Fillable Online You Must Have Receipts as Proof of Your 2021

What is the Fillable Online You Must Have Receipts As Proof Of Your

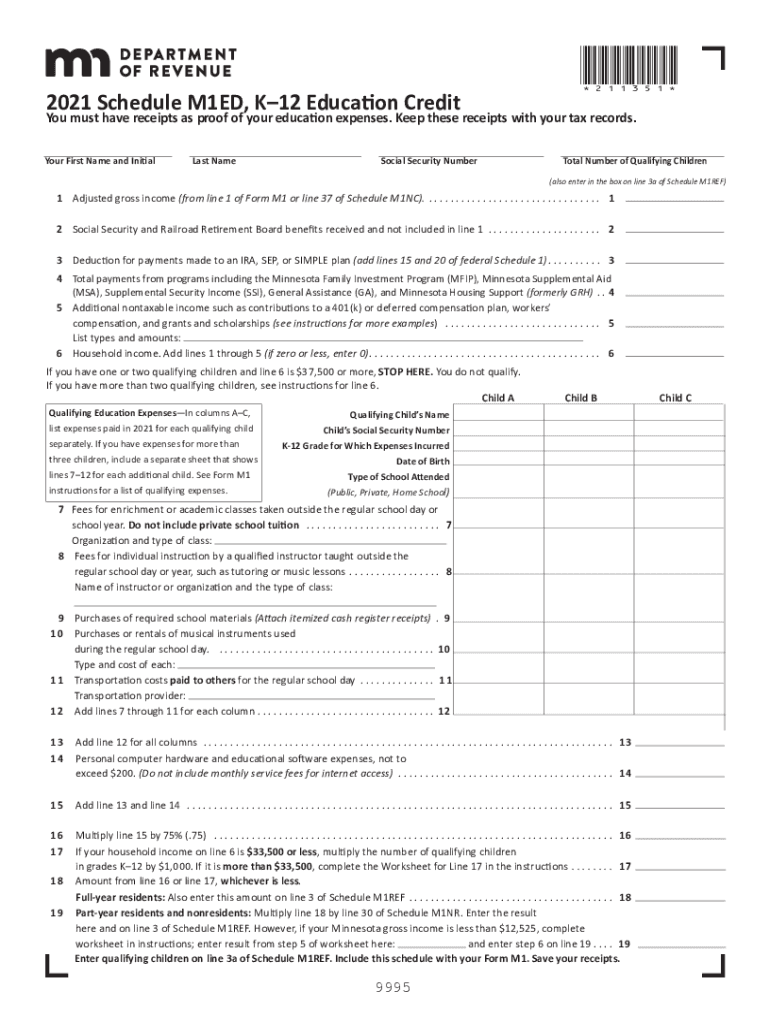

The Fillable Online You Must Have Receipts As Proof Of Your is a specific form designed to assist individuals and businesses in documenting and verifying transactions for tax purposes. This form is particularly important for those who need to provide proof of expenses or income when filing their taxes. It allows users to input necessary details electronically, ensuring that all information is organized and easily accessible. The digital format streamlines the process, making it more efficient compared to traditional paper methods.

How to use the Fillable Online You Must Have Receipts As Proof Of Your

Using the Fillable Online You Must Have Receipts As Proof Of Your involves several straightforward steps. First, access the form through a reliable platform that supports electronic signatures and document management. Next, input the required information, such as your name, address, and specific details related to the receipts you are submitting. Ensure that all entries are accurate to avoid complications during processing. Once completed, review the information for any errors, and then electronically sign the document. Finally, submit the form as directed by the relevant authority.

Steps to complete the Fillable Online You Must Have Receipts As Proof Of Your

Completing the Fillable Online You Must Have Receipts As Proof Of Your involves a series of methodical steps:

- Access the form through a secure platform.

- Fill in your personal details, including name and contact information.

- List the receipts you are submitting, ensuring to include dates and amounts.

- Attach any necessary documentation that supports your claims.

- Review the completed form for accuracy.

- Sign the document electronically to validate it.

- Submit the form according to the provided instructions.

Legal use of the Fillable Online You Must Have Receipts As Proof Of Your

The legal use of the Fillable Online You Must Have Receipts As Proof Of Your is crucial for ensuring compliance with tax regulations. This form serves as a formal record that can be presented during audits or inquiries by tax authorities. To be legally binding, the form must meet specific requirements, including proper signatures and adherence to electronic signature laws such as the ESIGN Act and UETA. Ensuring that the form is completed accurately and submitted on time is essential to avoid potential penalties.

Required Documents

When filling out the Fillable Online You Must Have Receipts As Proof Of Your, certain documents are typically required to support your claims. These may include:

- Receipts for all expenses being claimed.

- Proof of payment, such as bank statements or credit card statements.

- Any additional documentation that provides context or justification for the expenses.

Having these documents ready will facilitate a smoother completion process and ensure that your submission is comprehensive.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical when dealing with the Fillable Online You Must Have Receipts As Proof Of Your. Typically, forms must be submitted by specific dates to align with tax filing seasons. For most individuals, the deadline for submitting tax-related documents is April fifteenth of each year. However, if you are self-employed or have other unique circumstances, different deadlines may apply. Keeping track of these dates helps avoid late fees and ensures compliance with tax regulations.

Quick guide on how to complete fillable online you must have receipts as proof of your

Complete Fillable Online You Must Have Receipts As Proof Of Your effortlessly on any device

Online document management has become widely accepted by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Online You Must Have Receipts As Proof Of Your on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Fillable Online You Must Have Receipts As Proof Of Your with ease

- Obtain Fillable Online You Must Have Receipts As Proof Of Your and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet-ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to distribute your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from your preferred device. Modify and eSign Fillable Online You Must Have Receipts As Proof Of Your while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online you must have receipts as proof of your

Create this form in 5 minutes!

How to create an eSignature for the fillable online you must have receipts as proof of your

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is m1ed and how does it relate to airSlate SignNow?

m1ed is a key term associated with our document signing solutions. airSlate SignNow utilizes m1ed to enhance your experience with seamless eSigning and document management, helping businesses streamline their processes.

-

What are the pricing options for airSlate SignNow with m1ed?

airSlate SignNow offers competitive pricing plans that incorporate m1ed capabilities. You can choose from basic to advanced plans, each designed to fit different business needs and budget concerns while providing exceptional value.

-

Can I integrate airSlate SignNow's m1ed features with other software?

Yes, airSlate SignNow supports integration with various applications, allowing you to leverage m1ed functionalities seamlessly. This enhances your workflow by connecting essential tools and enabling efficient data management.

-

What are the key features of airSlate SignNow's m1ed solution?

The m1ed solution in airSlate SignNow offers robust features like multi-party signing, automated workflows, and document templates. These features streamline the signing process while ensuring that your documents are secure and legally compliant.

-

How can m1ed improve the efficiency of my business?

By incorporating m1ed functionalities from airSlate SignNow, businesses can signNowly reduce the time spent on document signing and management. This efficiency allows teams to focus on core business activities and enhance overall productivity.

-

Is airSlate SignNow's m1ed solution secure?

Absolutely! airSlate SignNow prioritizes security with m1ed by employing industry-standard encryption and compliance measures. This ensures that your documents are protected and safe from unauthorized access while signing.

-

What benefits does m1ed provide for remote teams?

m1ed facilitated by airSlate SignNow allows remote teams to collaborate effectively by enabling electronic signatures and document sharing from anywhere. This flexibility helps maintain productivity regardless of location, making it ideal for modern work environments.

Get more for Fillable Online You Must Have Receipts As Proof Of Your

- Dissolution no dependent form

- Florida short form

- Florida law financial form

- Florida child custody form

- Marital settlement agreement for dissolution of marriage with dependent or minor children florida form

- Dissolution marriage children form

- Settlement agreement contract form

- Affidavit corroborating witness form

Find out other Fillable Online You Must Have Receipts As Proof Of Your

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors