M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction 2022-2026

Understanding the M4NPNOL, Net Operating Loss Deduction

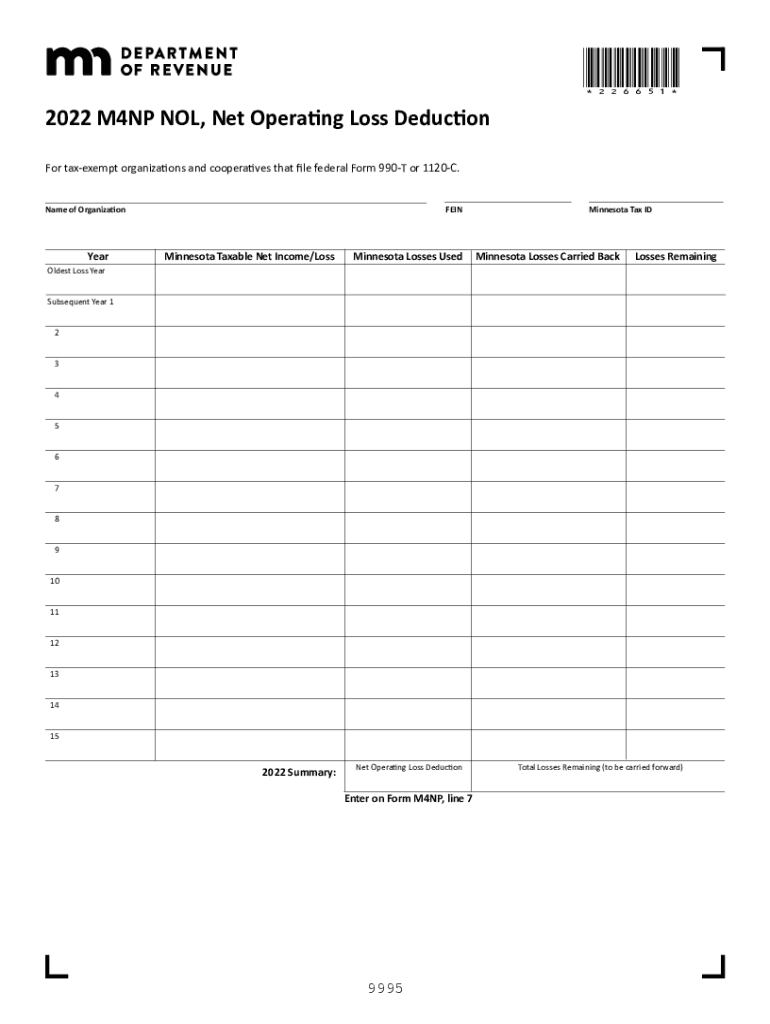

The M4NPNOL form is specifically designed for claiming a net operating loss (NOL) deduction in Minnesota. This deduction allows businesses to offset taxable income in other years, providing significant tax relief. Understanding the M4NPNOL is essential for businesses that have experienced financial losses, as it can help reduce their overall tax burden and improve cash flow. The form captures details about the loss, including the amount and the tax years affected.

Steps to Complete the M4NPNOL, Net Operating Loss Deduction

Completing the M4NPNOL requires careful attention to detail. Here are the key steps:

- Gather financial records to determine the amount of the net operating loss.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any necessary documentation that supports the reported loss.

- Review the form for accuracy to avoid delays in processing.

- Submit the completed form to the Minnesota Department of Revenue by the appropriate deadline.

Eligibility Criteria for the M4NPNOL, Net Operating Loss Deduction

To qualify for the M4NPNOL deduction, businesses must meet specific criteria. Generally, the business must have incurred a net operating loss in a tax year. Additionally, the loss must be carried forward or back to offset taxable income in other years. It's crucial to check that the business structure aligns with the requirements set forth by the Minnesota Department of Revenue, as different rules may apply to corporations, partnerships, and sole proprietorships.

Required Documents for the M4NPNOL, Net Operating Loss Deduction

When filing the M4NPNOL, certain documents are necessary to substantiate the claim. These may include:

- Tax returns for the years in which the losses occurred.

- Financial statements that detail income and expenses.

- Any prior correspondence with the Minnesota Department of Revenue regarding the losses.

- Supporting documentation for any adjustments made to income.

Filing Deadlines for the M4NPNOL, Net Operating Loss Deduction

Timely submission of the M4NPNOL is critical. The filing deadlines may vary based on the tax year and whether the business is carrying the loss back or forward. Generally, businesses should submit the form within the same timeframe as their annual tax return. Checking the Minnesota Department of Revenue's official guidelines for specific deadlines is advisable to ensure compliance.

Legal Use of the M4NPNOL, Net Operating Loss Deduction

The M4NPNOL form is legally recognized for claiming net operating loss deductions under Minnesota tax law. To ensure compliance, businesses must adhere to the regulations set forth by the Minnesota Department of Revenue. This includes maintaining accurate records and submitting the form within the designated timeframe. Proper use of the M4NPNOL can provide significant tax benefits, but failure to comply with legal requirements may result in penalties or denial of the deduction.

Quick guide on how to complete 2022 m4npnol net operating loss deduction 2022 m4npnol net operating loss deduction

Easily prepare M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly option to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction effortlessly

- Obtain M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 m4npnol net operating loss deduction 2022 m4npnol net operating loss deduction

Create this form in 5 minutes!

People also ask

-

What is m4np and how does it relate to airSlate SignNow?

M4np is the state-of-the-art document management feature within airSlate SignNow. It allows users to manage, send, and eSign documents efficiently. With m4np, businesses can streamline their workflows and improve collaboration, all while maintaining security and compliance.

-

How can I integrate m4np with my existing applications?

airSlate SignNow's m4np seamlessly integrates with various software solutions, enhancing your workflows. You can easily connect m4np with CRM systems, project management tools, and more through our API or integrations marketplace. This flexibility allows businesses to use m4np without disrupting their current processes.

-

What pricing options are available for m4np?

airSlate SignNow offers competitive pricing plans that include access to m4np functionality. We provide tiered pricing suited for businesses of all sizes, ensuring that you get the most value from m4np without breaking the bank. Visit our pricing page for detailed information on each plan and its features.

-

What are the key features of m4np?

M4np includes essential features such as document templates, bulk sending, and secure eSigning capabilities. Additionally, users benefit from automated workflows and tracking tools that enhance organizational efficiency. With these features, m4np supports your document management needs comprehensively.

-

What are the benefits of using m4np for document signing?

Using m4np for document signing simplifies the signature process with an easy-to-use interface. This efficiency reduces turnaround times, boosts productivity, and helps avoid paperwork bottlenecks. With m4np, businesses can also ensure compliance and security in document handling.

-

Is there a mobile app for using m4np?

Yes, airSlate SignNow offers a mobile app that supports m4np functionalities. This allows users to manage their documents, send for eSignatures, and track their workflows on the go. The mobile app ensures that m4np is accessible anytime, anywhere for maximum convenience.

-

Can I customize my m4np experience?

Absolutely! airSlate SignNow allows customization of the m4np interface to match your business needs. Users can create custom templates, set branding options, and tailor workflows, making the m4np experience unique to your organization’s requirements.

Get more for M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction

- Mutual wills or last will and testaments for unmarried persons living together with minor children nebraska form

- Non marital cohabitation living together agreement nebraska form

- Ne paternity form

- Bill of sale in connection with sale of business by individual or corporate seller nebraska form

- Office lease agreement nebraska form

- Commercial sublease nebraska form

- Residential lease renewal agreement nebraska form

- Notice to lessor exercising option to purchase nebraska form

Find out other M4NPNOL, Net Operating Loss Deduction M4NPNOL, Net Operating Loss Deduction

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now