About Schedule LEP Form 1040, Request for Change in Language 2022

What is the About Schedule LEP Form 1040, Request For Change In Language

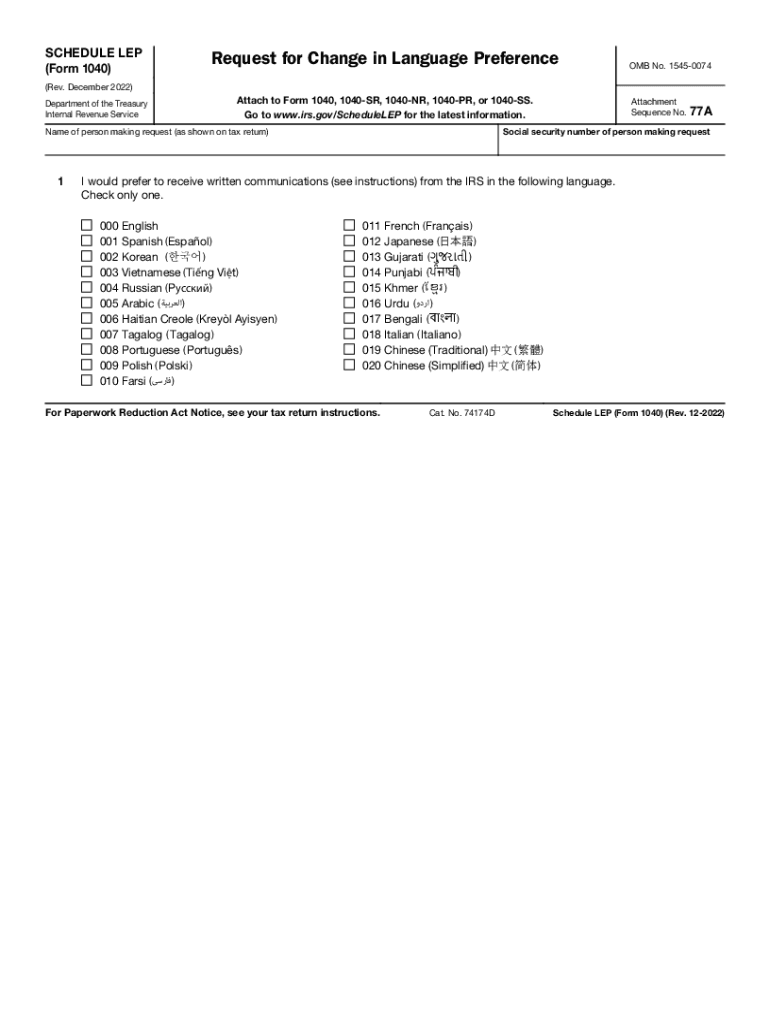

The About Schedule LEP Form 1040, Request for Change in Language, is a specific document used by taxpayers to request a change in the language used for communication with the Internal Revenue Service (IRS). This form is particularly important for individuals who may require assistance in a language other than English, ensuring that they can understand and comply with tax obligations. By submitting this form, taxpayers can facilitate clearer communication and improve their overall experience when dealing with the IRS.

How to use the About Schedule LEP Form 1040, Request For Change In Language

To effectively use the About Schedule LEP Form 1040, taxpayers should first ensure they have the correct version of the form. Once obtained, fill out the required fields, including personal identification information and the preferred language for communication. After completing the form, it can be submitted to the IRS either electronically or via mail, depending on the specific instructions provided with the form. This process helps ensure that all future correspondence with the IRS aligns with the taxpayer's language preference.

Steps to complete the About Schedule LEP Form 1040, Request For Change In Language

Completing the About Schedule LEP Form 1040 involves several key steps:

- Obtain the form from the IRS website or through a tax professional.

- Fill out your personal information, including your name, Social Security number, and address.

- Indicate your preferred language for communication with the IRS.

- Review the form for accuracy to avoid delays.

- Submit the completed form according to the provided instructions.

IRS Guidelines

The IRS has established guidelines for the use of the About Schedule LEP Form 1040. These guidelines include requirements for eligibility, the proper completion of the form, and submission methods. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to facilitate a smooth process when requesting a change in language. Adhering to these guidelines will help taxpayers avoid potential issues or delays in communication with the IRS.

Filing Deadlines / Important Dates

When submitting the About Schedule LEP Form 1040, it is crucial to be aware of any relevant filing deadlines. The IRS typically sets specific dates for the submission of forms, particularly during tax season. Taxpayers should ensure that their requests are submitted in a timely manner to avoid any disruptions in communication or processing of their tax-related matters. Keeping track of these important dates can help ensure compliance with IRS requirements.

Required Documents

To successfully submit the About Schedule LEP Form 1040, certain documents may be required. These can include proof of identity, such as a driver’s license or passport, and any previous correspondence with the IRS that may be relevant to the language change request. Having these documents ready can streamline the process and help the IRS process the request more efficiently.

Quick guide on how to complete about schedule lep form 1040 request for change in language

Accomplish About Schedule LEP Form 1040, Request For Change In Language effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as it allows you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle About Schedule LEP Form 1040, Request For Change In Language on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign About Schedule LEP Form 1040, Request For Change In Language with ease

- Obtain About Schedule LEP Form 1040, Request For Change In Language and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Adjust and electronically sign About Schedule LEP Form 1040, Request For Change In Language to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule lep form 1040 request for change in language

Create this form in 5 minutes!

People also ask

-

What is the internal revenue service change and how does it affect my business?

The internal revenue service change refers to updates or modifications in IRS regulations that can impact how businesses handle documentation and compliance. Understanding these changes is crucial for maintaining tax compliance and ensuring that your business adheres to new requirements, ultimately saving you from potential penalties.

-

How can airSlate SignNow help me adapt to internal revenue service changes?

airSlate SignNow offers a seamless solution for eSigning and managing documents that comply with internal revenue service changes. With features designed to simplify the documentation process, you can quickly adjust to new regulations and ensure your documents are legally binding and compliant.

-

What features does airSlate SignNow provide to handle internal revenue service changes?

airSlate SignNow provides features such as customizable templates and secure document storage that allow you to efficiently manage changes required by the internal revenue service. These tools enable you to create, edit, and store documents necessary for IRS compliance, ensuring you are always prepared for any adjustments.

-

Is airSlate SignNow a cost-effective solution for businesses facing internal revenue service changes?

Yes, airSlate SignNow is designed to be a cost-effective solution that helps businesses save time and resources when navigating internal revenue service changes. Our pricing structure aligns with your needs, ensuring you access the essential tools to maintain compliance without breaking the bank.

-

Can I integrate airSlate SignNow with other tools to manage internal revenue service changes?

Absolutely! airSlate SignNow integrates with various business tools, enhancing your ability to manage internal revenue service changes. Whether using CRM systems, cloud storage, or accounting software, these integrations provide a comprehensive solution to streamline your compliance tasks.

-

What are the benefits of using airSlate SignNow for internal revenue service changes?

Using airSlate SignNow for internal revenue service changes allows you to automate document workflows, ensuring that you remain compliant and efficient. The ability to eSign documents securely and store them in one place simplifies your processes and enhances overall productivity.

-

How does airSlate SignNow ensure the security of documents regarding internal revenue service changes?

airSlate SignNow employs advanced encryption and security measures to protect documents related to internal revenue service changes. Your sensitive information is safeguarded, providing peace of mind when managing compliance documentation and eSignatures.

Get more for About Schedule LEP Form 1040, Request For Change In Language

- Foundation contractor package hawaii form

- Plumbing contractor package hawaii form

- Brick mason contractor package hawaii form

- Roofing contractor package hawaii form

- Electrical contractor package hawaii form

- Sheetrock drywall contractor package hawaii form

- Flooring contractor package hawaii form

- Trim carpentry contractor package hawaii form

Find out other About Schedule LEP Form 1040, Request For Change In Language

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document