Minnesota Form M15C Additional Charge for Underpayment of Estimated 2022-2026

What is the Minnesota Form M15C Additional Charge For Underpayment Of Estimated

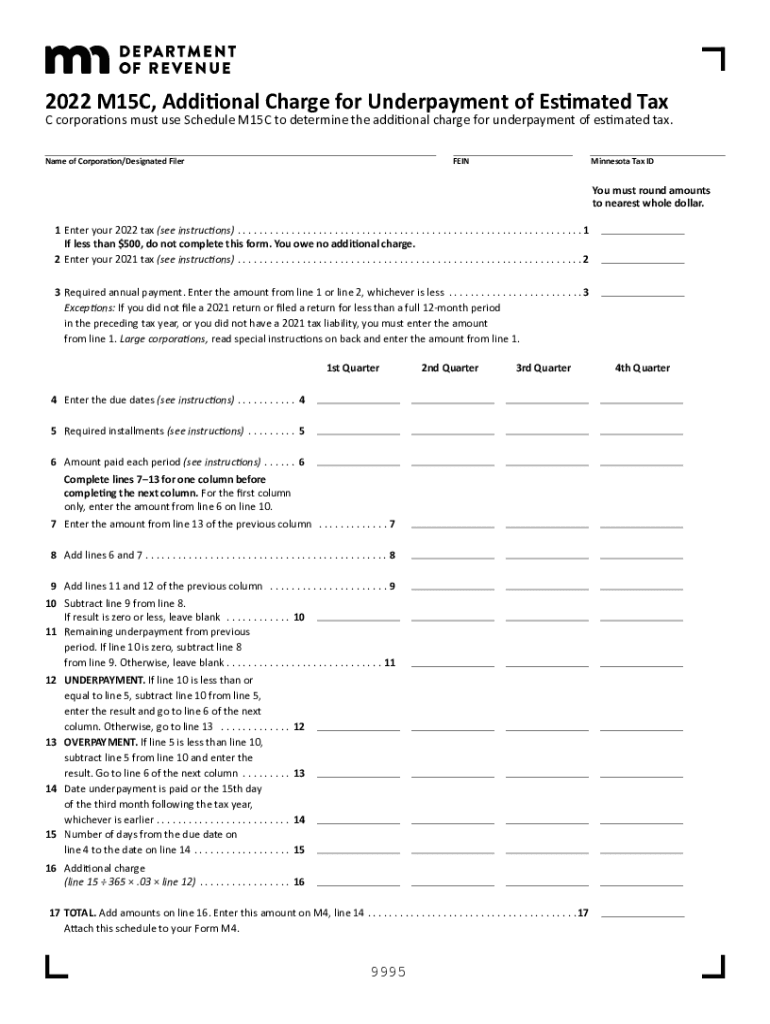

The Minnesota Form M15C relates to the additional charge imposed for underpayment of estimated tax. This form is used by taxpayers who have not paid enough estimated tax throughout the year and need to calculate the additional charge owed. It is essential for individuals and businesses to understand this form to ensure compliance with state tax regulations and avoid penalties.

Steps to complete the Minnesota Form M15C Additional Charge For Underpayment Of Estimated

Completing the Minnesota Form M15C involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your total estimated tax liability for the year. Then, determine the amount of estimated tax you have already paid. Subtract the amount paid from your total liability to find any underpayment. Finally, fill out the form accurately, ensuring all calculations are correct before submission.

Legal use of the Minnesota Form M15C Additional Charge For Underpayment Of Estimated

The Minnesota Form M15C is legally recognized as a valid document for reporting underpayment of estimated taxes. It must be completed in accordance with Minnesota tax laws to ensure that the additional charge is calculated correctly. Adhering to legal guidelines not only helps in avoiding penalties but also ensures that taxpayers fulfill their obligations under state law.

Filing Deadlines / Important Dates

Timely filing of the Minnesota Form M15C is crucial to avoid penalties. Generally, the form must be submitted by the due date of your Minnesota income tax return. Taxpayers should be aware of any specific deadlines related to estimated tax payments, which typically occur quarterly. Keeping track of these dates helps ensure compliance and reduces the risk of incurring additional charges.

Penalties for Non-Compliance

Failure to file the Minnesota Form M15C or underpaying estimated taxes can result in significant penalties. The state may impose additional charges based on the amount of underpayment and the duration of non-compliance. Understanding these penalties can motivate taxpayers to accurately assess their estimated tax payments and file the necessary forms on time.

Who Issues the Form

The Minnesota Department of Revenue is responsible for issuing the Form M15C. This state agency provides the necessary guidelines and resources for taxpayers to understand their obligations regarding estimated taxes and the associated charges for underpayment. Accessing official resources from the Department of Revenue ensures that taxpayers have the most current information and forms.

Quick guide on how to complete minnesota form m15c additional charge for underpayment of estimated

Effortlessly Prepare Minnesota Form M15C Additional Charge For Underpayment Of Estimated on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Minnesota Form M15C Additional Charge For Underpayment Of Estimated on any device via airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Minnesota Form M15C Additional Charge For Underpayment Of Estimated Seamlessly

- Locate Minnesota Form M15C Additional Charge For Underpayment Of Estimated and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Minnesota Form M15C Additional Charge For Underpayment Of Estimated to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m15c additional charge for underpayment of estimated

Create this form in 5 minutes!

People also ask

-

What is the mn charge for using airSlate SignNow?

The mn charge for using airSlate SignNow varies based on the plan you choose. We offer several pricing tiers, each tailored to meet the needs of businesses of all sizes. By selecting the plan that best suits your requirements, you can take full advantage of our eSignature features without breaking your budget.

-

What features are included in the mn charge?

With the mn charge for airSlate SignNow, you gain access to a variety of features such as document templates, customizable workflows, and real-time tracking. Each feature is designed to streamline your document signing process, making it efficient and user-friendly for all parties involved.

-

How does airSlate SignNow enhance document security in relation to the mn charge?

AirSlate SignNow takes document security seriously, which is reflected in the mn charge you pay. We implement top-tier encryption, secure access controls, and compliance with industry regulations to protect your sensitive data, ensuring that your documents are safe during the signing process.

-

Are there any discounts available for the mn charge?

Yes, airSlate SignNow often provides discounts that can reduce the mn charge for annual subscriptions. Additionally, you can check for promotional offers or special deals that may be available for new customers, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for the mn charge?

Absolutely! The mn charge for airSlate SignNow includes the ability to integrate seamlessly with various software solutions such as CRM systems, cloud storage services, and productivity tools. These integrations allow you to automate workflows and improve efficiency across your business operations.

-

What are the key benefits of choosing airSlate SignNow for the mn charge?

Choosing airSlate SignNow for the mn charge comes with numerous benefits, such as increased productivity, reduced turnaround times, and enhanced collaboration. Our user-friendly platform is designed to facilitate quick and easy document signing, allowing your team to focus on more critical tasks.

-

Is there a trial period available before the mn charge applies?

Yes, airSlate SignNow offers a free trial period, allowing you to experience our services before the mn charge applies. During this trial, you can explore our features and determine how well they meet your business needs, with no obligation to commit right away.

Get more for Minnesota Form M15C Additional Charge For Underpayment Of Estimated

- Closing statement nebraska form

- Flood zone statement and authorization nebraska form

- Name affidavit of buyer nebraska form

- Name affidavit of seller nebraska form

- Non foreign affidavit under irc 1445 nebraska form

- Owners or sellers affidavit of no liens nebraska form

- Affidavit of occupancy and financial status nebraska form

- Complex will with credit shelter marital trust for large estates nebraska form

Find out other Minnesota Form M15C Additional Charge For Underpayment Of Estimated

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation