Support Taxslayer Comhcen UsHow Do I Claim the Minnesota K12 Education Expense Schedule 2022-2026

Understanding the Minnesota Schedule M1ED Form

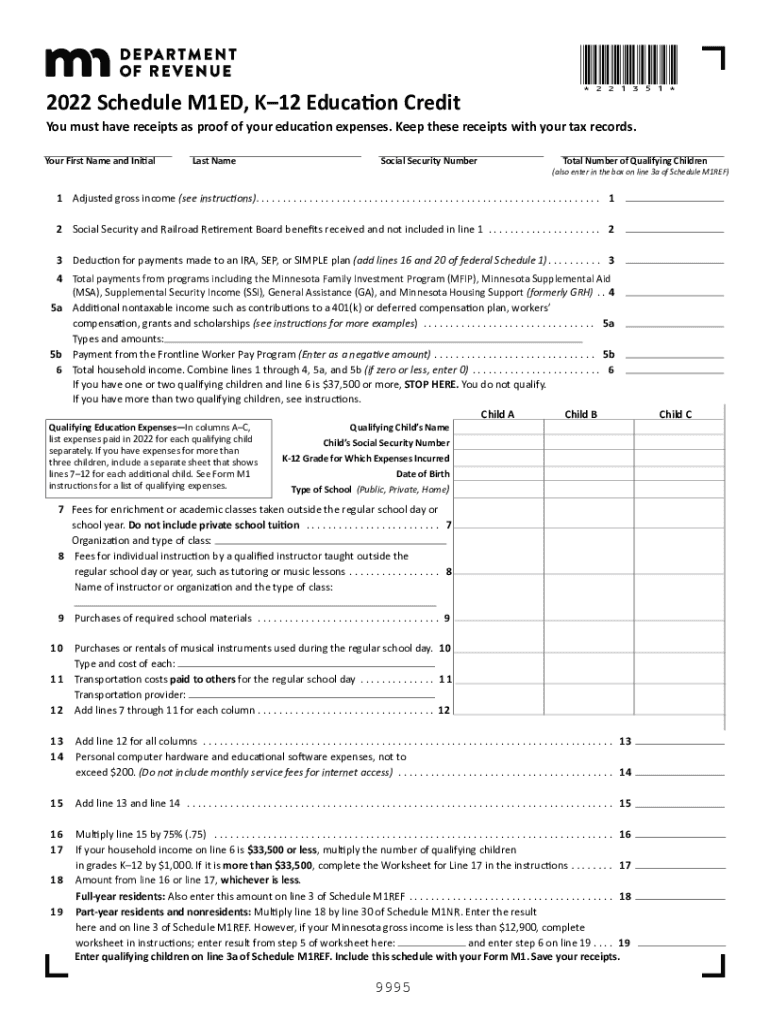

The Minnesota Schedule M1ED form is specifically designed for taxpayers seeking to claim education-related expenses for K-12 students. This form allows parents and guardians to report eligible educational expenses, which can help reduce their taxable income. The expenses typically include tuition, textbooks, and other necessary supplies. Understanding the details of the Schedule M1ED form is essential for maximizing potential tax benefits related to educational costs.

Steps to Complete the Minnesota Schedule M1ED Form

Completing the Minnesota Schedule M1ED form involves several key steps:

- Gather necessary documentation, including receipts for educational expenses.

- Fill out personal information, including your name, address, and Social Security number.

- List all eligible expenses, ensuring they meet the criteria set by the state.

- Calculate the total amount of eligible expenses and enter this figure on the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Claiming Education Expenses

To successfully claim expenses on the Minnesota Schedule M1ED, taxpayers must meet specific eligibility criteria. The student must be enrolled in a K-12 educational institution, and the expenses claimed must be directly related to their education. Additionally, the taxpayer must be able to provide documentation supporting the claimed expenses, such as receipts or invoices. Familiarizing yourself with these criteria can help ensure a smooth filing process.

Required Documents for Submission

When preparing to submit the Minnesota Schedule M1ED form, certain documents are essential. These include:

- Receipts for all claimed educational expenses.

- Proof of enrollment for the K-12 student.

- Any additional documentation that supports the eligibility of the expenses claimed.

Having these documents ready will facilitate the completion and submission of the form.

Filing Methods for the Minnesota Schedule M1ED Form

Taxpayers have several options for submitting the Minnesota Schedule M1ED form. The form can be filed electronically through approved tax software, which often simplifies the process and ensures compliance with state requirements. Alternatively, taxpayers may choose to mail a paper version of the form to the Minnesota Department of Revenue. It is important to follow the specific submission guidelines to avoid delays in processing.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Minnesota Schedule M1ED form can result in penalties. Taxpayers who incorrectly claim expenses or fail to provide necessary documentation may face adjustments to their tax returns, which could lead to additional taxes owed, interest, or even fines. Understanding the importance of compliance can help taxpayers avoid these potential issues.

Quick guide on how to complete supporttaxslayercomhcen ushow do i claim the minnesota k12 education expense schedule

Prepare Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule with ease on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed forms, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without unnecessary delays. Manage Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and eSign Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule effortlessly

- Obtain Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct supporttaxslayercomhcen ushow do i claim the minnesota k12 education expense schedule

Create this form in 5 minutes!

People also ask

-

What is the schedule m1ed form in airSlate SignNow?

The schedule m1ed form in airSlate SignNow allows users to easily prepare and send documents for electronic signatures. It streamlines the document signing process, ensuring that your forms are signed and returned quickly, enhancing productivity.

-

How do I schedule m1ed forms for my team?

To schedule m1ed forms for your team, simply log in to your airSlate SignNow account, select the form, and use the scheduling feature to designate when each participant should receive it. This automation improves workflow and keeps everyone on the same page.

-

Is there a cost associated with using the schedule m1ed form feature?

Yes, using the schedule m1ed form feature is included in various pricing plans offered by airSlate SignNow. Depending on the plan you choose, you can access a range of features designed for businesses of all sizes.

-

What are the key benefits of using the schedule m1ed form feature?

The key benefits of using the schedule m1ed form feature include increased efficiency, improved document tracking, and enhanced collaboration among team members. By scheduling forms, you minimize delays and ensure timely responses from signers.

-

Can I integrate schedule m1ed forms with other applications?

Absolutely! airSlate SignNow offers robust integrations with various applications, allowing you to connect your schedule m1ed forms with tools like CRM systems, project management software, and email platforms, enhancing your overall workflow.

-

How secure is the data when using the schedule m1ed form feature?

Data security is a top priority when using the schedule m1ed form feature in airSlate SignNow. The platform employs advanced encryption measures and complies with industry standards to protect your sensitive documents and information.

-

What types of documents can I send as schedule m1ed forms?

You can send a wide range of documents as schedule m1ed forms, including contracts, agreements, invoices, and applications. airSlate SignNow supports various file formats, making it easy to manage all your electronic signing needs.

Get more for Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease nebraska form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase nebraska form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant nebraska form

- Ne tenant landlord 497318091 form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services nebraska form

- Temporary lease agreement to prospective buyer of residence prior to closing nebraska form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497318094 form

- Letter from landlord to tenant returning security deposit less deductions nebraska form

Find out other Support taxslayer comhcen usHow Do I Claim The Minnesota K12 Education Expense Schedule

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word