S Corporation Form M8 Instructions 2022-2026

What is the S Corporation Form M8 Instructions

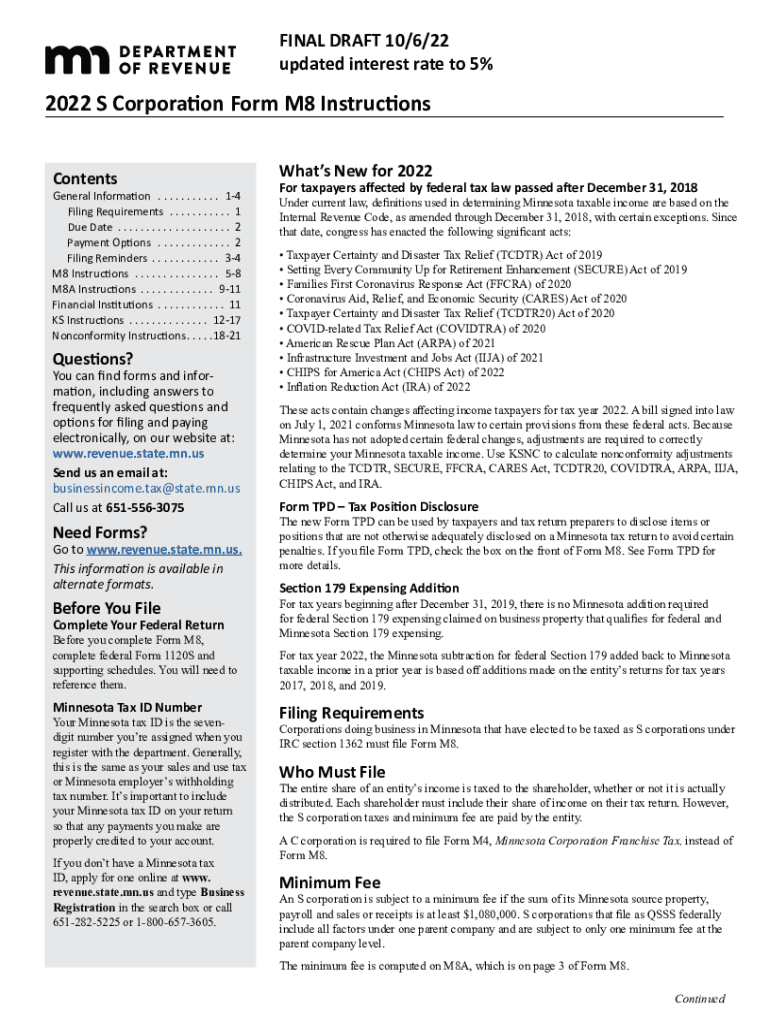

The Minnesota S Corporation Form M8 Instructions provide essential guidance for S corporations operating in Minnesota. This form is crucial for reporting the income, deductions, and credits of an S corporation to the state. Understanding the M8 instructions is vital for ensuring compliance with Minnesota tax laws. The instructions detail how to accurately fill out the form, including specific line items that need attention, making it easier for businesses to fulfill their tax obligations.

Steps to Complete the S Corporation Form M8 Instructions

Completing the Minnesota Form M8 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, follow these steps:

- Review the form layout and familiarize yourself with each section.

- Enter the corporation's name, address, and federal employer identification number (EIN) at the top of the form.

- Report total income and deductions in the appropriate sections, ensuring all figures are accurate.

- Calculate the Minnesota taxable income based on the provided guidelines.

- Complete any additional schedules or forms that may be required based on your corporation's activities.

- Sign and date the form before submission.

Legal Use of the S Corporation Form M8 Instructions

The legal use of the Minnesota Form M8 Instructions ensures that S corporations comply with state tax regulations. When filled out correctly, this form serves as a legally binding document that reports the corporation's financial activities to the state. It is essential to adhere to the guidelines provided in the instructions to avoid potential legal issues, including penalties for non-compliance. Understanding the legal implications of the form helps corporations maintain their good standing with the state.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for S corporations to avoid penalties. The Minnesota Form M8 is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15. It is important to mark this date on your calendar and ensure that all necessary documentation is prepared in advance to facilitate timely filing.

Required Documents

To complete the Minnesota Form M8 accurately, several documents are required. These include:

- Financial statements, including profit and loss statements.

- Records of all income received during the tax year.

- Documentation of any deductions claimed.

- Previous year’s tax return, if applicable, for reference.

Having these documents ready will streamline the process and help ensure that all information reported is accurate and complete.

Form Submission Methods

The Minnesota Form M8 can be submitted through various methods, providing flexibility for S corporations. The options include:

- Online submission through the Minnesota Department of Revenue's e-file system.

- Mailing a paper copy of the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can help ensure that the form is processed efficiently and securely.

Quick guide on how to complete 2022 s corporation form m8 instructions

Complete S Corporation Form M8 Instructions effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage S Corporation Form M8 Instructions on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to edit and electronically sign S Corporation Form M8 Instructions with ease

- Obtain S Corporation Form M8 Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method of sending your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign S Corporation Form M8 Instructions and ensure outstanding communication during any phase of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 s corporation form m8 instructions

Create this form in 5 minutes!

People also ask

-

What are the key features of the Minnesota M8 instructions 2023?

The Minnesota M8 instructions 2023 include enhanced document management, improved eSign capabilities, and user-friendly templates. These features are designed to streamline the signing process and ensure all documents are handled efficiently and securely.

-

How can I access the Minnesota M8 instructions 2023?

You can access the Minnesota M8 instructions 2023 directly through the airSlate SignNow platform. Simply create an account, then navigate to the resources section where you will find the complete instructions available for download.

-

Is there a cost associated with the Minnesota M8 instructions 2023?

The Minnesota M8 instructions 2023 are included as part of the airSlate SignNow subscription plans. We offer several cost-effective pricing options to ensure that users have access to all necessary resources without added fees.

-

How can Minnesota M8 instructions 2023 benefit my business?

Implementing the Minnesota M8 instructions 2023 can signNowly enhance your business's document workflow. By leveraging eSigning capabilities, you reduce turnaround time, minimize paperwork, and improve overall efficiency in handling documents.

-

Are there integrations available for Minnesota M8 instructions 2023?

Yes, the Minnesota M8 instructions 2023 integrate seamlessly with various other applications, including CRM systems and cloud storage services. This ensures that you can manage your documents and communications fluidly across platforms.

-

Can I customize the Minnesota M8 instructions 2023 for my specific needs?

Absolutely! The Minnesota M8 instructions 2023 can be customized to fit your specific requirements. airSlate SignNow allows users to create tailored templates and workflows that align with your business processes.

-

What support options are available for the Minnesota M8 instructions 2023?

airSlate SignNow provides comprehensive support for the Minnesota M8 instructions 2023, including FAQs, tutorials, and customer service assistance. You can easily signNow out to our support team for any inquiries or guidance needed.

Get more for S Corporation Form M8 Instructions

- Guaranty attachment to lease for guarantor or cosigner georgia form

- Ga lease form

- Warning notice due to complaint from neighbors georgia form

- Lease subordination agreement georgia form

- Apartment rules and regulations georgia form

- Ga cancellation form

- Amendment of residential lease georgia form

- Agreement for payment of unpaid rent georgia form

Find out other S Corporation Form M8 Instructions

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF