Httpswww Revenue State Mn Ussitesdefaultfile 2020

Key elements of the mn m8 instructions 2018

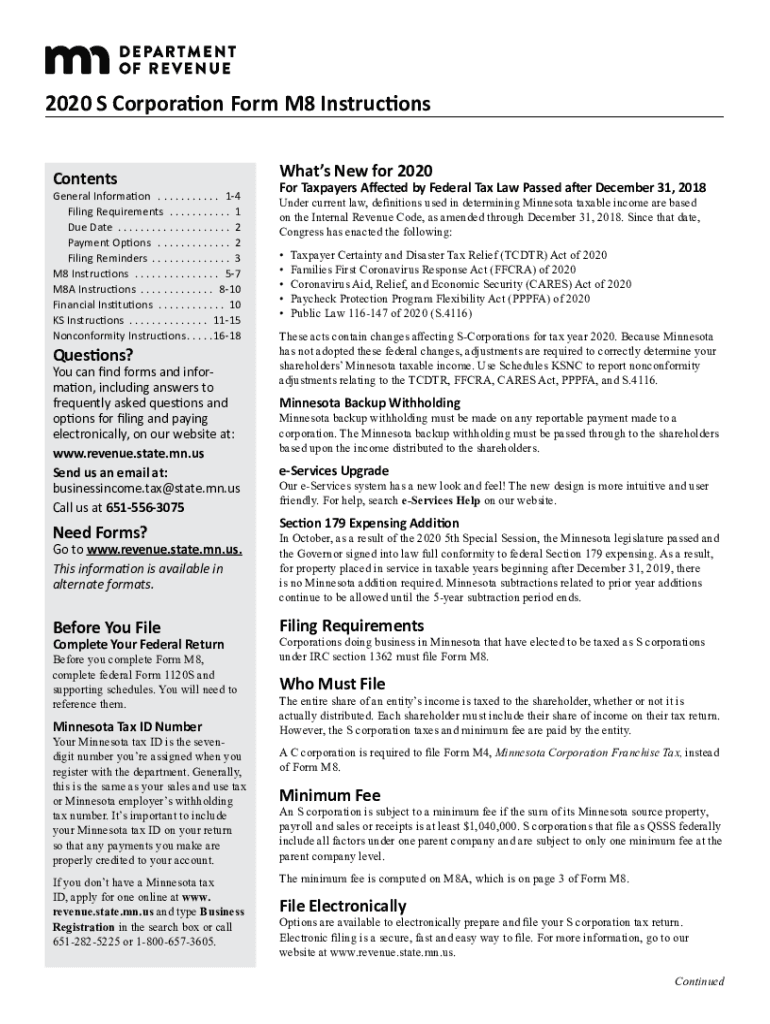

The mn m8 instructions 2018 are essential for individuals and businesses filing tax returns in Minnesota. This form provides guidance on how to report income, deductions, and credits accurately. Key elements include:

- Filing Status: Understanding your filing status is crucial, as it affects your tax rate and eligibility for certain deductions.

- Income Reporting: The instructions detail how to report various types of income, including wages, self-employment income, and investment earnings.

- Deductions and Credits: Taxpayers can find information on available deductions and credits that may reduce their tax liability.

- Signature Requirements: Proper signing of the form is necessary for it to be considered valid by the Minnesota Department of Revenue.

Steps to complete the mn m8 instructions 2018

Completing the mn m8 instructions 2018 involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth filing process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and calculate your total income.

- Review the deductions and credits available to you and calculate your eligibility.

- Fill out the mn m8 form accurately, ensuring all information is complete.

- Sign and date the form, confirming that the information provided is true and accurate.

- Submit the form either electronically or via mail, following the submission guidelines provided in the instructions.

Legal use of the mn m8 instructions 2018

The legal use of the mn m8 instructions 2018 is vital for ensuring that taxpayers comply with state tax laws. The form must be filled out accurately to avoid penalties and ensure that all claims for deductions and credits are legitimate. Adherence to the instructions helps in maintaining legal standing with the Minnesota Department of Revenue, as incorrect or fraudulent submissions can lead to audits and fines.

Filing Deadlines / Important Dates

Timely submission of the mn m8 instructions 2018 is critical. Key deadlines include:

- Tax Filing Deadline: Typically, the deadline for filing individual income tax returns in Minnesota is April 15.

- Extension Requests: If you need more time, you may file for an extension, but you must pay any taxes owed by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Submitting the mn m8 instructions 2018 can be done through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through approved tax software, which can simplify the process.

- Mail: Completed forms can be mailed to the address specified in the instructions, ensuring that they are sent well before the deadline.

- In-Person: Some individuals may prefer to submit their forms in person at designated locations, allowing for immediate confirmation of receipt.

Required Documents

To complete the mn m8 instructions 2018 accurately, several documents are required. These include:

- W-2 Forms: These forms report wages and tax withheld from your employer.

- 1099 Forms: These forms are necessary for reporting various types of income, such as freelance work or interest earned.

- Receipts for Deductions: Keep records of any expenses you plan to deduct, such as medical expenses or educational costs.

Quick guide on how to complete httpswwwrevenuestatemnussitesdefaultfile

Complete Httpswww revenue state mn ussitesdefaultfile seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the essential tools to create, alter, and electronically sign your documents quickly and efficiently. Manage Httpswww revenue state mn ussitesdefaultfile on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Httpswww revenue state mn ussitesdefaultfile with ease

- Locate Httpswww revenue state mn ussitesdefaultfile and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Httpswww revenue state mn ussitesdefaultfile and maintain excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct httpswwwrevenuestatemnussitesdefaultfile

Create this form in 5 minutes!

How to create an eSignature for the httpswwwrevenuestatemnussitesdefaultfile

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What are the mn m8 instructions 2018 for using airSlate SignNow?

The mn m8 instructions 2018 guide users through the process of sending and eSigning documents seamlessly with airSlate SignNow. It includes step-by-step instructions on how to create, customize, and manage your documents efficiently. By following these instructions, businesses can enhance their document workflow and ensure a smooth signing experience.

-

How does airSlate SignNow compare in pricing with other eSignature solutions?

airSlate SignNow offers competitive pricing that is designed to be cost-effective while providing robust features. Compared to other eSignature solutions, you’ll find that airSlate SignNow delivers exceptional value with its customizable plans, which cater to different business sizes and needs. The mn m8 instructions 2018 can help you get started without overspending.

-

What key features should I look for in the mn m8 instructions 2018?

When reviewing the mn m8 instructions 2018, key features to look for include document templates, customizable workflows, and secure storage options. airSlate SignNow provides all these features to streamline your signing process. Understanding these features will maximize your efficiency and productivity within the platform.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow can be integrated with various applications and platforms to enhance its functionality. The mn m8 instructions 2018 also highlight the simple integration process with popular tools such as CRM systems and cloud storage services. This allows businesses to create a seamless workflow and improve collaboration.

-

What are the benefits of using airSlate SignNow as outlined in the mn m8 instructions 2018?

The mn m8 instructions 2018 emphasize several benefits of using airSlate SignNow, including improved efficiency, reduced turnaround time for documents, and enhanced security. By leveraging these benefits, businesses can ensure compliance and build trust with their clients. Overall, it transforms the signing process to be quick and reliable.

-

Is there a mobile app for using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage and eSign documents on the go. Refer to the mn m8 instructions 2018 for details on how to download and navigate the app efficiently. This mobile capability adds flexibility for users who need to work away from their desks.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes user security by implementing features such as data encryption, secure access controls, and audit trails. The mn m8 instructions 2018 cover these security measures in detail, ensuring users can sign and send documents with confidence. This robust security framework protects sensitive information and ensures compliance.

Get more for Httpswww revenue state mn ussitesdefaultfile

Find out other Httpswww revenue state mn ussitesdefaultfile

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form