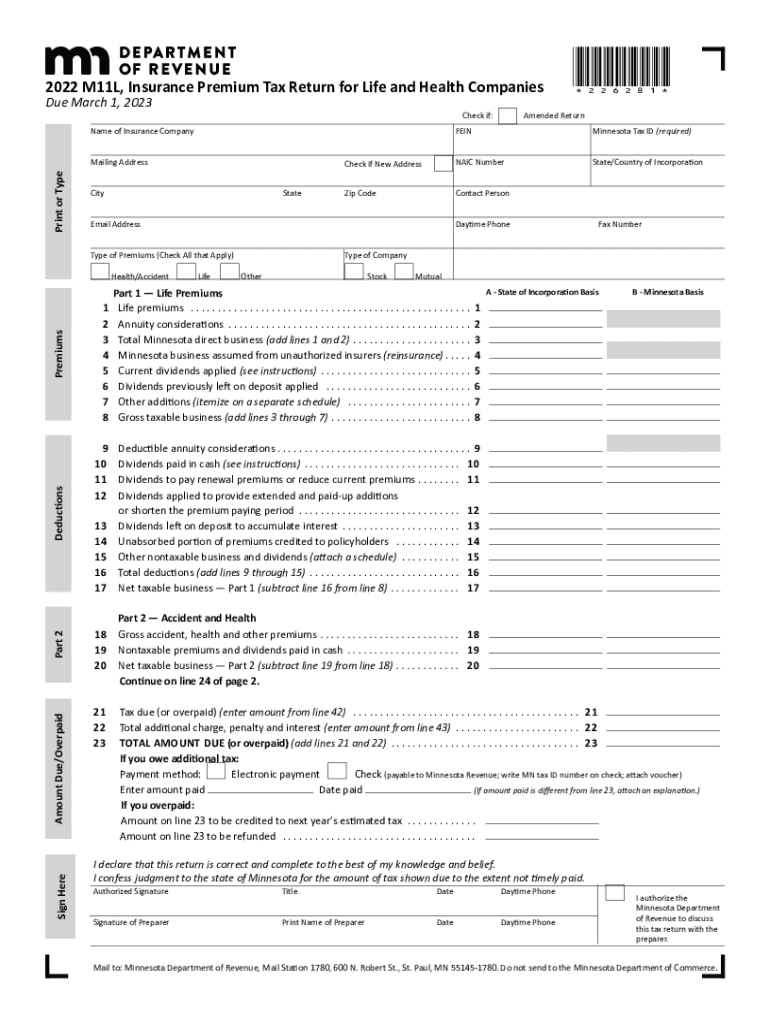

Printable Minnesota Form M11L Insurance Premium Tax Return for Life and 2022-2026

What is the 1095 A Form?

The 1095 A form, also known as the health insurance tax form, is a document that provides information about health coverage obtained through the Health Insurance Marketplace. It is essential for individuals who enrolled in a health plan through the Marketplace, as it details the months of coverage, the premium amounts, and any premium tax credits received. This form is crucial for filing federal income taxes, as it helps determine eligibility for premium tax credits and whether the individual met the health coverage requirement under the Affordable Care Act.

Key Elements of the 1095 A Form

The 1095 A form contains several key elements that are important for tax filing. These include:

- Marketplace Identifier: This section identifies the specific Marketplace where the coverage was obtained.

- Covered Individuals: Names and details of individuals covered under the health plan.

- Months of Coverage: A breakdown of the months during which coverage was active.

- Premium Amounts: The total monthly premium amounts for the coverage.

- Premium Tax Credits: Any tax credits that were applied to lower the premium costs.

Steps to Complete the 1095 A Form

Completing the 1095 A form involves several straightforward steps:

- Gather Information: Collect all necessary information regarding your health coverage, including the Marketplace details and the coverage period.

- Fill Out the Form: Accurately enter the required information in the appropriate sections of the form.

- Review for Accuracy: Double-check all entries to ensure they are correct before submission.

- File with Your Tax Return: Include the completed 1095 A form when filing your federal income tax return.

IRS Guidelines for the 1095 A Form

The IRS provides specific guidelines regarding the 1095 A form, emphasizing its importance for tax compliance. Taxpayers are required to report the information from this form when filing their annual tax returns. The IRS uses this data to verify that individuals have met the health coverage requirements and to determine the correct amount of premium tax credits. It is crucial to keep a copy of the 1095 A form for your records, as it may be needed for future reference or audits.

Filing Deadlines for the 1095 A Form

Filing deadlines for the 1095 A form align with the general federal tax filing deadlines. Typically, taxpayers must submit their federal income tax returns by April fifteenth of each year. If you receive a 1095 A form, it is advisable to complete your tax return as soon as possible to avoid any potential penalties. Additionally, the Marketplace is required to send out the 1095 A forms to individuals by January thirty-first of the following year, allowing ample time for tax preparation.

Penalties for Non-Compliance with the 1095 A Form

Failure to include the 1095 A form when filing your tax return can result in penalties. The IRS may impose fines for not reporting health coverage accurately, which could lead to additional taxes owed. It is essential to ensure that the information reported on the 1095 A form is accurate and submitted on time to avoid any complications with your tax filing. Keeping thorough records of your health coverage can help mitigate issues related to non-compliance.

Quick guide on how to complete printable minnesota form m11l insurance premium tax return for life and

Effortlessly Prepare Printable Minnesota Form M11L Insurance Premium Tax Return For Life And on Any Device

The management of documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Printable Minnesota Form M11L Insurance Premium Tax Return For Life And on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Printable Minnesota Form M11L Insurance Premium Tax Return For Life And with Ease

- Find Printable Minnesota Form M11L Insurance Premium Tax Return For Life And and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Printable Minnesota Form M11L Insurance Premium Tax Return For Life And and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable minnesota form m11l insurance premium tax return for life and

Create this form in 5 minutes!

People also ask

-

What is a 1095 a form, and why is it important?

A 1095 a form is a document provided by health insurance marketplaces that summarizes the health coverage you had during the year. It is important for tax reporting purposes because it helps determine your eligibility for the Premium Tax Credit and ensures compliance with the Affordable Care Act.

-

How can airSlate SignNow help with filling out a 1095 a form?

airSlate SignNow offers features that simplify the process of completing a 1095 a form. With our intuitive eSigning tools and document management capabilities, you can easily fill out, sign, and send the form securely, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for a 1095 a form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. With our affordable pricing, you can efficiently manage your 1095 a form along with other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the 1095 a form?

Absolutely! airSlate SignNow provides integration options with various software solutions, allowing you to streamline your workflow when handling a 1095 a form. This ensures that you can manage your documents efficiently and within your existing systems.

-

What features does airSlate SignNow offer for electronic signing of a 1095 a form?

Our platform includes features such as customizable templates, mobile signing, and secure cloud storage, making it easy to electronically sign a 1095 a form. These features not only enhance user experience but also ensure legal compliance with electronic signatures.

-

How secure is airSlate SignNow when handling sensitive documents like a 1095 a form?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the 1095 a form. Our compliance with industry standards ensures that your data remains secure and confidential throughout the signing process.

-

Can airSlate SignNow be used for bulk signing of multiple 1095 a forms?

Yes, airSlate SignNow supports bulk sending and signing of documents, making it ideal for businesses needing to manage multiple 1095 a forms quickly. This feature allows you to save time while ensuring all forms are properly executed and documented.

Get more for Printable Minnesota Form M11L Insurance Premium Tax Return For Life And

- Unconditional waiver and release of lien upon progress payment by corporation or llc nebraska form

- Quitclaim deed from individual to llc nebraska form

- Warranty deed from individual to llc nebraska form

- Ne waiver form

- Unconditional waiver and release of lien upon final payment nebraska form

- Ne husband wife form

- Warranty deed from husband and wife to corporation nebraska form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form nebraska

Find out other Printable Minnesota Form M11L Insurance Premium Tax Return For Life And

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT