Minnesota Form M1R Age 65 or OlderDisabled Subtraction 2021

What is the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

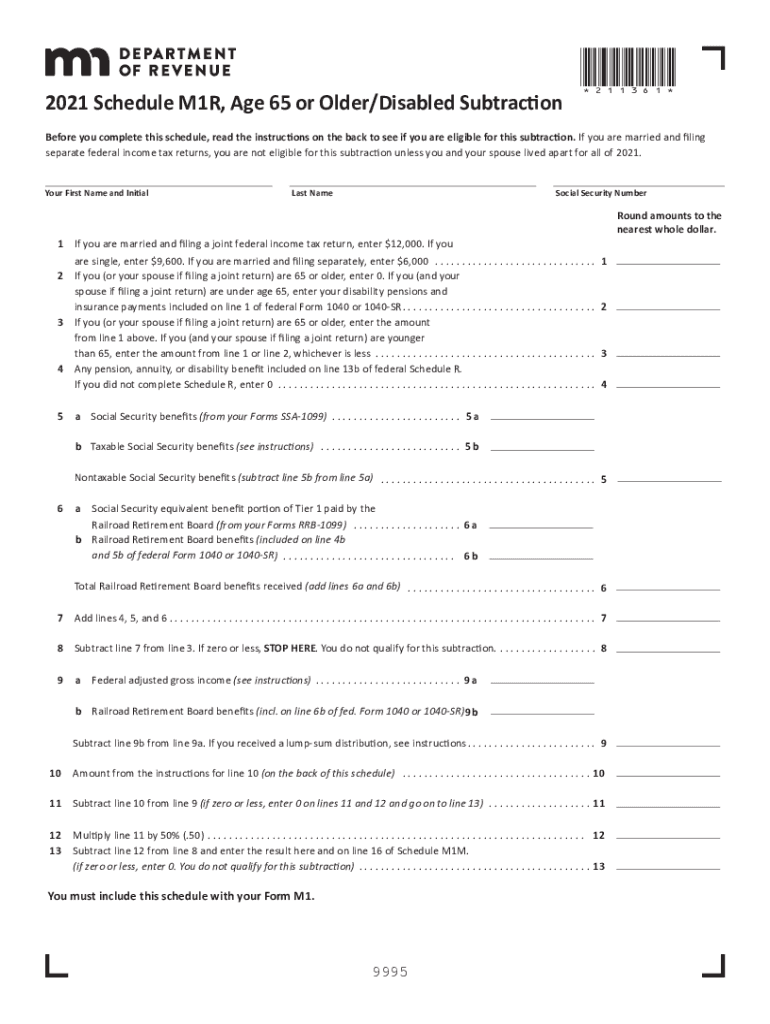

The Minnesota Form M1R is specifically designed for taxpayers aged sixty-five or older, or those who are disabled, allowing them to claim a subtraction on their Minnesota income tax return. This form enables eligible individuals to reduce their taxable income based on specific criteria set forth by the state. The subtraction is aimed at providing financial relief to seniors and disabled taxpayers, acknowledging their unique circumstances. The amount that can be subtracted varies depending on the taxpayer's filing status and income level.

Eligibility Criteria for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

To qualify for the Minnesota Form M1R, taxpayers must meet certain eligibility requirements. Individuals must be at least sixty-five years old or have a permanent disability. Additionally, the taxpayer’s income must fall within specific limits established by the Minnesota Department of Revenue. It is essential to review these income thresholds annually, as they may change, impacting the amount of subtraction available. Taxpayers should also ensure they are filing the correct tax return, as this form is specifically for those who meet the age or disability criteria.

Steps to Complete the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Completing the Minnesota Form M1R involves several straightforward steps. First, gather all necessary documentation, including income statements and any relevant tax documents. Next, accurately fill out the form, ensuring that all personal information is correct. Taxpayers must calculate their eligible subtraction based on their income and filing status. Finally, review the completed form for accuracy before submitting it. This process can be done either digitally or by mailing a paper form, depending on the taxpayer's preference.

Key Elements of the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Several key elements are crucial for understanding the Minnesota Form M1R. These include the specific subtraction amounts allowed for different income levels, the requirements for documentation, and the deadlines for submission. Additionally, taxpayers should be aware of any changes in state tax laws that may affect their eligibility or the amount they can subtract. Familiarity with these elements can help ensure that taxpayers maximize their benefits while remaining compliant with state regulations.

Form Submission Methods for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Taxpayers have multiple options for submitting the Minnesota Form M1R. They can file online through the Minnesota Department of Revenue's e-filing system, which offers a convenient and efficient method. Alternatively, individuals may choose to print the form and submit it by mail. For those preferring in-person assistance, local tax offices can provide guidance and accept submissions directly. Each method has its own set of benefits, and taxpayers should select the one that best fits their needs.

Filing Deadlines for the Minnesota Form M1R Age 65 Or Older Disabled Subtraction

Filing deadlines for the Minnesota Form M1R are typically aligned with the general tax filing deadlines for the state. Taxpayers should be aware that the deadline for submitting their income tax returns, including the M1R, usually falls on April fifteenth. However, extensions may be available under certain circumstances. It is crucial for taxpayers to stay informed about any changes to these deadlines, as timely submission is essential to avoid penalties and ensure eligibility for the subtraction.

Quick guide on how to complete minnesota form m1r age 65 or olderdisabled subtraction

Effortlessly prepare Minnesota Form M1R Age 65 Or OlderDisabled Subtraction on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Handle Minnesota Form M1R Age 65 Or OlderDisabled Subtraction on any device using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to alter and eSign Minnesota Form M1R Age 65 Or OlderDisabled Subtraction with ease

- Find Minnesota Form M1R Age 65 Or OlderDisabled Subtraction and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Minnesota Form M1R Age 65 Or OlderDisabled Subtraction for effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1r age 65 or olderdisabled subtraction

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1r age 65 or olderdisabled subtraction

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the process to schedule m1r with airSlate SignNow?

To schedule m1r with airSlate SignNow, simply log into your account and navigate to the scheduling section. From there, you can set your desired time and preferences for the m1r. The platform provides an intuitive interface that makes scheduling documents hassle-free.

-

How does scheduling m1r benefit my business?

By scheduling m1r through airSlate SignNow, businesses can streamline their document signing process, reducing delays and enhancing productivity. This feature allows for better time management, ensuring that critical documents are executed on time. Ultimately, it improves overall efficiency and client satisfaction.

-

What are the pricing options for scheduling m1r with airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that cater to different business needs when scheduling m1r. You can choose from monthly or annual subscriptions, with features ranging from basic to advanced. Review the pricing page to find the plan that best fits your requirements.

-

Can I integrate other tools while scheduling m1r?

Yes, airSlate SignNow allows integration with various tools such as CRM systems, project management apps, and more while scheduling m1r. This flexibility enables users to connect their workflows seamlessly and enhance productivity. Check our integrations page for specific tools that work effectively with airSlate SignNow.

-

Is it secure to schedule m1r using airSlate SignNow?

Absolutely! airSlate SignNow employs robust security protocols to ensure that scheduling m1r and all document transactions are secure. With features like encryption, secure access, and compliance with regulations, your sensitive information is protected at all times.

-

What types of documents can I manage when I schedule m1r?

You can manage a variety of document types when scheduling m1r with airSlate SignNow, including contracts, agreements, and forms. The platform is designed to support diverse document formats, making it easy for businesses to handle their documentation needs. This versatility enhances your workflow efficiency.

-

What support options are available when scheduling m1r?

airSlate SignNow provides various support options for users scheduling m1r, including an extensive knowledge base, email support, and live chat assistance. Our team is dedicated to helping you navigate any issues or questions you may have. Access our support resources anytime you need assistance.

Get more for Minnesota Form M1R Age 65 Or OlderDisabled Subtraction

- Letter from tenant to landlord about insufficient notice to terminate rental agreement florida form

- Tenant landlord rent form

- Letter tenant unauthorized 497302996 form

- Shut off notice 497302997 form

- Tenant landlord about 497302998 form

- Fl disclosure form

- Change name a make form

- Florida change name form

Find out other Minnesota Form M1R Age 65 Or OlderDisabled Subtraction

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe