M4NP Unrelated Business Income Tax UBIT Return 2020

What is the M4NP Unrelated Business Income Tax UBIT Return

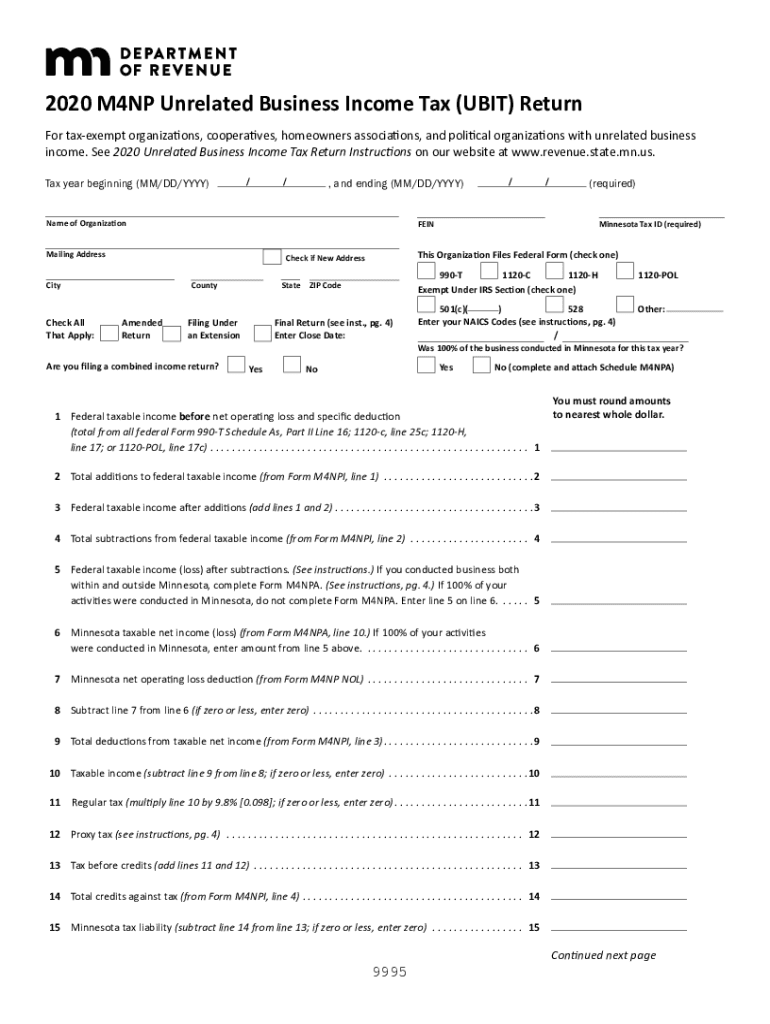

The Minnesota tax form M4NP is specifically designed for organizations that generate unrelated business income. This form is essential for tax-exempt entities, such as charities and nonprofits, to report income from activities not directly related to their primary purpose. The Unrelated Business Income Tax (UBIT) applies when these organizations engage in business activities that are not substantially related to their exempt functions. By filing the M4NP, organizations ensure compliance with state tax laws while accurately reporting their unrelated business income.

Steps to complete the M4NP Unrelated Business Income Tax UBIT Return

Completing the M4NP form involves several key steps to ensure accurate reporting of unrelated business income. First, gather all necessary financial documents, including income statements and expense records related to the unrelated business activities. Next, fill out the form by providing detailed information about the organization, the nature of the unrelated business, and the income generated. It is important to calculate the taxable income correctly by deducting allowable expenses. After completing the form, review it for accuracy before submission to avoid penalties.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the M4NP form to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization's tax year. For example, if the tax year ends on December 31, the M4NP must be filed by May 15 of the following year. It is crucial for organizations to track these dates and ensure timely submission to maintain compliance with Minnesota tax regulations.

Legal use of the M4NP Unrelated Business Income Tax UBIT Return

The M4NP form is legally recognized for reporting unrelated business income by tax-exempt organizations in Minnesota. To ensure its legal validity, the form must be completed accurately and submitted within the designated timeframe. Compliance with state tax laws is essential, as failure to file or inaccuracies can lead to penalties. Utilizing a reliable electronic signature platform can further enhance the legal standing of the submitted form, ensuring that all signatures are authenticated and compliant with eSignature regulations.

Key elements of the M4NP Unrelated Business Income Tax UBIT Return

Several key elements must be included in the M4NP form to ensure comprehensive reporting. These elements include the organization’s name, address, and federal tax identification number. Additionally, the form requires a detailed account of the unrelated business activities, including the type of income generated and any related expenses. Accurate reporting of these elements is vital for determining the correct amount of tax owed and for maintaining compliance with Minnesota tax regulations.

Who Issues the Form

The M4NP Unrelated Business Income Tax form is issued by the Minnesota Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among tax-exempt organizations. Organizations seeking to file the M4NP should refer to the Minnesota Department of Revenue for official guidance, updates, and resources related to the form and its requirements.

Form Submission Methods (Online / Mail / In-Person)

The M4NP form can be submitted through various methods to accommodate different preferences. Organizations may choose to file electronically through the Minnesota Department of Revenue’s online portal, which offers a streamlined process for submission. Alternatively, the form can be printed and mailed to the appropriate address provided by the Department of Revenue. In some cases, organizations may also have the option to submit the form in person at designated tax offices. Each method has its own advantages, and organizations should select the one that best fits their needs.

Quick guide on how to complete 2020 m4np unrelated business income tax ubit return

Complete M4NP Unrelated Business Income Tax UBIT Return effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage M4NP Unrelated Business Income Tax UBIT Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign M4NP Unrelated Business Income Tax UBIT Return without breaking a sweat

- Locate M4NP Unrelated Business Income Tax UBIT Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device you choose. Modify and electronically sign M4NP Unrelated Business Income Tax UBIT Return to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 m4np unrelated business income tax ubit return

Create this form in 5 minutes!

How to create an eSignature for the 2020 m4np unrelated business income tax ubit return

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the Minnesota tax form M4NP?

The Minnesota tax form M4NP is a specific form used for organizations that are exempt from Minnesota income tax. This form helps in reporting the organization's income and financial activities. By using the Minnesota tax form M4NP, exempt organizations can ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Minnesota tax form M4NP?

AirSlate SignNow simplifies the process of completing the Minnesota tax form M4NP by allowing users to electronically sign and send documents securely. Our platform makes it easy to collaborate with team members while ensuring document integrity. Utilizing airSlate SignNow can save time and reduce errors in your Minnesota tax form M4NP submissions.

-

What features does airSlate SignNow offer for eSigning Minnesota tax form M4NP?

AirSlate SignNow offers features such as customizable templates, secure storage, and real-time tracking for the Minnesota tax form M4NP. Users can easily add their signatures and send the document for other signatures, ensuring a smooth workflow. Additionally, our user-friendly interface makes it simple for anyone to navigate and complete their Minnesota tax form M4NP efficiently.

-

Is airSlate SignNow affordable for small businesses preparing the Minnesota tax form M4NP?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses preparing the Minnesota tax form M4NP. We offer flexible pricing plans that cater to varying needs and budgets. This ensures that even small businesses can access the tools needed to manage their Minnesota tax form M4NP seamlessly.

-

Can airSlate SignNow integrate with other applications for preparing the Minnesota tax form M4NP?

Absolutely! AirSlate SignNow can be integrated with various applications, enhancing your workflow while preparing the Minnesota tax form M4NP. By connecting with popular software, users can automate many processes, making it easier to track and manage documents related to their Minnesota tax form M4NP.

-

What are the benefits of using airSlate SignNow for the Minnesota tax form M4NP?

Using airSlate SignNow for the Minnesota tax form M4NP offers several benefits, including enhanced security, increased efficiency, and reduced processing times. This platform ensures that all document transactions are secure and compliant. With airSlate SignNow, businesses can focus on their core activities while handling their Minnesota tax form M4NP smoothly.

-

Is it easy to navigate airSlate SignNow when working on the Minnesota tax form M4NP?

Yes, airSlate SignNow features an intuitive interface, making it easy to navigate when working on the Minnesota tax form M4NP. Users can quickly access templates, track document progress, and gather signatures efficiently. This user-friendly experience minimizes the learning curve, allowing you to focus on completing your Minnesota tax form M4NP.

Get more for M4NP Unrelated Business Income Tax UBIT Return

Find out other M4NP Unrelated Business Income Tax UBIT Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors