MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank 2024-2026

Understanding the Missouri Form 53 1

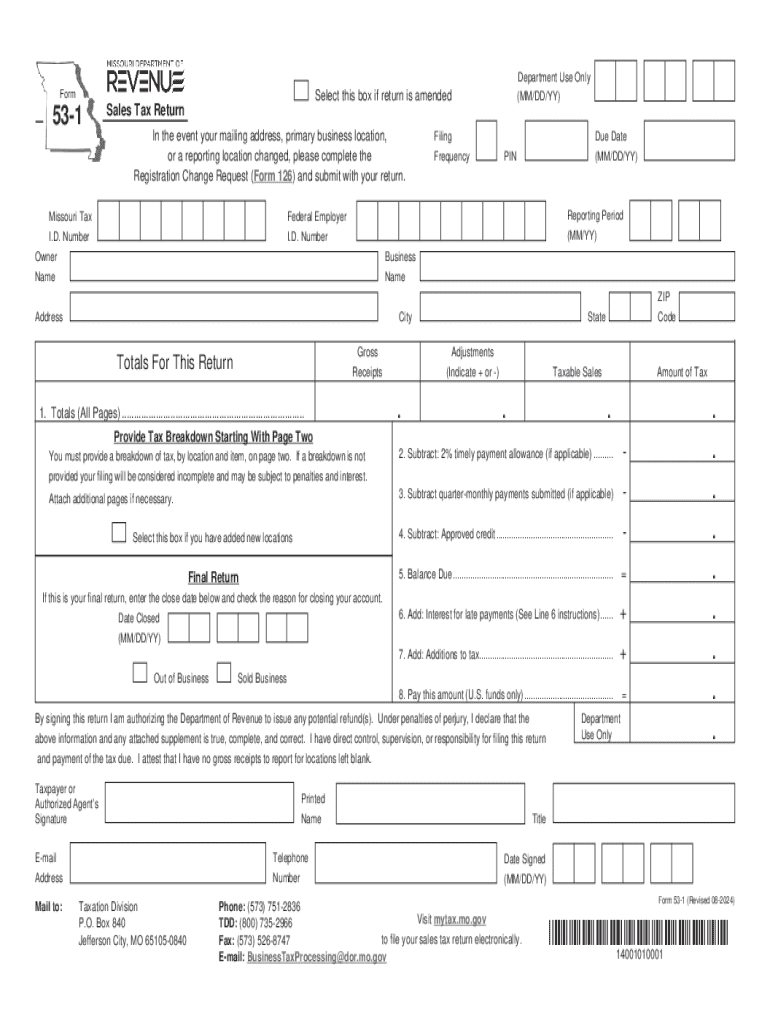

The Missouri Form 53 1 is a sales tax return form used by businesses to report and remit sales tax to the Missouri Department of Revenue. This form is essential for ensuring compliance with state tax laws and is applicable to various business entities, including sole proprietorships, partnerships, and corporations. The form captures crucial information regarding sales made during a specific period, allowing the state to assess the appropriate tax owed.

Steps to Complete the Missouri Form 53 1

Completing the Missouri Form 53 1 involves several steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. This includes total sales, exempt sales, and any sales tax collected. Next, fill out the form by entering your business information, including your Missouri sales tax ID number. Then, calculate the total sales tax due based on the applicable tax rates. Finally, review the form for any errors before submitting it to the Missouri Department of Revenue.

Obtaining the Missouri Form 53 1

The Missouri Form 53 1 can be obtained directly from the Missouri Department of Revenue’s website. It is available in both printable and fillable formats, allowing users to complete the form digitally or by hand. For those who prefer a physical copy, the form can be printed and filled out manually. Ensure you have the most current version of the form to avoid any compliance issues.

Key Elements of the Missouri Form 53 1

Key elements of the Missouri Form 53 1 include sections for reporting total sales, exempt sales, and the total amount of sales tax collected. Additionally, the form requires the business's contact information and sales tax identification number. Accurate reporting in these sections is crucial for determining the correct sales tax liability. The form also includes instructions for calculating tax rates based on the specific location of the business.

Legal Use of the Missouri Form 53 1

The Missouri Form 53 1 is legally required for businesses that collect sales tax in the state. Filing this form ensures compliance with state tax laws and helps avoid penalties for non-compliance. Businesses must submit the form by the designated filing deadlines to maintain good standing with the Missouri Department of Revenue. Failure to file or inaccuracies in reporting can result in financial penalties and interest on unpaid taxes.

Filing Deadlines for the Missouri Form 53 1

Filing deadlines for the Missouri Form 53 1 vary based on the business's reporting frequency, which can be monthly, quarterly, or annually. Businesses that collect significant amounts of sales tax may be required to file monthly, while smaller businesses may file quarterly or annually. It is important to check the specific deadlines set by the Missouri Department of Revenue to ensure timely submission and avoid late fees.

Handy tips for filling out MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank online

Quick steps to complete and e-sign MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to e-sign and share MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct mo dor form 53 1 fill online printable fillable blank

Create this form in 5 minutes!

How to create an eSignature for the mo dor form 53 1 fill online printable fillable blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 53 1?

The Missouri Form 53 1 is a specific document used for various legal and administrative purposes in the state of Missouri. It is essential for businesses and individuals to understand its requirements and how to complete it accurately. Using airSlate SignNow can simplify the process of filling out and submitting the Missouri Form 53 1.

-

How can airSlate SignNow help with the Missouri Form 53 1?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Missouri Form 53 1. With features like templates and automated workflows, you can streamline the process, ensuring that your documents are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Missouri Form 53 1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value considering the features available for managing documents like the Missouri Form 53 1. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Missouri Form 53 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the Missouri Form 53 1. These features enhance the user experience and ensure that your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for the Missouri Form 53 1?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage the Missouri Form 53 1 alongside other tools you use, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the Missouri Form 53 1?

Using airSlate SignNow for the Missouri Form 53 1 offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the signing process, making it easier for you to manage important documents without the hassle of traditional methods.

-

Is airSlate SignNow compliant with Missouri regulations for the Form 53 1?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the Missouri Form 53 1. This ensures that your documents are legally binding and meet the necessary standards for submission in Missouri.

Get more for MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank

Find out other MO DoR Form 53 1 Fill Online, Printable, Fillable, Blank

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself