Form M15C Additional Charge for Underpayment of Estimated Tax 2021

What is the Form M15C Additional Charge For Underpayment Of Estimated Tax

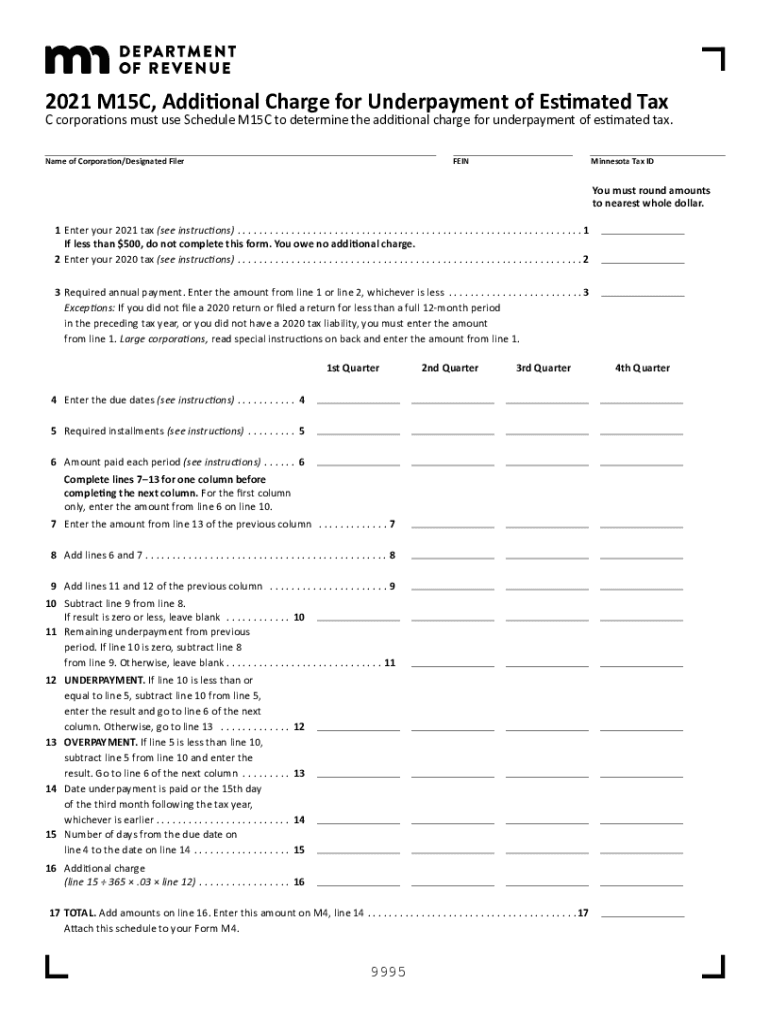

The Form M15C is a tax document used to assess additional charges for individuals or businesses that have underpaid their estimated taxes. This form is particularly relevant for taxpayers who have not met their tax obligations throughout the year, resulting in a potential penalty. Understanding the implications of the M15C is crucial for maintaining compliance with tax regulations and avoiding unnecessary fees.

How to use the Form M15C Additional Charge For Underpayment Of Estimated Tax

Using the Form M15C involves several steps. First, taxpayers should gather their financial records, including income statements and previous tax returns. Next, they must calculate their estimated tax payments for the year and compare them to the actual payments made. If there is a discrepancy indicating underpayment, the M15C should be filled out accurately, detailing the amounts owed. Finally, the completed form must be submitted to the appropriate tax authority, ensuring that all figures are correct to avoid further penalties.

Steps to complete the Form M15C Additional Charge For Underpayment Of Estimated Tax

Completing the Form M15C requires careful attention to detail. Here are the steps to follow:

- Review your income and tax payment history for the year.

- Calculate the total estimated tax owed based on your income.

- Determine the total amount of estimated tax payments made.

- Fill out the M15C form, including all required personal and financial information.

- Double-check all calculations to ensure accuracy.

- Submit the form to the relevant tax authority by the specified deadline.

Legal use of the Form M15C Additional Charge For Underpayment Of Estimated Tax

The legal use of the Form M15C is governed by federal and state tax laws. It serves as an official record of underpayment and is essential for compliance with tax obligations. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with established guidelines. Failure to adhere to these legal requirements may result in penalties or additional charges.

Filing Deadlines / Important Dates

Timely filing of the Form M15C is crucial to avoid penalties. Generally, the form should be submitted by the same deadlines as federal tax returns. Taxpayers should be aware of specific dates that may vary by state, including quarterly estimated tax payment deadlines. Keeping track of these dates helps ensure compliance and minimizes the risk of incurring additional charges.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form M15C can lead to significant penalties. Taxpayers who fail to file the form on time or provide inaccurate information may face fines, interest on unpaid taxes, and potential legal action. Understanding these penalties emphasizes the importance of accurate and timely submission to avoid financial repercussions.

Quick guide on how to complete form m15c additional charge for underpayment of estimated tax

Complete Form M15C Additional Charge For Underpayment Of Estimated Tax seamlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Form M15C Additional Charge For Underpayment Of Estimated Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Form M15C Additional Charge For Underpayment Of Estimated Tax effortlessly

- Obtain Form M15C Additional Charge For Underpayment Of Estimated Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign Form M15C Additional Charge For Underpayment Of Estimated Tax and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m15c additional charge for underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the form m15c additional charge for underpayment of estimated tax

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What is the m15c feature of airSlate SignNow?

The m15c feature of airSlate SignNow allows users to streamline their document signing process efficiently. This functionality enhances the eSigning experience by providing advanced options for collaboration and document management. Businesses can leverage the m15c feature to ensure secure and speedy transactions.

-

How much does airSlate SignNow cost for m15c users?

Pricing for airSlate SignNow catering to m15c users is highly competitive and designed to suit various business needs. There are several subscription plans available, with options suited for small to large organizations. These plans ensure that businesses utilizing the m15c feature get the best value for their investment.

-

What are the key benefits of using the m15c feature?

The m15c feature in airSlate SignNow offers numerous benefits, including increased efficiency and enhanced security for document signing. Users enjoy a user-friendly interface that simplifies the process of sending and signing documents. Additionally, businesses experience improved workflow, thanks to the m15c feature's automation capabilities.

-

Can I integrate m15c with other applications?

Yes, airSlate SignNow's m15c feature supports integration with various applications, facilitating seamless workflows. Users can connect with popular tools like Google Drive, Salesforce, and many more to enhance their document management. These integrations allow businesses to use the m15c feature in conjunction with their existing systems effectively.

-

Is the m15c feature suitable for small businesses?

Absolutely! The m15c feature is tailored to accommodate businesses of all sizes, including small businesses. It provides an affordable and efficient solution for document signing that is easy to implement. By using the m15c feature, small businesses can save time and resources while ensuring compliance with document regulations.

-

How secure is the m15c feature for document signing?

The m15c feature in airSlate SignNow offers top-notch security for all document signing processes. With encryption and secure user authentication, businesses can trust that their documents remain confidential. This high level of security ensures peace of mind when utilizing the m15c feature for sensitive transactions.

-

What types of documents can I sign using m15c?

With the m15c feature, you can sign a wide variety of documents, including contracts, agreements, and consent forms. The flexibility of airSlate SignNow enables users to customize the document types based on their needs. This versatility is one of the many advantages of utilizing the m15c feature.

Get more for Form M15C Additional Charge For Underpayment Of Estimated Tax

Find out other Form M15C Additional Charge For Underpayment Of Estimated Tax

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself