Missouri Sales 2022

What is the Missouri Sales Tax?

The Missouri sales tax is a consumption tax imposed on the sale of goods and certain services within the state. It is a key source of revenue for state and local governments, funding various public services and infrastructure projects. The state sales tax rate is currently four point two five percent, but local jurisdictions can impose additional taxes, leading to varying total rates across different areas. Understanding the Missouri sales tax is essential for businesses and consumers alike, as it affects pricing, compliance, and financial planning.

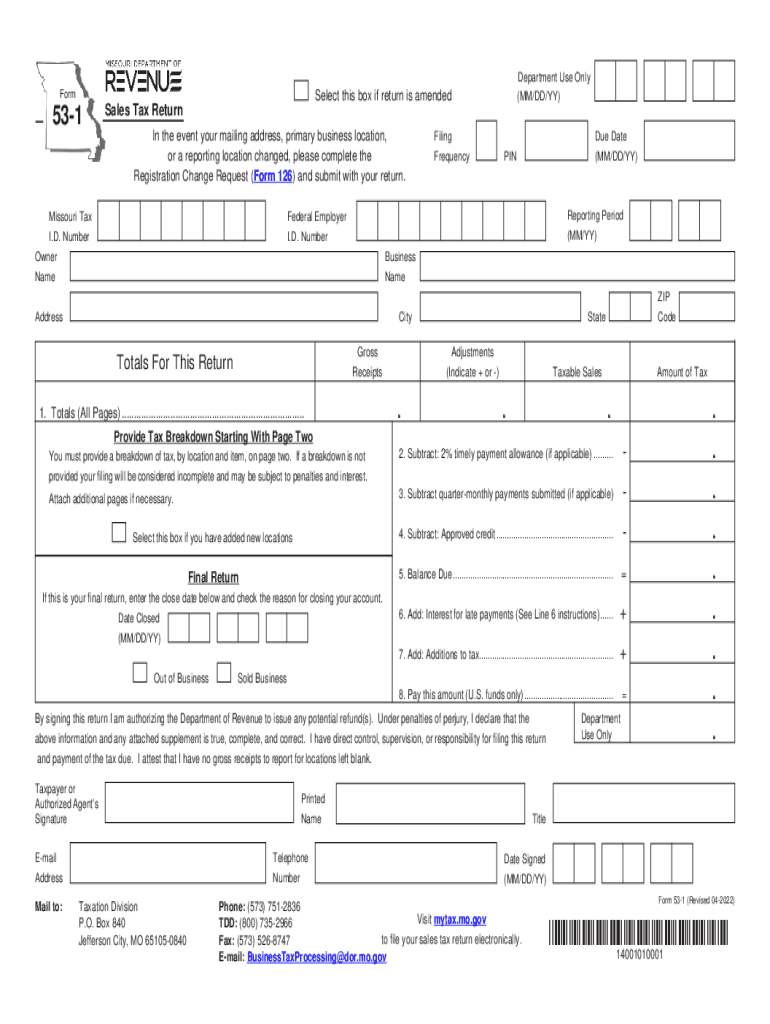

Steps to Complete the Missouri Sales Tax Form 53-1

Completing the Missouri sales tax form 53-1 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including invoices and receipts, for the reporting period. Next, calculate the total taxable sales and the applicable sales tax collected. Fill out the form by entering your business information, total sales, exemptions, and the total sales tax due. Review the completed form for accuracy before submitting it. Finally, ensure the form is filed by the due date to avoid any penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri sales tax form 53-1 vary based on the frequency of your tax reporting, which can be monthly, quarterly, or annually. Typically, monthly filers must submit their forms by the 20th of the following month, while quarterly filers have until the 20th of the month following the end of the quarter. Annual filers should submit their forms by January 31 of the following year. It is crucial to mark these dates on your calendar to maintain compliance and avoid late fees.

Legal Use of the Missouri Sales Tax Form 53-1

The Missouri sales tax form 53-1 is legally binding when completed and submitted according to state regulations. To ensure its legality, businesses must accurately report their sales and tax collected, maintain proper documentation, and adhere to all filing deadlines. Electronic submissions are accepted and considered valid, provided they comply with the state's eSignature regulations. Understanding the legal implications of the form helps businesses avoid potential audits and penalties.

Key Elements of the Missouri Sales Tax Form 53-1

The Missouri sales tax form 53-1 includes several key elements that must be accurately filled out. These elements consist of the business name, address, and sales tax identification number. The form also requires details on total sales, taxable sales, exempt sales, and the total sales tax collected. Additionally, it includes sections for reporting any adjustments or credits. Each component is crucial for calculating the correct tax liability and ensuring compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Missouri sales tax form 53-1 through various methods. Online submission is available via the Missouri Department of Revenue's website, offering a convenient and efficient way to file. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the department. In-person submissions are also accepted at designated offices. Each method has its own processing times, so businesses should choose the one that best fits their needs and timelines.

Penalties for Non-Compliance

Failure to comply with Missouri sales tax regulations can result in significant penalties for businesses. These penalties may include late filing fees, interest on unpaid taxes, and potential audits. The state imposes a penalty of up to ten percent for late submissions, along with interest that accrues daily. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid financial repercussions and maintain good standing with the state.

Quick guide on how to complete missouri sales

Complete Missouri Sales effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Missouri Sales on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to adjust and eSign Missouri Sales with ease

- Obtain Missouri Sales and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Adjust and eSign Missouri Sales and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri sales

Create this form in 5 minutes!

People also ask

-

What is Missouri sales tax, and how is it calculated?

Missouri sales tax is a consumption tax imposed on the sale of goods and services in the state. It is typically calculated as a percentage of the sales price, which varies based on the location and type of product. Understanding this tax is essential for businesses to ensure compliance and proper financial planning.

-

How does airSlate SignNow assist with managing Missouri sales tax documents?

AirSlate SignNow streamlines the process of managing documents related to Missouri sales tax. Our platform allows you to easily prepare, send, and eSign tax-related documents, ensuring compliance with state regulations. This efficient management process can save your business valuable time and reduce the risk of errors.

-

What features in airSlate SignNow are beneficial for handling Missouri sales tax forms?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning that are particularly useful for handling Missouri sales tax forms. These features help ensure that you generate accurate documentation quickly and in compliance with the Missouri sales tax regulations. This not only enhances the efficiency of your team but also minimizes the potential for mistakes.

-

Is airSlate SignNow cost-effective for small businesses managing Missouri sales tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Missouri sales tax. Our pricing options are designed to fit varying budgets, providing accessible tools to track and manage tax documents efficiently. With its user-friendly interface, even those unfamiliar with tax documentation can utilize it effectively.

-

Can I integrate airSlate SignNow with other financial applications for Missouri sales tax?

Absolutely! AirSlate SignNow integrates seamlessly with various financial applications, allowing you to manage Missouri sales tax processes efficiently. This integration means you can sync your sales data and ensure that all tax documentation is up-to-date and compliant with state requirements.

-

What are the benefits of using airSlate SignNow for Missouri sales tax compliance?

Using airSlate SignNow for Missouri sales tax compliance offers numerous benefits, including time savings, enhanced accuracy, and improved document security. With our platform, you can automate your tax documentation processes, reducing the workload on your staff while ensuring compliance with Missouri sales tax laws. This allows your business to operate more efficiently and confidently.

-

How does eSigning with airSlate SignNow help with Missouri sales tax documentation?

ESigning with airSlate SignNow simplifies the approval process for Missouri sales tax documentation. By allowing stakeholders to sign documents electronically, you accelerate the workflow and ensure that all necessary approvals are obtained quickly. This efficiency is particularly critical in maintaining compliance with Missouri sales tax regulations.

Get more for Missouri Sales

- Paving contract for contractor hawaii form

- Site work contract for contractor hawaii form

- Siding contract for contractor hawaii form

- Refrigeration contract for contractor hawaii form

- Drainage contract for contractor hawaii form

- Foundation contract for contractor hawaii form

- Plumbing contract for contractor hawaii form

- Brick mason contract for contractor hawaii form

Find out other Missouri Sales

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement