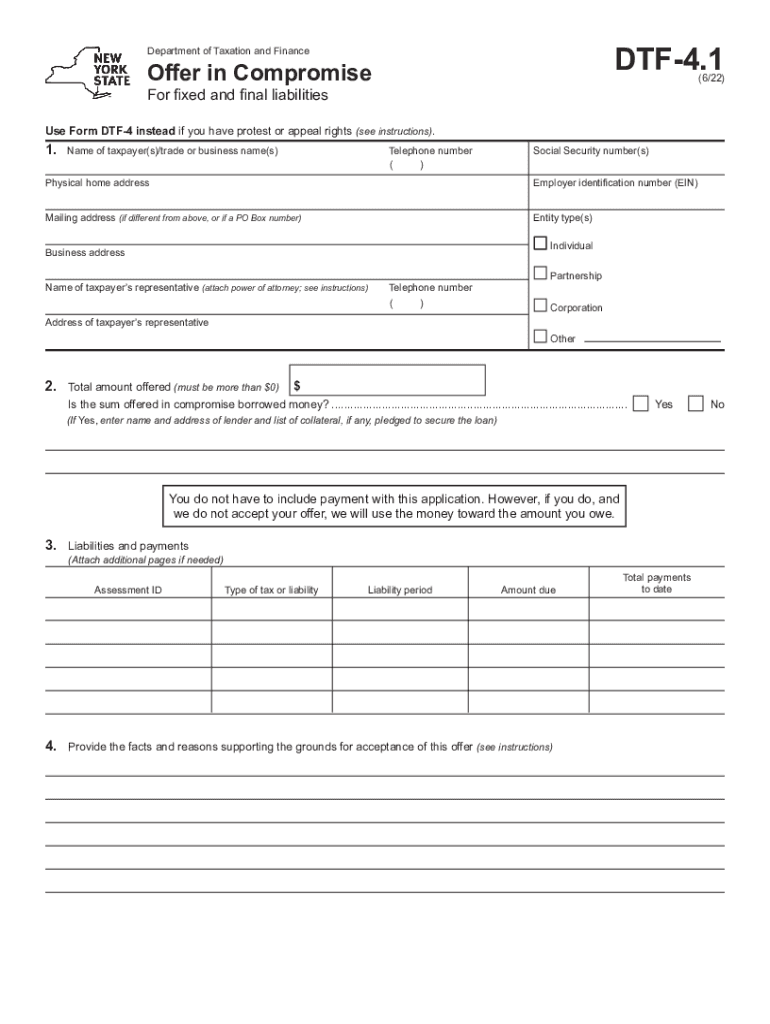

Www Tax Ny GovenforcementcollectionsOffer in Compromise Program Department of Taxation and Finance 2022-2026

Understanding the RS 2050 Adjustment Report

The RS 2050 adjustment report is a crucial document for individuals participating in the New York State and Local Retirement System. This form allows members to adjust their retirement benefits based on specific criteria, ensuring that their retirement income reflects their service and contributions accurately. Understanding the purpose and requirements of the RS 2050 is essential for anyone looking to manage their retirement benefits effectively.

Steps to Complete the RS 2050 Adjustment Report

Filling out the RS 2050 adjustment report involves several key steps to ensure that the form is completed accurately. Begin by gathering all necessary personal information, including your NYS retirement number and employment history. Next, carefully review the instructions provided with the form to understand what adjustments you may be eligible for. After completing the form, double-check all entries for accuracy before submission.

Required Documents for the RS 2050 Form

To successfully complete the RS 2050 adjustment report, you will need several supporting documents. These may include proof of employment history, documentation of previous retirement contributions, and any relevant tax forms. Having these documents ready will streamline the process and help ensure that your adjustments are processed without delay.

Eligibility Criteria for the RS 2050 Adjustment Report

Eligibility for filing the RS 2050 adjustment report typically depends on your length of service and the specific retirement plan you are enrolled in. Generally, members who have made contributions to the New York State and Local Retirement System may qualify. It is essential to review the eligibility guidelines to determine if you can file for adjustments.

Form Submission Methods for the RS 2050

The RS 2050 adjustment report can be submitted through various methods. Members can choose to file the form online through the New York State retirement website, or they may opt to submit a paper version via mail. Ensure that you follow the submission guidelines carefully to avoid any processing delays.

Legal Use of the RS 2050 Adjustment Report

The RS 2050 adjustment report is legally binding once completed and submitted according to the guidelines set by the New York State retirement system. It is essential to ensure compliance with all legal requirements to protect your rights and benefits as a member of the retirement system. Understanding the legal implications of the adjustments you are requesting is vital for proper form completion.

Quick guide on how to complete wwwtaxnygovenforcementcollectionsoffer in compromise program department of taxation and finance

Effortlessly Prepare Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Simplest Way to Modify and eSign Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance Effortlessly

- Obtain Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your edits.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovenforcementcollectionsoffer in compromise program department of taxation and finance

Create this form in 5 minutes!

People also ask

-

What is rs 2050 and how does it relate to airSlate SignNow?

The rs 2050 is a powerful feature of airSlate SignNow designed to streamline document signing processes. It offers enhanced security and efficiency, ensuring that businesses can send and eSign documents reliably. With rs 2050, users benefit from a user-friendly interface and advanced integration options.

-

How much does airSlate SignNow's rs 2050 cost?

Pricing for airSlate SignNow’s rs 2050 varies based on the subscription plan chosen. Businesses can select from several tiers to find a cost-effective solution that fits their needs. Each plan offers different features, ensuring value for users at every level.

-

What features are included with the rs 2050?

The rs 2050 includes a range of features such as customizable templates, real-time tracking, and cloud storage integration. Users can also enjoy bulk send options and automated workflows, making the document signing process seamless. These features collectively enhance productivity for businesses using airSlate SignNow.

-

What are the benefits of using airSlate SignNow's rs 2050?

Using the rs 2050 with airSlate SignNow provides several benefits, including improved document security and faster turnaround times. Businesses can rely on robust encryption and compliance features, ensuring that sensitive information is protected. Additionally, the solution enhances collaboration among teams and clients.

-

Can I integrate rs 2050 with other software?

Yes, airSlate SignNow’s rs 2050 supports integration with various third-party applications, including CRM and project management tools. This flexibility allows businesses to streamline their workflows and manage documents more effectively. Integration capabilities make it easy to incorporate rs 2050 into existing systems.

-

Is rs 2050 user-friendly for new customers?

Absolutely! The rs 2050 is designed with user experience in mind, ensuring that even new customers can navigate it easily. The intuitive interface guides users through the document signing process, reducing the learning curve signNowly. Overall, it provides a straightforward approach to eSigning for everyone.

-

What industries benefit most from using rs 2050?

Various industries, including real estate, legal, and healthcare, greatly benefit from using rs 2050. The ability to efficiently manage and eSign documents is crucial in these sectors, enhancing workflow and compliance. AirSlate SignNow's rs 2050 caters to the specific needs of these industries, providing tailored solutions.

Get more for Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance

- Legal last will and testament form for married person with adult and minor children north dakota

- Mutual wills package with last wills and testaments for married couple with adult and minor children north dakota form

- Legal last will and testament form for a widow or widower with adult children north dakota

- Legal last will and testament form for widow or widower with minor children north dakota

- Legal last will form for a widow or widower with no children north dakota

- Legal last will and testament form for a widow or widower with adult and minor children north dakota

- Legal last will and testament form for divorced and remarried person with mine yours and ours children north dakota

- Legal last will and testament form with all property to trust called a pour over will north dakota

Find out other Www tax ny govenforcementcollectionsOffer In Compromise Program Department Of Taxation And Finance

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself