Minnesota Form M1R Age 65 or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 or OlderPrintable Minnesota Form M1R a 2022-2026

Understanding the Minnesota Form M1R for Age 65 or Older and Disabled Subtraction

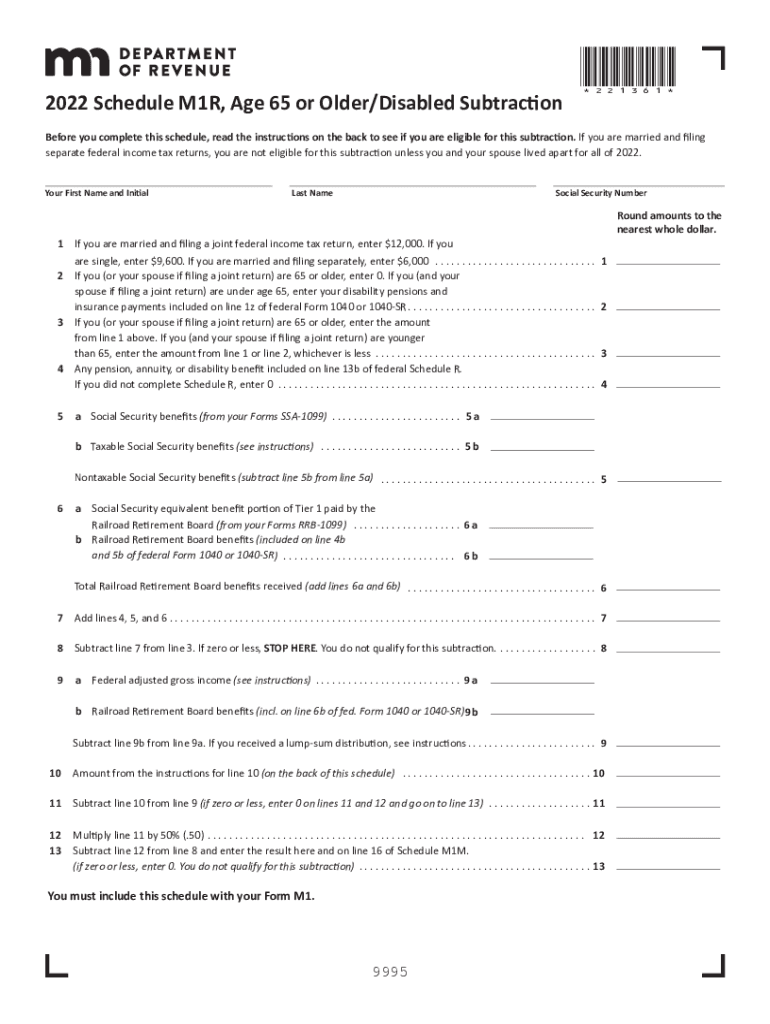

The Minnesota Form M1R is designed to provide tax benefits for individuals aged 65 or older or those who are disabled. This form allows eligible taxpayers to subtract certain amounts from their taxable income, potentially lowering their overall tax liability. The subtraction is intended to ease the financial burden on seniors and disabled individuals, acknowledging their unique circumstances. Understanding the specifics of this form is essential for maximizing potential savings.

Steps to Complete the Minnesota Form M1R for Age 65 or Older and Disabled Subtraction

Completing the Minnesota Form M1R involves several key steps to ensure accuracy and compliance with state tax regulations. Begin by gathering necessary documents, including your federal tax return and any relevant income statements. Next, fill out the form by providing personal information, including your age and disability status. Carefully calculate the subtraction amount based on the guidelines provided in the form instructions. Finally, review your completed form for any errors before submission.

Eligibility Criteria for the Minnesota Form M1R Age 65 or Older and Disabled Subtraction

To qualify for the Minnesota Form M1R, applicants must meet specific eligibility criteria. Individuals must be at least 65 years old or have a qualifying disability. Income limits may also apply, which can affect the amount that can be subtracted. It is important to review the eligibility requirements carefully to ensure compliance and maximize potential benefits.

Legal Use of the Minnesota Form M1R for Age 65 or Older and Disabled Subtraction

The Minnesota Form M1R is legally recognized by the state for tax purposes. When completed correctly, it serves as a valid document for claiming the age 65 or older and disabled subtraction. Compliance with state tax laws is crucial, as incorrect submissions may lead to penalties or delays in processing. Utilizing a reliable platform for electronic submission can enhance the legal standing of your completed form.

Obtaining the Minnesota Form M1R for Age 65 or Older and Disabled Subtraction

The Minnesota Form M1R can be obtained from the Minnesota Department of Revenue website or through authorized tax preparation services. It is available in both printable and fillable formats, allowing taxpayers to choose the method that best suits their needs. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the Minnesota Form M1R Age 65 or Older and Disabled Subtraction

Key elements of the Minnesota Form M1R include personal identification details, income information, and the specific subtraction calculations. The form also requires signatures and dates to validate the submission. Understanding these elements is essential for accurately completing the form and ensuring all required information is provided.

Quick guide on how to complete minnesota form m1r age 65 or olderdisabled subtractionprintable 2020 minnesota form m1r age 65 or olderprintable 2020 minnesota

Complete Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A without hassle

- Locate Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1r age 65 or olderdisabled subtractionprintable 2020 minnesota form m1r age 65 or olderprintable 2020 minnesota

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can I schedule m1r?

airSlate SignNow is a user-friendly platform that allows businesses to send and eSign documents efficiently. To schedule m1r, simply log into your account, navigate to the scheduling feature, and set your desired time for document signing. It's designed to streamline the eSignature process, making it quick and hassle-free.

-

What features does airSlate SignNow offer for scheduling m1r?

With airSlate SignNow, users can not only schedule m1r but also customize templates, set reminders, and track document statuses. These features enhance your productivity by ensuring you never miss an important signing timeline. The platform's intuitive design makes it accessible for users of all skill levels.

-

How does scheduling m1r benefit my business?

Scheduling m1r with airSlate SignNow improves workflow efficiency, allowing your team to focus on core business activities rather than chasing signatures. It reduces turnaround time for contracts and agreements, ultimately accelerating your business processes. This leads to higher client satisfaction and retention rates.

-

What is the pricing structure for airSlate SignNow when using schedule m1r?

AirSlate SignNow offers competitive pricing plans that accommodate various business sizes, making it easy to schedule m1r without breaking the bank. Plans typically include features such as unlimited templates and document storage. You can choose a plan that best fits your needs and budget.

-

Can I integrate other tools with airSlate SignNow while scheduling m1r?

Yes, scheduling m1r with airSlate SignNow can be seamlessly integrated with other popular business tools such as Google Drive, Dropbox, and Salesforce. This enhances your workflows by allowing you to manage all your documents in one place. Such integrations ensure a smooth transition and improved data handling.

-

Is it easy to track documents when I schedule m1r using airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking for all documents you schedule m1r for. You can see when a document is viewed, signed, or completed, giving you complete visibility over your signing processes. This feature enhances accountability and helps in managing your client interactions more effectively.

-

What types of documents can I schedule m1r for?

You can use airSlate SignNow to schedule m1r for a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring you can manage all necessary paperwork without difficulty. This versatility makes it suitable for various industries and business needs.

Get more for Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A

- Letter from tenant to landlord about sexual harassment nebraska form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children nebraska form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure nebraska form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497318075 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497318076 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497318077 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497318078 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497318079 form

Find out other Minnesota Form M1R Age 65 Or OlderDisabled SubtractionPrintable Minnesota Form M1R Age 65 Or OlderPrintable Minnesota Form M1R A

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure