliant with local regulations.

-

Is there a cost associated with the lee county tourist tax login?

Accessing the lee county tourist tax login itself is typically free, but there may be fees associated with certain transactions. Using airSlate SignNow can enhance your experience by offering cost-effective solutions for eSigning and document management, making it an invaluable tool for businesses dealing with these taxes.

-

What features does airSlate SignNow offer for managing lee county tourist tax documents?

airSlate SignNow offers robust features including electronic signatures, secure document sharing, and customizable templates which are ideal for managing lee county tourist tax documentation. Our platform simplifies the entire process, ensuring that all documents are signed and stored in compliance with local laws. You'll also receive real-time notifications on your document's status.

-

Can airSlate SignNow integrate with other tax management tools?

Yes, airSlate SignNow offers integrations with various tax management tools that can enhance your lee county tourist tax login experience. This allows you to synchronize data seamlessly and improve overall efficiency. By integrating our eSigning capabilities with your existing systems, you can streamline your tax submission process.

-

What benefits does airSlate SignNow provide for businesses dealing with tourist taxes?

Businesses dealing with tourist taxes can greatly benefit from airSlate SignNow's easy-to-use solution for the lee county tourist tax login. Not only does it save time with document handling, but it also enhances security through encrypted eSignatures. This means you can focus on your core business activities while ensuring compliance and reducing errors.

-

How do I create an account for the lee county tourist tax login?

Creating an account for the lee county tourist tax login involves visiting the official website and completing a registration form. airSlate SignNow can assist you in preparing your account documentation so that you can get started quickly. After submitting the required information, you'll gain access to manage your tourist tax documents efficiently.

Get more for Lee County Tourist Tax Login

- North dakota certificate of service north dakota form

- Nd change form

- North dakota name change instructions and forms package for a minor north dakota

- Name change instructions and forms package for a family north dakota

- North dakota change form

- North dakota affidavit 497317734 form

- Information name change

- North dakota change 497317736 form

Find out other Lee County Tourist Tax Login

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer