Mo Revenue Mofpt 2019

What is the Missouri Food Pantry Tax Credit?

The Missouri Food Pantry Tax Credit is a state-level tax incentive designed to encourage donations to food pantries and food banks within Missouri. This credit allows individuals and businesses to receive a tax credit for contributions made to qualified food pantries, which play a vital role in addressing food insecurity in the community. The program aims to support local organizations that provide essential food resources to those in need, thereby enhancing the overall well-being of residents.

Eligibility Criteria for the Missouri Food Pantry Tax Credit

To qualify for the Missouri Food Pantry Tax Credit, donors must meet specific criteria. Contributions must be made to a food pantry that is recognized and certified by the Missouri Department of Revenue. Eligible donors include individuals, corporations, and partnerships. The amount of the credit is typically a percentage of the donation made, and there may be limits on the total credit available to each donor. It is essential to review the guidelines to ensure compliance and maximize the benefits of this tax credit.

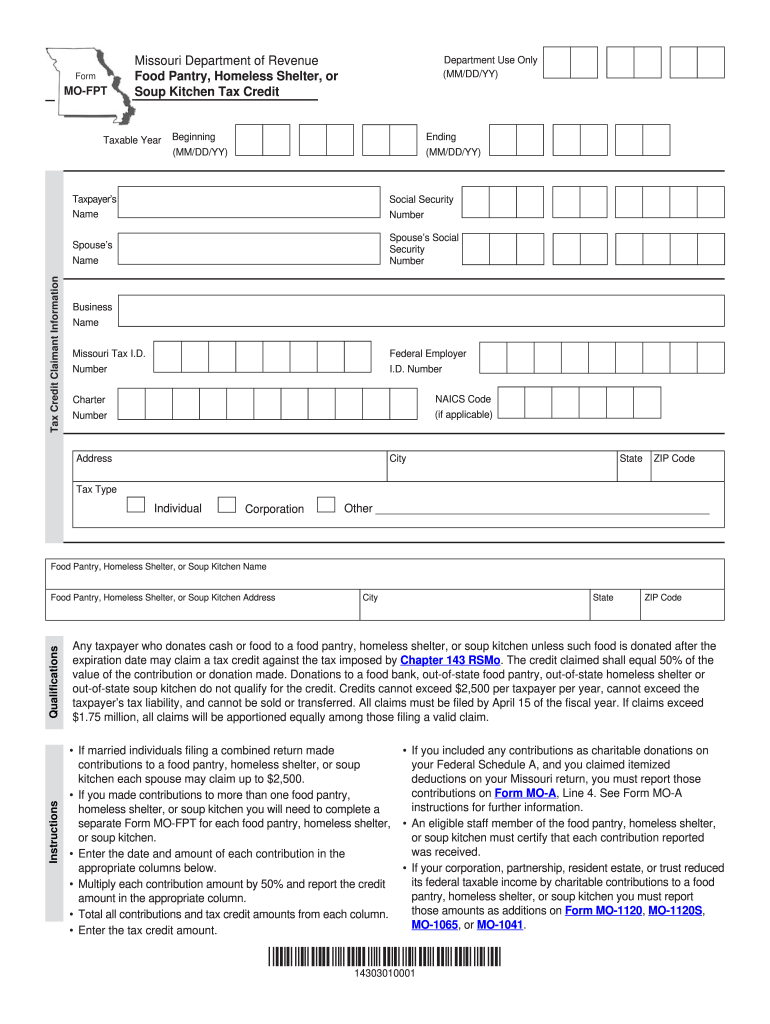

Steps to Complete the Missouri Food Pantry Tax Credit Form

Completing the Missouri Food Pantry Tax Credit form involves several key steps:

- Gather documentation of your donation, including receipts and any correspondence from the food pantry.

- Obtain the Missouri Food Pantry Tax Credit form, which can be accessed through the Missouri Department of Revenue website.

- Fill out the form accurately, ensuring all required information is provided, including your personal details and the amount donated.

- Submit the completed form along with your tax return, ensuring all necessary attachments are included.

Following these steps will help ensure that your claim for the tax credit is processed smoothly.

Required Documents for the Missouri Food Pantry Tax Credit

When applying for the Missouri Food Pantry Tax Credit, it is crucial to have the following documents ready:

- Proof of donation, such as receipts or acknowledgment letters from the food pantry.

- The completed Missouri Food Pantry Tax Credit form.

- Your personal or business tax return, where the credit will be claimed.

Having these documents organized will facilitate a more efficient application process and help avoid any potential delays.

Form Submission Methods for the Missouri Food Pantry Tax Credit

There are multiple ways to submit the Missouri Food Pantry Tax Credit form:

- Online: Many taxpayers prefer to file electronically through tax software that supports the Missouri tax forms.

- By Mail: Completed forms can be mailed to the Missouri Department of Revenue at the address specified on the form.

- In-Person: Taxpayers may also choose to deliver their forms directly to a local Department of Revenue office.

Choosing the right submission method can depend on personal preference and the resources available to the taxpayer.

Legal Use of the Missouri Food Pantry Tax Credit

The Missouri Food Pantry Tax Credit is legally recognized under state law, providing a legitimate avenue for taxpayers to reduce their tax liability through charitable contributions. To ensure compliance, it is essential to adhere to all guidelines set forth by the Missouri Department of Revenue. This includes maintaining accurate records of donations and ensuring that contributions are made to qualified food pantries. Understanding the legal framework surrounding this credit can help taxpayers navigate the application process effectively.

Quick guide on how to complete mo revenue mofpt

Effortlessly complete Mo Revenue Mofpt on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Mo Revenue Mofpt on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign Mo Revenue Mofpt effortlessly

- Locate Mo Revenue Mofpt and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Mo Revenue Mofpt to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo revenue mofpt

Create this form in 5 minutes!

How to create an eSignature for the mo revenue mofpt

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Missouri food pantry tax credit?

The Missouri food pantry tax credit is a tax incentive designed to encourage donations to food pantries in Missouri. By participating, individuals and businesses can receive credits that help offset their state income tax liability. This initiative aims to support local food pantries and enhance food security in the state.

-

How can I take advantage of the Missouri food pantry tax credit?

To take advantage of the Missouri food pantry tax credit, you need to make a qualifying donation to an approved food pantry in Missouri. After making your donation, ensure you receive a receipt, which you will need to submit with your tax filings. Consult with a tax professional to maximize your benefits under the Missouri food pantry tax credit program.

-

Are there limits on the Missouri food pantry tax credit?

Yes, there are limits on the Missouri food pantry tax credit, which vary based on your tax filing status. Individuals can claim credits up to a certain amount, while businesses may have different thresholds. It's essential to check the latest guidelines from the Missouri Department of Revenue for precise figures.

-

What types of donations qualify for the Missouri food pantry tax credit?

Generally, monetary donations and specific types of food donations to approved food pantries qualify for the Missouri food pantry tax credit. However, it’s important to ensure that the pantry is recognized by the state for tax credit purposes. Always verify with the food pantry and consult the relevant regulations for the most accurate information.

-

How do I report the Missouri food pantry tax credit on my taxes?

To report the Missouri food pantry tax credit on your taxes, you must fill out the appropriate forms provided by the Missouri Department of Revenue. This includes providing documentation of your donations, such as receipts, along with your tax return. Organize your records carefully to ensure a smooth filing process.

-

Will using the Missouri food pantry tax credit affect my eligibility for other tax incentives?

Using the Missouri food pantry tax credit should not affect your eligibility for other tax incentives, as long as you meet the requirements for all programs you wish to partake in. It’s recommended to discuss these concerns with a tax professional. They can provide guidance on claiming multiple credits and avoiding any potential pitfalls.

-

How can businesses benefit from the Missouri food pantry tax credit?

Businesses can benefit from the Missouri food pantry tax credit by enhancing their community engagement and improving their public image. Supporting local food pantries through donations not only qualifies for tax credits but also demonstrates corporate social responsibility. This can positively influence brand loyalty among consumers who value community support.

Get more for Mo Revenue Mofpt

- Alabama power appliances form

- Silver diamine fluoride consent form pdf

- Vaal christian boarding school application forms

- Clyde valley housing application form

- Nakheel noc form download

- Building ampamp safety divisioncity of downey cabuilding ampamp safety divisioncity of downey cabuilding ampamp safety form

- 9 teams 3 game guarantee form

- Checklist of self management skills 785072152 form

Find out other Mo Revenue Mofpt

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile