Minnesota Form M15C Additional Charge for Underpayment of 2019

What is the Minnesota Form M15C Additional Charge For Underpayment Of

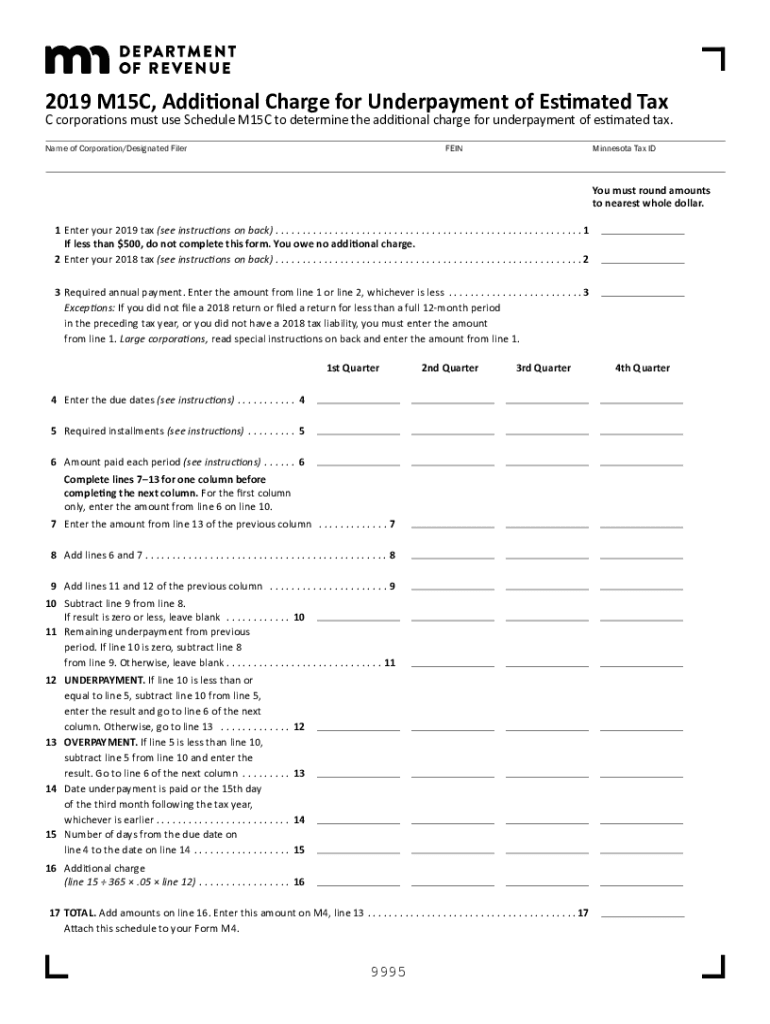

The Minnesota Form M15C Additional Charge For Underpayment Of is a tax form used by individuals and businesses in Minnesota to report and calculate additional charges incurred due to underpayment of taxes. This form is essential for ensuring compliance with state tax regulations and helps taxpayers understand their obligations regarding underpayment penalties. The form outlines the specific circumstances under which these additional charges apply, providing clarity on how to avoid potential financial repercussions related to tax underpayment.

Steps to complete the Minnesota Form M15C Additional Charge For Underpayment Of

Completing the Minnesota Form M15C Additional Charge For Underpayment Of involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year based on your income and applicable deductions.

- Determine the amount of tax you have already paid throughout the year.

- Compare your total tax liability with the amount paid to identify any underpayment.

- Fill out the form accurately, ensuring all calculations are correct and all required information is included.

- Review the completed form for accuracy before submission.

How to use the Minnesota Form M15C Additional Charge For Underpayment Of

The Minnesota Form M15C Additional Charge For Underpayment Of is used to report any additional charges due to underpayment of taxes. Taxpayers should use this form if they have underpaid their taxes during the year and need to calculate the additional amount owed. This form must be filed with the Minnesota Department of Revenue along with any outstanding tax payments to ensure compliance and avoid further penalties.

Legal use of the Minnesota Form M15C Additional Charge For Underpayment Of

The legal use of the Minnesota Form M15C Additional Charge For Underpayment Of is governed by state tax laws. It is essential for taxpayers to use this form correctly to report underpayment charges accurately. Failure to do so may result in penalties or legal action by the Minnesota Department of Revenue. The form must be completed in accordance with the guidelines provided by the state, ensuring that all necessary information is disclosed and all calculations are performed accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form M15C Additional Charge For Underpayment Of typically align with the state tax filing deadlines. Taxpayers should be aware of these important dates to avoid late fees or additional penalties. It is advisable to check the Minnesota Department of Revenue's official website for the most current deadlines and any changes to filing requirements that may occur annually.

Penalties for Non-Compliance

Non-compliance with the requirements of the Minnesota Form M15C Additional Charge For Underpayment Of can lead to significant penalties. These may include additional charges on the unpaid tax amount, interest on the outstanding balance, and potential legal repercussions. It is crucial for taxpayers to understand the implications of underpayment and to file the form accurately and on time to mitigate any risks associated with non-compliance.

Quick guide on how to complete minnesota form m15c additional charge for underpayment of

Effortlessly Prepare Minnesota Form M15C Additional Charge For Underpayment Of on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a flawless eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle Minnesota Form M15C Additional Charge For Underpayment Of on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Minnesota Form M15C Additional Charge For Underpayment Of with Ease

- Locate Minnesota Form M15C Additional Charge For Underpayment Of and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information using specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether through email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Minnesota Form M15C Additional Charge For Underpayment Of and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m15c additional charge for underpayment of

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m15c additional charge for underpayment of

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the Minnesota Form M15C Additional Charge For Underpayment Of?

The Minnesota Form M15C Additional Charge For Underpayment Of is a tax form that individuals might need to file if they haven't paid enough tax during the year. This form helps calculate any additional charges for underpayment of taxes owed. It's essential for maintaining compliance with Minnesota tax regulations.

-

How can airSlate SignNow help with the Minnesota Form M15C Additional Charge For Underpayment Of?

airSlate SignNow streamlines the process of preparing, signing, and submitting the Minnesota Form M15C Additional Charge For Underpayment Of. Our platform allows users to easily create and customize tax documents while ensuring they are signed securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Minnesota Form M15C Additional Charge For Underpayment Of?

Yes, using airSlate SignNow involves a subscription fee, which provides access to all features, including support for the Minnesota Form M15C Additional Charge For Underpayment Of. Our pricing is competitive, offering a cost-effective solution for eSigning and document management.

-

What features are included when using airSlate SignNow for tax forms like the Minnesota Form M15C Additional Charge For Underpayment Of?

When using airSlate SignNow, you'll benefit from features such as secure eSigning, template creation, and easy document sharing. These features help ensure that your Minnesota Form M15C Additional Charge For Underpayment Of is completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software to handle the Minnesota Form M15C Additional Charge For Underpayment Of?

Yes, airSlate SignNow offers integrations with various software applications, including accounting and tax software. This integration can streamline the management of the Minnesota Form M15C Additional Charge For Underpayment Of alongside other financial documents.

-

What are the benefits of using an eSigning solution like airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including the Minnesota Form M15C Additional Charge For Underpayment Of, provides benefits such as faster processing times, enhanced security, and increased accuracy. It simplifies document management and helps businesses stay organized.

-

Is airSlate SignNow secure for managing sensitive documents like the Minnesota Form M15C Additional Charge For Underpayment Of?

Absolutely. airSlate SignNow prioritizes security with features such as encryption and secure cloud storage. Users can trust that their sensitive documents, including the Minnesota Form M15C Additional Charge For Underpayment Of, are well-protected.

Get more for Minnesota Form M15C Additional Charge For Underpayment Of

- Addendum to td vaccine tetanus and diphtheria vaccine form

- Instructions for completing esrd facility incident report texas esrdnetwork form

- Esrd incident report form with instructions 051019doc

- Cmhrs at risk of physical injury screening dmas p502 form

- Medical test site mts application certificate of waiver doh wa form

- General information for authorization washington state health care authority presents general information for authorization form

- Diabetic limitation extension request form

- Forms and publicationswashington state health care

Find out other Minnesota Form M15C Additional Charge For Underpayment Of

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself