MO FPT 2024-2026

What is the MO FPT?

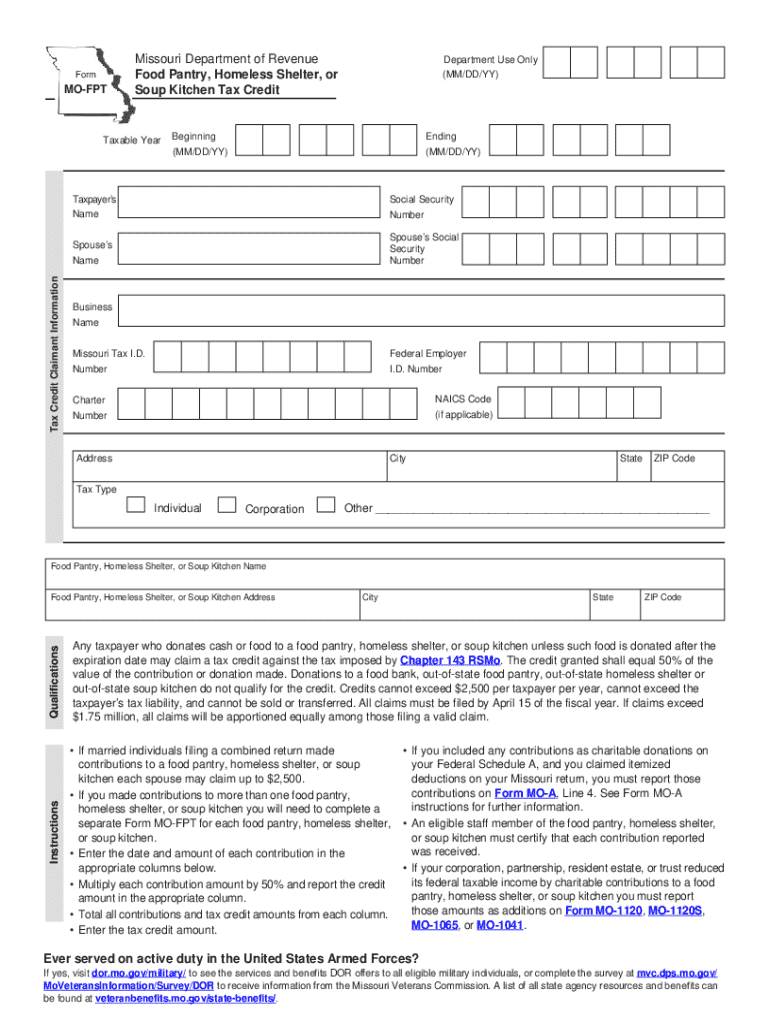

The MO FPT, or Missouri Food Pantry Tax Credit form, is a document that allows taxpayers in Missouri to claim a tax credit for donations made to qualified food pantries. This form is designed to encourage charitable contributions to food assistance programs, helping to alleviate food insecurity within the community. By completing the MO FPT, individuals and businesses can reduce their tax liability while supporting local food pantries that serve those in need.

How to use the MO FPT

To effectively use the MO FPT, taxpayers must first ensure they have made eligible donations to a recognized food pantry in Missouri. After confirming the donation, the next step is to fill out the form accurately, providing necessary details such as the amount donated and the name of the food pantry. Once completed, the form should be submitted along with the taxpayer's state income tax return to claim the corresponding credit. It is important to keep records of the donations for verification purposes.

Steps to complete the MO FPT

Completing the MO FPT involves several key steps:

- Gather documentation of your donations, including receipts or acknowledgment letters from the food pantry.

- Obtain the MO FPT form, which can typically be found on the Missouri Department of Revenue website or through local tax offices.

- Fill out the form, ensuring all required information is accurate and complete.

- Attach the completed form to your state tax return when filing.

- Retain copies of the form and any supporting documents for your records.

Eligibility Criteria

To qualify for the Missouri Food Pantry Tax Credit, taxpayers must meet certain eligibility criteria. Donations must be made to food pantries that are registered and recognized by the state. Additionally, the donations must be in cash or food items, with specific limits on the amount that can be claimed as a credit. Individual taxpayers, as well as businesses, can apply for this credit, making it accessible to a wide range of contributors.

Form Submission Methods

The MO FPT can be submitted through various methods, depending on the taxpayer's preference. The form can be filed online through the Missouri Department of Revenue's e-filing system, which offers a convenient way to submit tax documents electronically. Alternatively, taxpayers may choose to mail the completed form along with their state tax return or submit it in person at designated tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits the taxpayer's needs.

Key elements of the MO FPT

Several key elements are essential for the MO FPT to be valid and effective:

- Donor Information: Taxpayers must provide their name, address, and taxpayer identification number.

- Donation Details: The form requires information about the food pantry receiving the donation, including its name and address.

- Credit Amount: Taxpayers must specify the total amount of the donation for which they are claiming the tax credit.

- Signature: The form must be signed by the taxpayer to certify the accuracy of the information provided.

Create this form in 5 minutes or less

Find and fill out the correct mo fpt

Create this form in 5 minutes!

How to create an eSignature for the mo fpt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo fpt form and how does it work?

The mo fpt form is a digital document that allows users to fill out and sign forms electronically. With airSlate SignNow, you can easily create, send, and eSign the mo fpt form, streamlining your document management process. This solution enhances efficiency and reduces the need for physical paperwork.

-

How can I integrate the mo fpt form with other applications?

airSlate SignNow offers seamless integrations with various applications, allowing you to connect the mo fpt form with your existing workflows. You can integrate with popular tools like Google Drive, Salesforce, and more, ensuring that your document processes are efficient and cohesive.

-

What are the pricing options for using the mo fpt form?

airSlate SignNow provides flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that includes features for managing the mo fpt form effectively. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for the mo fpt form?

With airSlate SignNow, you can enjoy features such as customizable templates, automated workflows, and secure eSigning for the mo fpt form. These features help you save time and ensure that your documents are processed quickly and securely.

-

What are the benefits of using the mo fpt form with airSlate SignNow?

Using the mo fpt form with airSlate SignNow provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. By digitizing your document processes, you can focus more on your core business activities while ensuring compliance and accuracy.

-

Is the mo fpt form secure for sensitive information?

Yes, the mo fpt form is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your sensitive information. You can confidently use the mo fpt form knowing that your data is safe and secure.

-

Can I track the status of my mo fpt form submissions?

Absolutely! airSlate SignNow allows you to track the status of your mo fpt form submissions in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you complete visibility into your document workflow.

Get more for MO FPT

- 2021 2022 low income statement form lisf please read

- Note taking rubric form

- Lbccd stamp here dpss stamp here long beach city college form

- Fillable online your guide to prevent test and treat form

- Apsc capstone experience proposal animal and poultry sciences form

- Student progress report form waubonsee community college waubonsee

- Filliomission college santa clara nursefillable mission college santa clara nurse assistant form

- Verification form dependent studentpdf priority submission deadline

Find out other MO FPT

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer