Pass through Deduction New ResearchTax Foundation 2021

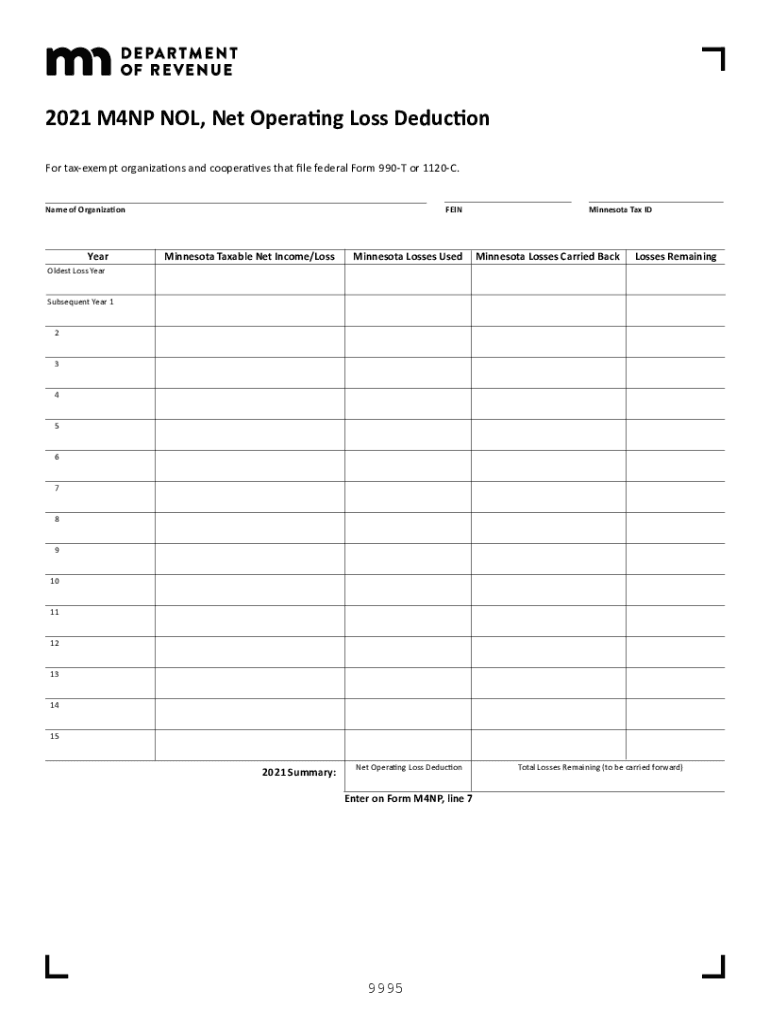

Understanding the Minnesota Form M4NP

The Minnesota form M4NP is a tax document used for claiming the pass-through deduction. This deduction allows eligible taxpayers to reduce their taxable income by a certain percentage of their qualified business income. The form is particularly relevant for individuals who are part of pass-through entities such as partnerships, S corporations, and sole proprietorships. Understanding the nuances of the M4NP can help taxpayers maximize their deductions and ensure compliance with state tax regulations.

Steps to Complete the Minnesota Form M4NP

Completing the Minnesota form M4NP involves several key steps:

- Gather necessary financial documents, including your business income statements and any relevant tax returns.

- Determine your eligibility for the pass-through deduction based on your business type and income level.

- Fill out the form by providing your personal information, business details, and the amount of qualified business income.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form either electronically or via mail, depending on your preference and compliance requirements.

Eligibility Criteria for the Pass-Through Deduction

To qualify for the pass-through deduction on the Minnesota form M4NP, taxpayers must meet specific criteria:

- Be a resident of Minnesota and file state income taxes.

- Have income derived from a pass-through entity, such as an S corporation, partnership, or sole proprietorship.

- Meet income thresholds set by the state, which may vary based on filing status.

Required Documents for Filing the M4NP

When preparing to file the Minnesota form M4NP, it is essential to have the following documents ready:

- Previous year’s tax returns, including federal and state returns.

- Financial statements from your business, detailing income and expenses.

- Any documentation supporting your claim for the pass-through deduction, such as K-1 forms from partnerships or S corporations.

Legal Use of the Minnesota Form M4NP

The Minnesota form M4NP must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to guidelines set forth by the Minnesota Department of Revenue regarding the pass-through deduction. Failure to comply with these regulations may result in penalties or denial of the deduction. It is advisable to consult with a tax professional if there are uncertainties about the legal implications of using this form.

Filing Deadlines for the M4NP

Timely submission of the Minnesota form M4NP is crucial for compliance. The filing deadlines typically align with the state income tax return deadlines. For most taxpayers, this means the form should be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances, allowing additional time for filing without incurring penalties.

Quick guide on how to complete pass through deduction new researchtax foundation

Complete Pass through Deduction New ResearchTax Foundation effortlessly on any device

Managing documents online has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Pass through Deduction New ResearchTax Foundation on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest way to edit and eSign Pass through Deduction New ResearchTax Foundation without hassle

- Find Pass through Deduction New ResearchTax Foundation and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight necessary sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Edit and eSign Pass through Deduction New ResearchTax Foundation and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pass through deduction new researchtax foundation

Create this form in 5 minutes!

How to create an eSignature for the pass through deduction new researchtax foundation

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What is m4np and how does it relate to airSlate SignNow?

M4np is an innovative feature of airSlate SignNow that streamlines the document signing process. It allows users to efficiently manage and sign documents electronically, ensuring a seamless experience for both senders and recipients.

-

What pricing options does airSlate SignNow offer for m4np?

airSlate SignNow provides competitive pricing plans that include access to the m4np feature. Users can choose from monthly or annual subscriptions, ensuring they find a plan that fits their budget and needs.

-

What are the key features of m4np in airSlate SignNow?

The m4np feature includes advanced document editing, real-time tracking of signatures, and customizable templates. These tools are designed to enhance productivity and make document management more efficient.

-

How can businesses benefit from using m4np with airSlate SignNow?

By leveraging the m4np feature, businesses can reduce turnaround time for document signing, enhance collaboration, and save on printing costs. This ultimately leads to improved workflow and customer satisfaction.

-

Can m4np be integrated with other tools and services?

Yes, m4np in airSlate SignNow can be integrated with various third-party applications, such as CRM systems and cloud storage services. This ensures that users can create a cohesive workflow tailored to their specific business needs.

-

Is m4np secure for handling sensitive documents?

Absolutely! airSlate SignNow adheres to stringent security protocols to ensure that m4np handles sensitive documents securely. With features like encryption and secure access controls, businesses can confidently manage their documentation.

-

How user-friendly is the m4np feature in airSlate SignNow?

The m4np feature is designed with user experience in mind, providing an intuitive interface that makes it easy to navigate. Whether you are tech-savvy or a beginner, you will find sending and signing documents straightforward.

Get more for Pass through Deduction New ResearchTax Foundation

- Tenant consent to background and reference check florida form

- Florida lease form

- Residential rental lease agreement florida 497303225 form

- Tenant welcome letter florida form

- Warning of default on commercial lease florida form

- Warning of default on residential lease florida form

- Fl deposit form

- Affidavit for attorneys fees florida form

Find out other Pass through Deduction New ResearchTax Foundation

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free