Schedule F Form

What is the Schedule F

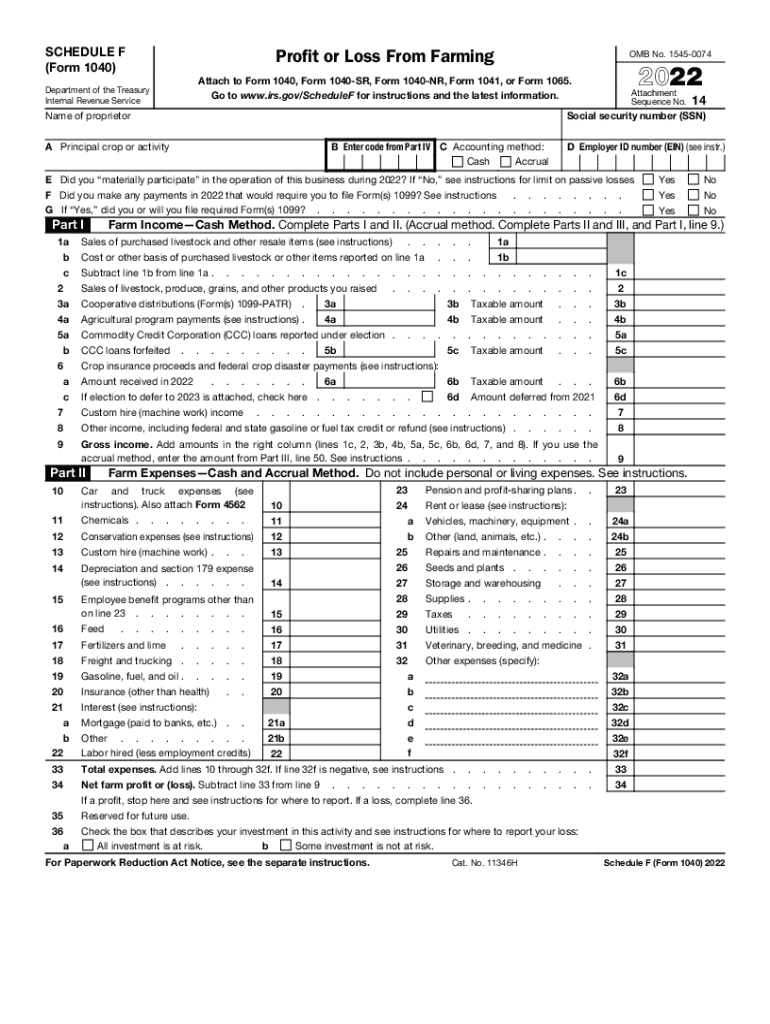

The Schedule F is a tax form used by farmers in the United States to report income and expenses related to farming activities. It is part of the IRS Form 1040 series, specifically designed for individuals engaged in farming. This form allows farmers to detail their earnings from agricultural activities, including sales of livestock, crops, and other farm products. Additionally, it provides a space to list various deductible expenses, such as feed, fertilizer, and labor costs, which can help reduce taxable income.

How to use the Schedule F

To effectively use the Schedule F, taxpayers must gather all relevant financial information regarding their farming operations. This includes records of income from sales and any expenses incurred during the tax year. The form is divided into sections that require specific details about income sources and expenses. Farmers should ensure that they accurately report all figures to avoid discrepancies with the IRS. Utilizing digital tools can streamline this process, making it easier to fill out the form and maintain records.

Steps to complete the Schedule F

Completing the Schedule F involves several key steps:

- Gather all income and expense records related to farming activities.

- Fill out the income section, detailing all sources of revenue from farming.

- Complete the expenses section, listing all deductible costs associated with farming operations.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss to the appropriate section of Form 1040.

Legal use of the Schedule F

The Schedule F must be completed in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting income and expenses, as well as maintaining supporting documentation for all claims made on the form. Electronic signatures can be used when submitting the form online, provided that they comply with the legal standards set forth by the ESIGN Act and UETA. It is essential to keep copies of the completed form and any related documents for future reference or in case of an audit.

Filing Deadlines / Important Dates

Farmers must be aware of the filing deadlines associated with the Schedule F. Generally, the form is due on April 15, coinciding with the federal tax deadline for individual taxpayers. However, if additional time is needed, farmers can file for an extension, which typically grants an extra six months. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the Schedule F, several documents are necessary:

- Income statements from sales of farm products.

- Receipts for all deductible expenses, including supplies and equipment.

- Records of any loans or grants received for farming activities.

- Prior year tax returns for reference.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F, which can be found in the instructions accompanying the form. These guidelines outline what qualifies as income and what expenses can be deducted. It is important for farmers to familiarize themselves with these rules to ensure compliance and maximize their deductions. Regular updates to tax laws may also affect how the Schedule F is completed, so staying informed is essential.

Quick guide on how to complete schedule f 622996868

Effortlessly Prepare Schedule F on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documentation, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly and without interruption. Handle Schedule F on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign Schedule F with minimal effort

- Obtain Schedule F and then click Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Schedule F to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2021 IRS schedule and why is it important?

The 2021 IRS schedule refers to the various forms and documents that taxpayers must file to report their income and expenses to the IRS for the tax year. Understanding the 2021 IRS schedule is crucial as it ensures compliance with tax regulations and helps avoid penalties. Proper documentation can make tax filing seamless, especially when utilizing tools like airSlate SignNow for eSigning necessary documents.

-

How can airSlate SignNow help with the 2021 IRS schedule?

airSlate SignNow offers an effortless way to eSign and send documents related to your 2021 IRS schedule. With our platform, you can quickly prepare and sign essential tax forms without hassle. This saves you time and reduces the chances of errors, ensuring a smoother tax filing process.

-

What kind of documents can I sign for the 2021 IRS schedule using airSlate SignNow?

You can sign various documents related to your 2021 IRS schedule, including tax returns, W-2s, 1099s, and other essential tax documents. Our platform streamlines the signing process for both individuals and businesses, making it easy to manage and store important paperwork securely. With airSlate SignNow, you can ensure that all necessary documents are properly signed and submitted on time.

-

Is airSlate SignNow a cost-effective solution for managing the 2021 IRS schedule?

Yes, airSlate SignNow provides a cost-effective solution for managing the 2021 IRS schedule. Our pricing plans are designed for businesses of all sizes, ensuring that you only pay for what you need. By minimizing the paperwork and simplifying the signing process, our solution can save you both time and money when preparing your taxes.

-

Can I integrate airSlate SignNow with accounting software for my 2021 IRS schedule?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your 2021 IRS schedule more efficiently. This integration helps automate the flow of documents and signatures, reducing the risk of errors and ensuring that your tax information is accurate and up-to-date. Simplify your tax process with our one-stop solution.

-

What features does airSlate SignNow offer for managing my 2021 IRS schedule?

airSlate SignNow offers a variety of features designed to streamline your 2021 IRS schedule management. These include customizable templates, robust eSignature options, and secure document storage. Additionally, our platform allows for real-time collaboration and tracking, ensuring your tax documents are handled promptly and efficiently.

-

How does airSlate SignNow ensure the security of my documents related to the 2021 IRS schedule?

Security is a top priority at airSlate SignNow, especially when it comes to your sensitive documents related to the 2021 IRS schedule. We employ advanced encryption and security protocols to protect your data during transmission and storage. You can rest assured knowing that your tax documents are safe and secure with us.

Get more for Schedule F

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy georgia form

- Warranty deed husband and wife to husband and wife georgia form

- Warranty deed for parents to child with reservation of life estate georgia form

- Warranty deed for separate or joint property to joint tenancy georgia form

- Warranty deed to separate property of one spouse to both as joint tenants with right of survivorship georgia form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries georgia form

- Warranty deed from limited partnership or llc is the grantor or grantee georgia form

- Georgia warranty deed form

Find out other Schedule F

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile