ST388 EM Draft PDF 2022-2026

What is the ST-388 Form?

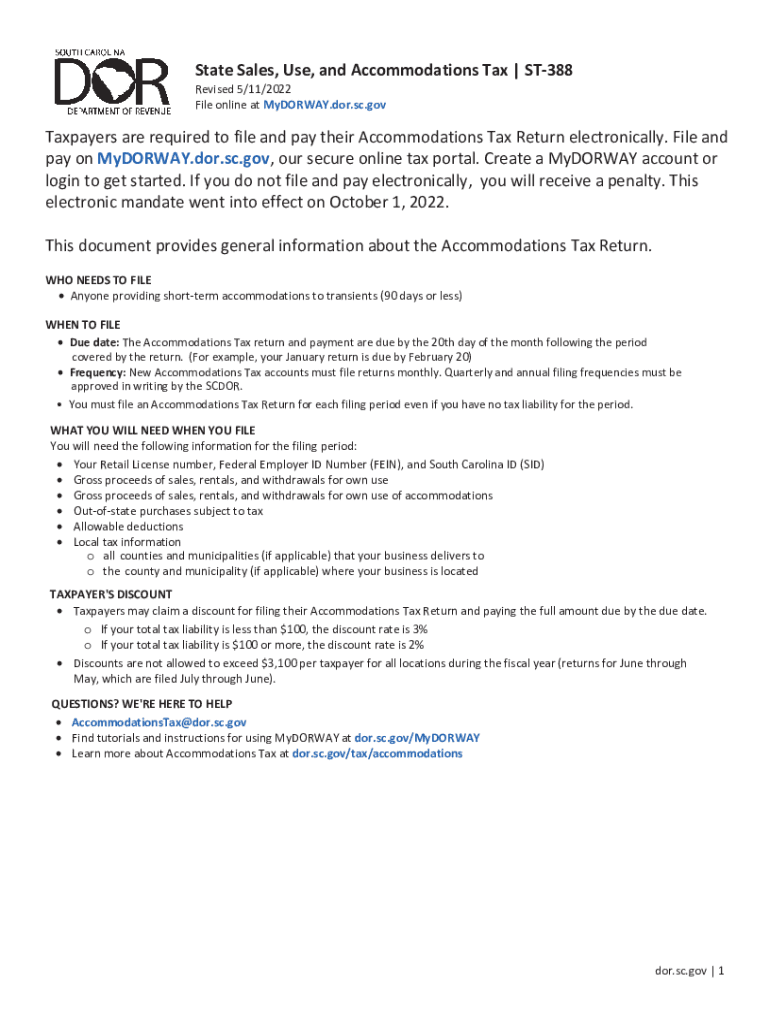

The ST-388 form, also known as the South Carolina Use Tax Return, is a tax document used by businesses and individuals to report and pay use tax on items purchased for use in South Carolina. This form is particularly relevant for transactions where sales tax was not collected at the time of purchase. The ST-388 is essential for ensuring compliance with state tax laws and helps maintain accurate records of taxable purchases.

Steps to Complete the ST-388 Form

Completing the ST-388 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your purchases, including receipts and invoices. Next, fill out the form by providing details such as your name, address, and the total amount of use tax owed. Be sure to include specific information about the items purchased, including their description and cost. After completing the form, review it for any errors before submitting it to the appropriate state department.

Legal Use of the ST-388 Form

The ST-388 form is legally binding and must be completed accurately to fulfill state tax obligations. Proper use of this form ensures that individuals and businesses comply with South Carolina tax laws. It is important to understand the legal implications of submitting an incorrect or incomplete form, as this may result in penalties or fines. Utilizing a reliable e-signature platform can enhance the legal standing of your submission by providing a digital certificate and ensuring compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the ST-388 form are crucial for avoiding penalties. Typically, the form must be submitted by the 20th day of the month following the end of the reporting period. For example, if you are reporting use tax for the month of January, the form is due by February 20. Staying informed about these deadlines helps ensure timely compliance and prevents unnecessary fees.

Required Documents for ST-388 Submission

When submitting the ST-388 form, it is essential to have all required documents on hand. This includes receipts for purchases made, invoices, and any other documentation that supports your claim for use tax. Having these documents readily available not only facilitates the completion of the form but also ensures that you can provide evidence of your transactions if needed.

Form Submission Methods

The ST-388 form can be submitted through various methods, including online, by mail, or in person. For online submissions, using a secure e-signature platform can streamline the process and enhance the security of your data. If you choose to submit by mail, ensure that you send the form to the correct state department address. In-person submissions may be made at designated tax offices, where assistance can be provided if needed.

Penalties for Non-Compliance

Failure to file the ST-388 form on time or submitting inaccurate information can result in penalties. These penalties may include fines based on the amount of use tax owed, as well as interest on any unpaid taxes. Understanding the potential consequences of non-compliance is essential for maintaining good standing with the South Carolina Department of Revenue and avoiding unnecessary financial burdens.

Quick guide on how to complete st388 em draftpdf

Effortlessly manage ST388 EM Draft pdf on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle ST388 EM Draft pdf on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign ST388 EM Draft pdf smoothly

- Locate ST388 EM Draft pdf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign ST388 EM Draft pdf to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st388 em draftpdf

Create this form in 5 minutes!

People also ask

-

What is st 388, and how does it relate to airSlate SignNow?

ST 388 refers to a specific form used in certain business transactions. airSlate SignNow simplifies the process of completing and eSigning ST 388 documents efficiently, ensuring that you can handle compliance and documentation without hassle.

-

How does pricing work for using airSlate SignNow with ST 388?

airSlate SignNow offers flexible pricing plans tailored to your business needs, making it cost-effective to manage your ST 388 documents. Whether you are a small business or a large enterprise, you can find an affordable plan that suits your document signing frequency.

-

What features does airSlate SignNow offer for handling ST 388 documents?

airSlate SignNow provides a robust set of features for managing ST 388 documents, including templates, advanced eSignature functionality, and mobile access. These features help streamline your workflow and ensure that documents are completed efficiently.

-

What are the benefits of using airSlate SignNow for ST 388 processing?

By using airSlate SignNow for ST 388, users can enjoy benefits like quicker turnaround times, enhanced security for sensitive information, and a user-friendly interface. This leads to improved productivity and decreased paper usage.

-

Can airSlate SignNow integrate with other tools for managing ST 388 processes?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms to enhance your ST 388 management. This allows for easier data transfer and improved collaboration across teams, making your processes more efficient.

-

Is airSlate SignNow compliant with regulations concerning ST 388 forms?

airSlate SignNow ensures compliance with all necessary regulations associated with ST 388 forms. This means you can confidently eSign documents while adhering to industry standards and legal requirements.

-

How secure is the airSlate SignNow platform for ST 388 document storage?

The airSlate SignNow platform incorporates top-tier security measures to protect your ST 388 documents, including encryption and secure cloud storage. You can trust that your sensitive information remains safe and accessible only to authorized users.

Get more for ST388 EM Draft pdf

- Bankrupty nd form

- Bill of sale with warranty by individual seller north dakota form

- Bill of sale with warranty for corporate seller north dakota form

- Bill of sale without warranty by individual seller north dakota form

- Bill of sale without warranty by corporate seller north dakota form

- North dakota agreement 497317663 form

- Verification of matrix pro se north dakota form

- Verification of creditors matrix north dakota form

Find out other ST388 EM Draft pdf

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile