Form MO FPT Food Pantry, Homeless Shelter, or Soup Kitchen Tax Credit 2022

What is the Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit

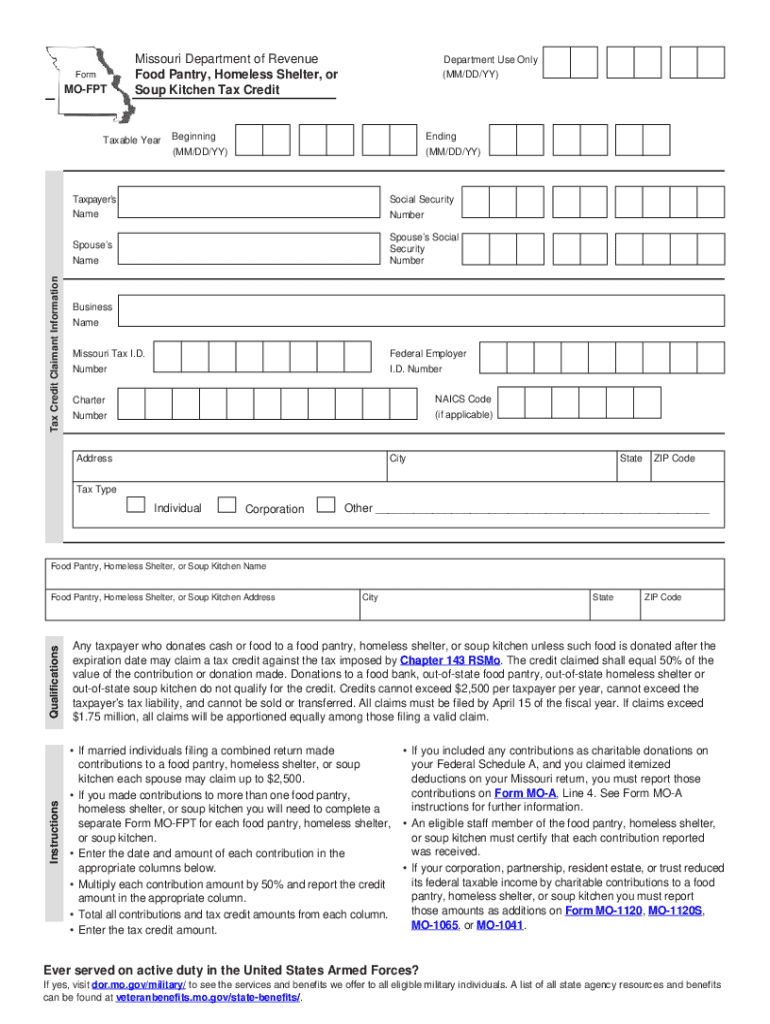

The Form MO FPT is designed to provide tax credits for donations made to food pantries, homeless shelters, or soup kitchens in Missouri. This tax credit encourages individuals and businesses to contribute to organizations that support those in need. By filling out this form, donors can receive a percentage of their contributions back as a tax credit, which can significantly reduce their overall tax liability. Understanding this form is essential for anyone looking to support local food assistance programs while benefiting financially.

Eligibility Criteria for the Form MO FPT Food Pantry Tax Credit

To qualify for the Missouri food pantry tax credit, donors must meet specific eligibility criteria. Contributions must be made to qualified organizations that provide food assistance, such as licensed food pantries or shelters. The donations can be in the form of cash or food items, and they must be documented properly. Additionally, the donor must be a resident of Missouri or a business entity registered in the state. It's important for potential claimants to ensure that their contributions align with these guidelines to take full advantage of the tax credit.

Steps to Complete the Form MO FPT Food Pantry Tax Credit

Completing the Form MO FPT requires careful attention to detail. Here are the essential steps:

- Gather documentation of your donations, including receipts or acknowledgment letters from the food pantry or shelter.

- Fill out the form with your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Detail the contributions made, specifying the amounts and types of donations.

- Calculate the tax credit based on the contributions, following the guidelines provided in the form instructions.

- Submit the completed form to the Missouri Department of Revenue, either online or via mail, ensuring you keep copies for your records.

Form Submission Methods for the MO FPT Tax Credit

The Form MO FPT can be submitted through various methods, providing flexibility for donors. Individuals can choose to file the form online through the Missouri Department of Revenue's website, where they can complete and submit the form electronically. Alternatively, donors may print the completed form and send it via mail to the appropriate department. In-person submissions are also an option at designated state offices. Each method has its advantages, and donors should select the one that best fits their needs.

Key Elements of the Form MO FPT Food Pantry Tax Credit

Understanding the key elements of the Form MO FPT is crucial for successful completion. The form includes sections for personal information, donation details, and the calculation of the tax credit. Donors must provide accurate records of their contributions, including the name of the organization, the date of the donation, and the total amount contributed. Additionally, the form may require signatures to validate the information provided. Ensuring all sections are filled out correctly will help avoid delays in processing the tax credit.

Legal Use of the Form MO FPT Food Pantry Tax Credit

The legal use of the Form MO FPT is governed by Missouri tax law, which outlines the requirements for claiming the food pantry tax credit. Donors must ensure that their contributions are made to eligible organizations and that they follow all filing procedures as specified by the Missouri Department of Revenue. Misuse of the form, such as claiming credits for ineligible donations, can result in penalties or disqualification from receiving the tax credit. It is essential for donors to maintain accurate records and comply with all legal stipulations to ensure their claims are valid.

Quick guide on how to complete form mo fpt food pantry homeless shelter or soup kitchen tax credit

Complete Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit with ease

- Find Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark signNow portions of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo fpt food pantry homeless shelter or soup kitchen tax credit

Create this form in 5 minutes!

People also ask

-

What are the benefits of using a Missouri food pantry?

Utilizing a Missouri food pantry provides essential resources to families in need, ensuring they have access to nutritious meals. These pantries often offer a variety of food items, helping to reduce food insecurity in the community. Additionally, they can serve as a vital support system, offering referrals to other local services.

-

How can I find a Missouri food pantry near me?

To find a Missouri food pantry near you, check local community resource websites or contact local food banks for locations. Many pantries also have online directories that can help you locate services in your area. You can also ask for recommendations from community organizations that support food assistance.

-

Are there any eligibility requirements for accessing a Missouri food pantry?

Eligibility requirements can vary by Missouri food pantry, but generally, they are open to anyone in need of food assistance. Some pantries may require proof of residency or identification. It’s best to contact the specific pantry beforehand for their exact requirements.

-

What types of food are typically available at a Missouri food pantry?

Missouri food pantries usually offer a variety of non-perishable items like canned goods, dry foods, and sometimes fresh produce and baked goods. Some pantries also provide personal hygiene items and household supplies. The availability may vary based on donations and local partnerships.

-

How can I donate to a Missouri food pantry?

Donating to a Missouri food pantry is a rewarding way to help your community. You can typically donate food items, financial contributions, or your time through volunteering. Check the pantry's website or contact them directly to understand their specific needs and donation guidelines.

-

What is the cost of using a Missouri food pantry?

Most Missouri food pantries provide their services at no cost to clients, making food assistance accessible to those in need. However, some may suggest a small monetary donation or encourage community support to sustain their operations. Always verify with the specific pantry for any cost-related inquiries.

-

Can I volunteer at a Missouri food pantry?

Yes, many Missouri food pantries welcome volunteers to help with various tasks such as sorting donations, distributing food, and organizing events. Volunteering not only supports the pantry but also helps you connect with your community. Contact your local pantry for available opportunities and how to get involved.

Get more for Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit

- Commercial contract for contractor new hampshire form

- Excavator contract for contractor new hampshire form

- Renovation contract for contractor new hampshire form

- Concrete mason contract for contractor new hampshire form

- Demolition contract for contractor new hampshire form

- Framing contract for contractor new hampshire form

- New hampshire contract form

- New hampshire contract 497318483 form

Find out other Form MO FPT Food Pantry, Homeless Shelter, Or Soup Kitchen Tax Credit

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document