Minnesota Form M1R Age 65 or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 or Older Minnesota Form M1R Age 65 or 2020

What is the Minnesota Form M1R Age 65 Or Older Disabled Subtraction?

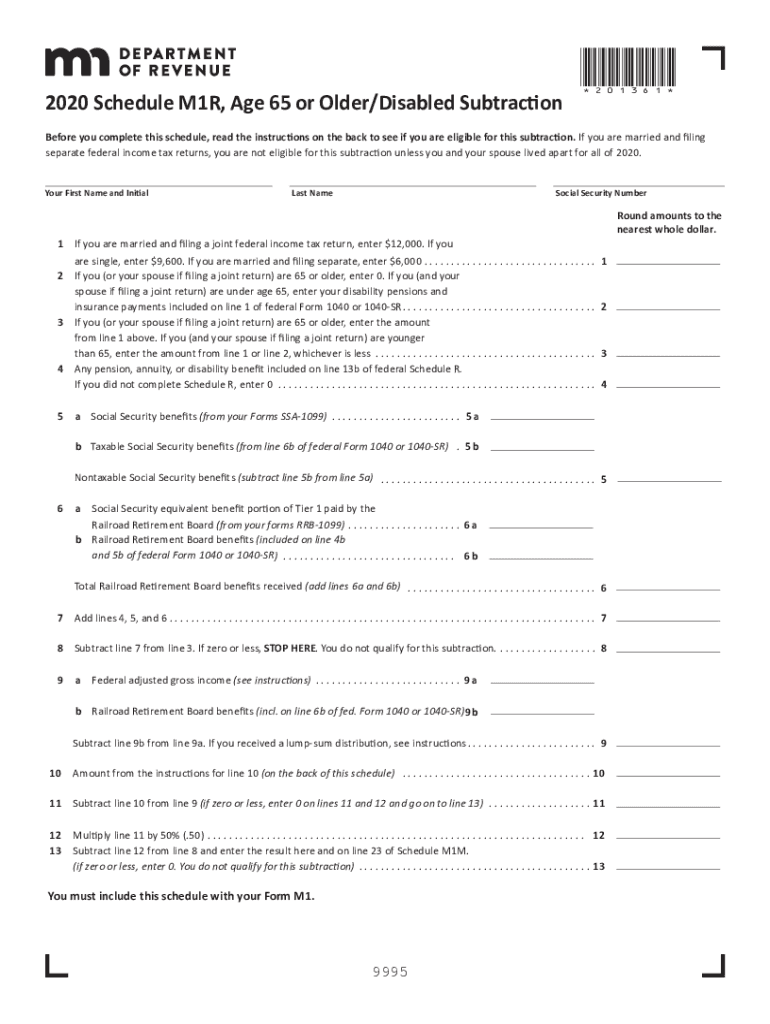

The Minnesota Form M1R is a tax form specifically designed for residents aged 65 or older, as well as disabled individuals, to claim a subtraction from their taxable income. This form allows eligible taxpayers to reduce their income tax burden by accounting for certain expenses and income adjustments. The form is part of Minnesota's efforts to provide tax relief to seniors and disabled residents, ensuring they receive appropriate financial support.

How to Use the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Using the Minnesota Form M1R involves several steps to accurately report your income and claim the subtraction. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, complete the form by providing your personal information, income details, and any qualifying expenses. Ensure that all information is accurate to avoid delays in processing. Once completed, the form can be submitted electronically or mailed to the appropriate tax authority.

Steps to Complete the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

To complete the Minnesota Form M1R, follow these steps:

- Obtain the form from the Minnesota Department of Revenue website or local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income for the year, including wages, pensions, and other sources.

- List any qualifying deductions or expenses that apply to you.

- Calculate the subtraction amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Eligibility for the Minnesota Form M1R is primarily based on age and disability status. To qualify, you must be at least 65 years old or classified as disabled according to state guidelines. Additionally, your income must fall within certain limits set by the Minnesota Department of Revenue. It is essential to review these criteria to ensure you meet the requirements before filing.

Required Documents for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

When preparing to file the Minnesota Form M1R, gather the following documents:

- W-2 forms or 1099 forms that report your income.

- Documentation of any qualifying expenses, such as medical bills or property taxes.

- Proof of age or disability status, if necessary.

- Previous year’s tax return, if applicable, for reference.

Form Submission Methods for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

The Minnesota Form M1R can be submitted through various methods to accommodate different preferences. You can file the form electronically using approved e-filing software, which often simplifies the process and provides instant confirmation. Alternatively, you can print the completed form and mail it to the Minnesota Department of Revenue. Ensure that you follow the specific submission guidelines outlined by the state to avoid any issues.

Quick guide on how to complete minnesota form m1r age 65 or olderdisabled subtraction printable 2020 minnesota form m1r age 65 or older minnesota form m1r age

Effortlessly Complete Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily Edit and eSign Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or Without Stress

- Find Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to submit your form—via email, SMS, or invite link, or download it to your PC.

Eliminate the issues of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1r age 65 or olderdisabled subtraction printable 2020 minnesota form m1r age 65 or older minnesota form m1r age

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1r age 65 or olderdisabled subtraction printable 2020 minnesota form m1r age 65 or older minnesota form m1r age

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Minnesota Form M1R Age 65 Or OlderDisabled Subtraction?

The Minnesota Form M1R Age 65 Or Older Disabled Subtraction allows eligible seniors or disabled individuals to subtract a portion of their income on their state taxes. This form is essential for those who qualify and offers signNow tax benefits. For more information, refer to the Printable Minnesota Form M1R Age 65 Or Older and its detailed Instructions For Schedule R Internal Revenue.

-

How do I obtain a Printable Minnesota Form M1R Age 65 Or Older?

You can easily download the Printable Minnesota Form M1R Age 65 Or Older from the Minnesota Department of Revenue website. This form is accessible in PDF format, allowing for easy printing and filling out. Ensure to follow the Instructions For Schedule R Internal Revenue for proper completion.

-

What are the eligibility criteria for the Minnesota Form M1R Age 65 Or OlderDisabled Subtraction?

To qualify for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction, you must be aged 65 or older or be permanently disabled according to Minnesota's regulations. Additionally, your income must fall within the designated limits to benefit from this subtraction. Refer to the official guidelines for comprehensive eligibility requirements.

-

Are there any fees associated with using airSlate SignNow for tax document signing?

airSlate SignNow offers a cost-effective solution with various pricing plans depending on your needs. Utilizing our platform to eSign documents like the Minnesota Form M1R Age 65 Or OlderDisabled Subtraction is seamless and affordable. Check our pricing page for detailed options.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow utilizes advanced encryption and security protocols to safeguard your documents, including tax forms such as the Minnesota Form M1R Age 65 Or OlderDisabled Subtraction. Our system complies with industry standards to ensure your sensitive information remains protected during the signing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow easily integrates with a variety of software applications for tax preparation. This feature improves your workflow and makes it easier to manage forms like the Printable Minnesota Form M1R Age 65 Or Older. Look for the integrations section on our website to learn more about compatible software.

-

What are the benefits of using airSlate SignNow for signing the Minnesota Form M1R?

Using airSlate SignNow for signing the Minnesota Form M1R Age 65 Or OlderDisabled Subtraction simplifies the signing process, making it quick and efficient. Our platform allows you to sign documents electronically from anywhere, reducing the need for physical paperwork. Experience the convenience and speed of eSigning with us today.

Get more for Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or

Find out other Minnesota Form M1R Age 65 Or OlderDisabled Subtraction Printable Minnesota Form M1R Age 65 Or Older Minnesota Form M1R Age 65 Or

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple