Internal Revenue Service Change 2021

What is the Internal Revenue Service Change

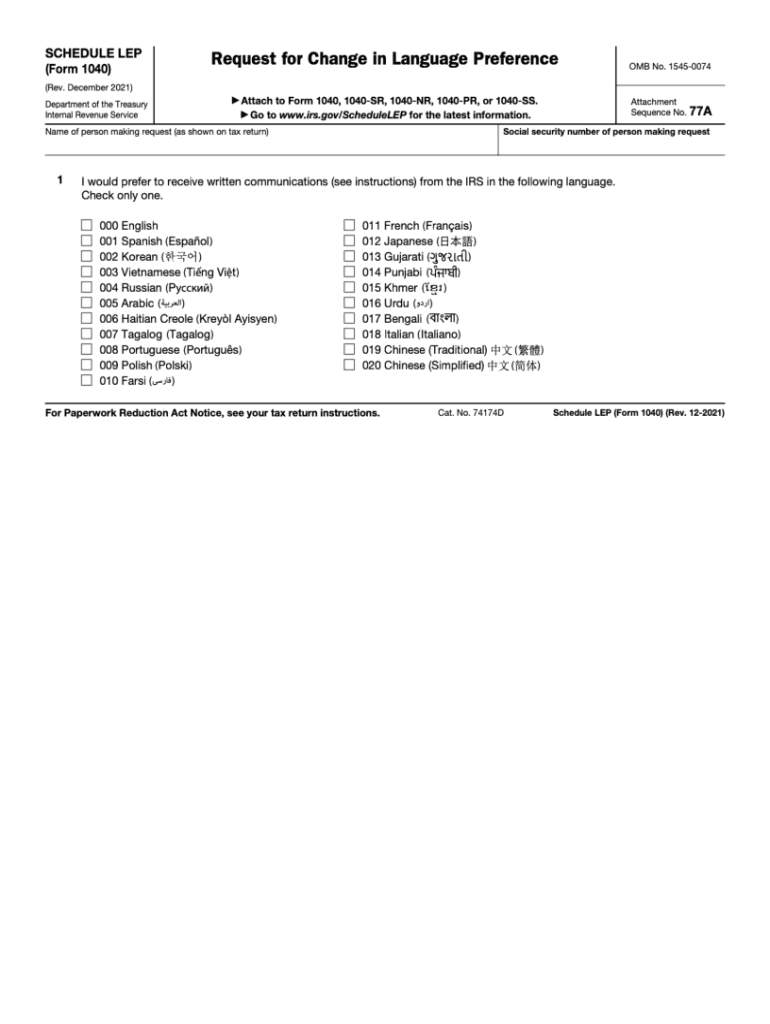

The Internal Revenue Service change refers to modifications made by the IRS regarding tax regulations, procedures, or forms. These changes can affect how taxpayers fill out their forms, report income, or claim deductions. Understanding these changes is crucial for compliance and ensuring accurate tax filings. The IRS regularly updates its guidelines to reflect new laws, economic conditions, or administrative needs, which can influence various aspects of tax preparation, including the IRS Schedule LEP for language access.

How to use the Internal Revenue Service Change

Using the Internal Revenue Service change involves staying informed about the latest updates and understanding how they apply to your tax situation. Taxpayers should regularly check the IRS website or consult tax professionals to comprehend any new forms or changes in filing procedures. When filling out forms, ensure that you incorporate the latest instructions provided by the IRS, as these can impact your tax liabilities and potential refunds.

Steps to complete the Internal Revenue Service Change

Completing the Internal Revenue Service change requires a systematic approach:

- Review the latest IRS guidelines related to the change.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the relevant forms accurately, ensuring that you follow the updated instructions.

- Double-check your entries for accuracy and completeness.

- Submit the form electronically or by mail, depending on your preference and the specific requirements.

Legal use of the Internal Revenue Service Change

The legal use of the Internal Revenue Service change is governed by federal tax laws and regulations. It is essential to ensure that any changes made to your tax filings comply with IRS rules. This includes using the correct forms, adhering to submission deadlines, and maintaining accurate records. Failure to comply with these legal requirements can result in penalties or audits by the IRS.

Required Documents

When dealing with the Internal Revenue Service change, certain documents are typically required to support your filings:

- Previous tax returns for reference.

- W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for deductions and credits claimed.

- Any correspondence from the IRS regarding previous filings.

Filing Deadlines / Important Dates

Filing deadlines for the Internal Revenue Service change are crucial to avoid penalties. Typically, individual tax returns are due on April fifteenth each year, but this can vary based on specific circumstances. It's important to stay updated on any changes to these deadlines, as the IRS may extend them in certain situations, such as natural disasters or significant policy changes.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Internal Revenue Service change can be done through various methods:

- Online: Many forms can be submitted electronically through the IRS e-file system or authorized e-file providers.

- Mail: You can send your completed forms to the appropriate IRS address based on your location and the type of form.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, especially for complex issues or when seeking assistance.

Quick guide on how to complete internal revenue service change

Complete Internal Revenue Service Change seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Internal Revenue Service Change on any system with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Internal Revenue Service Change effortlessly

- Obtain Internal Revenue Service Change and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you'd like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing additional copies. airSlate SignNow accommodates all your document management needs in a few clicks from any device of your choice. Edit and electronically sign Internal Revenue Service Change and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service change

Create this form in 5 minutes!

People also ask

-

What is the internal revenue service change and how does it affect my eSigning process?

The internal revenue service change refers to modifications in IRS regulations that affect how electronic signatures are recognized. Understanding these changes is crucial for ensuring your eSigning processes remain compliant and valid. airSlate SignNow helps you stay updated with the latest IRS requirements to simplify your document management.

-

How does airSlate SignNow integrate with IRS regulations related to the internal revenue service change?

airSlate SignNow is designed to comply with the internal revenue service change by implementing features that ensure secure and legally binding eSignatures. Our platform stays current with IRS regulations, providing you the confidence to send and sign documents while adhering to legal standards.

-

Are there any pricing plans available for users needing to comply with internal revenue service change?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing to comply with the internal revenue service change. With our cost-effective solution, you can choose a plan that best fits your budget and eSigning needs without compromising compliance.

-

What features does airSlate SignNow offer that can help navigate the internal revenue service change?

airSlate SignNow provides features like customizable workflows and advanced security options to assist with the internal revenue service change. These tools ensure that your documents remain compliant, while also enhancing your efficiency in managing eSignatures.

-

Can airSlate SignNow handle high-volume signing needs in light of the internal revenue service change?

Absolutely! airSlate SignNow is equipped to handle high-volume signing needs efficiently, even amid the internal revenue service change. Our platform enables you to send multiple documents at once, making it easier for businesses to adapt to increased signing demands.

-

What benefits can I expect from using airSlate SignNow concerning internal revenue service change compliance?

By using airSlate SignNow, you can streamline your document workflows, enhance compliance with the internal revenue service change, and reduce turnaround times. Our easy-to-use solution promotes efficiency while ensuring that your eSignature processes meet all IRS requirements.

-

How does airSlate SignNow support integrations that relate to the internal revenue service change?

airSlate SignNow seamlessly integrates with various third-party applications to help you navigate the internal revenue service change effectively. This allows for automatic data transfers and enhanced workflows, simplifying your compliance journey while eSigning documents.

Get more for Internal Revenue Service Change

- Tdl 180 form

- Fsa crawford advisor claim forms

- Candidate information sheet cognizant

- Genworth beneficiary change form

- Phonak repair form 45810933

- Majury gov login form

- Building certificate nec papers form

- Request will be processed within 5 10 working days upon receipt in the office and verification of receipt form

Find out other Internal Revenue Service Change

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure