Form 53 1 Sales Tax Return Missouri Department of Revenue 2020

What is the Form 53-1 Sales Tax Return Missouri Department of Revenue

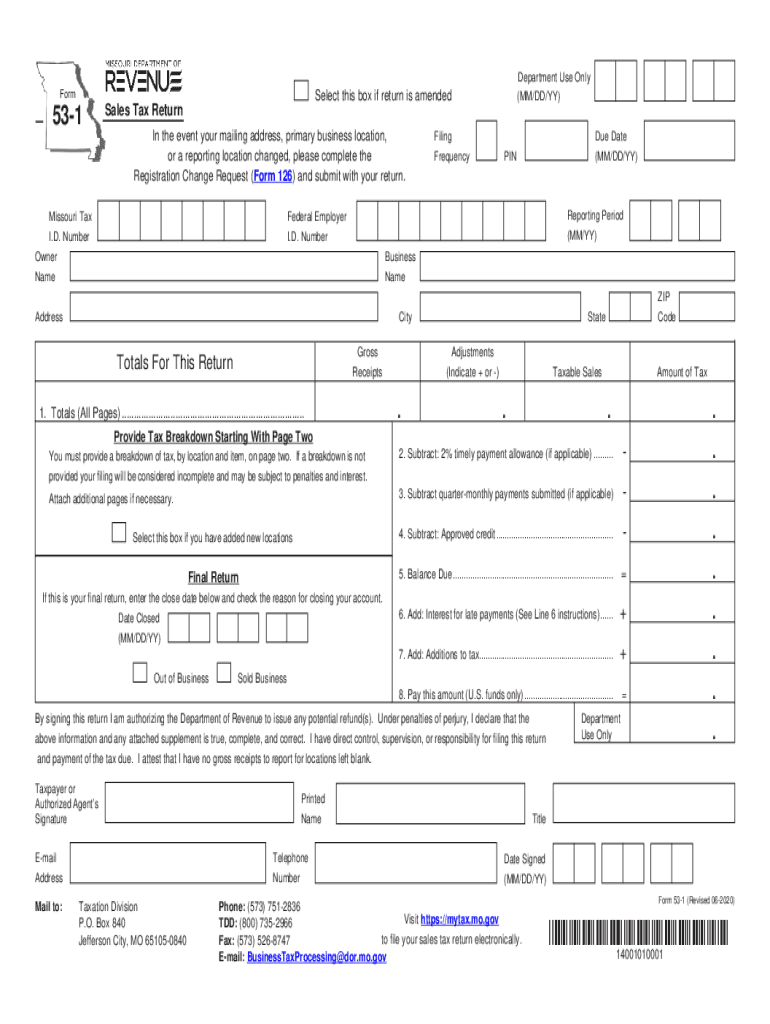

The Form 53-1 is the official Sales Tax Return used by businesses in Missouri to report and remit sales tax collected during a specific period. This form is essential for compliance with state tax laws and is required for all entities that sell tangible personal property or taxable services in Missouri. The Missouri Department of Revenue oversees the collection of sales tax, and the Form 53-1 must be completed accurately to ensure proper reporting and payment.

Steps to Complete the Form 53-1 Sales Tax Return Missouri Department of Revenue

Completing the Form 53-1 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect sales records, tax rates, and any exemptions that apply to your business.

- Fill in business details: Provide your business name, address, and Missouri sales tax identification number at the top of the form.

- Report gross sales: Enter the total sales amount for the reporting period in the designated section.

- Calculate taxable sales: Deduct any exempt sales from your gross sales to determine the taxable amount.

- Determine sales tax owed: Multiply the taxable sales amount by the applicable sales tax rate to find the total sales tax due.

- Review and sign: Double-check all entries for accuracy, then sign and date the form before submission.

How to Obtain the Form 53-1 Sales Tax Return Missouri Department of Revenue

The Form 53-1 can be easily obtained from the Missouri Department of Revenue's official website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, businesses can request physical copies of the form by contacting the Department of Revenue directly. Ensuring you have the most current version of the form is crucial for compliance.

Legal Use of the Form 53-1 Sales Tax Return Missouri Department of Revenue

The Form 53-1 is legally binding when completed and submitted in accordance with Missouri state laws. It serves as an official record of sales tax collected and remitted to the state. Accurate completion of this form is essential, as errors or omissions can lead to penalties or audits. Businesses must retain copies of submitted forms for their records, as they may be required for future reference or verification by the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the Form 53-1 is crucial to avoid penalties. The due date for submitting the form typically aligns with the end of the reporting period, which can be monthly, quarterly, or annually, depending on the business's sales volume. Businesses should be aware of specific deadlines to ensure compliance and avoid late fees. It is advisable to mark these dates on your calendar and prepare the form in advance to facilitate timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 53-1 can be submitted through various methods to accommodate different business needs:

- Online submission: Businesses can file electronically through the Missouri Department of Revenue's online portal, which offers a streamlined process.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-person: Businesses may also choose to deliver their forms directly to local Department of Revenue offices for immediate processing.

Quick guide on how to complete form 53 1 sales tax return missouri department of revenue

Effortlessly prepare Form 53 1 Sales Tax Return Missouri Department Of Revenue on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 53 1 Sales Tax Return Missouri Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign Form 53 1 Sales Tax Return Missouri Department Of Revenue with ease

- Locate Form 53 1 Sales Tax Return Missouri Department Of Revenue and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 53 1 Sales Tax Return Missouri Department Of Revenue and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 53 1 sales tax return missouri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form 53 1 sales tax return missouri department of revenue

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What are mo dor forms and how can they benefit my business?

Mo dor forms are essential documents used in various official transactions in Missouri. With airSlate SignNow, you can easily create, send, and eSign these forms, streamlining your workflow and ensuring compliance. By utilizing mo dor forms through our platform, you'll save time and reduce the chances of errors in your documentation processes.

-

How much does it cost to use airSlate SignNow for mo dor forms?

AirSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can start with a free trial to explore features related to mo dor forms without any commitment. Our subscription plans provide cost-effective solutions, making it easy for businesses to manage and eSign their documents efficiently.

-

What features does airSlate SignNow offer for managing mo dor forms?

AirSlate SignNow includes a variety of features specifically designed for handling mo dor forms. These features include customizable templates, secure electronic signatures, real-time tracking, and automated reminders. This comprehensive toolkit ensures your forms are processed quickly and securely.

-

Can I integrate airSlate SignNow with other applications for mo dor forms?

Yes, airSlate SignNow can seamlessly integrate with many popular applications such as Google Drive, Salesforce, and more. This allows you to manage your mo dor forms alongside other tools you already use, increasing your efficiency and maintaining consistency across all your business processes.

-

Is airSlate SignNow secure for handling sensitive mo dor forms?

Absolutely! AirSlate SignNow prioritizes security and compliance, using methods like encryption and secure storage to protect your mo dor forms. We adhere to industry standards and regulations, ensuring that your documents remain confidential and safe throughout their lifecycle.

-

What types of businesses can benefit from using mo dor forms with airSlate SignNow?

Businesses across various industries, including real estate, healthcare, and legal sectors, can benefit from using mo dor forms with airSlate SignNow. Our flexible platform is designed to accommodate different workflows, making it suitable for any organization that requires efficient document management and electronic signatures.

-

How do I get started with airSlate SignNow for mo dor forms?

Getting started with airSlate SignNow is simple! Sign up for a free trial on our website to explore our user-friendly platform. Once registered, you can start creating, sending, and eSigning your mo dor forms in just a few clicks.

Get more for Form 53 1 Sales Tax Return Missouri Department Of Revenue

- Landscaping contractor package virginia form

- Commercial contractor package virginia form

- Excavation contractor package virginia form

- Virginia contractor form

- Concrete mason contractor package virginia form

- Demolition contractor package virginia form

- Security contractor package virginia form

- Insulation contractor package virginia form

Find out other Form 53 1 Sales Tax Return Missouri Department Of Revenue

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter