Schedule LEP Form 1040 Rev December Request for Change in Language Preference 2024-2026

What is the Schedule LEP Form 1040 Rev December Request For Change In Language Preference

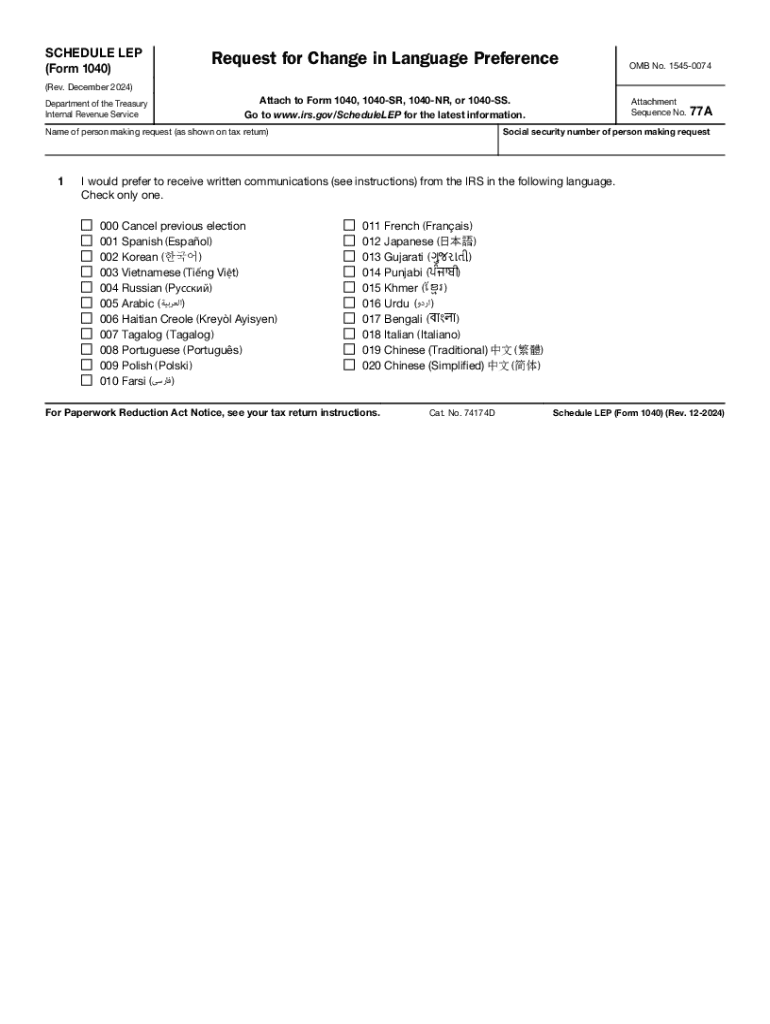

The Schedule LEP Form 1040 Rev December is a document used by taxpayers to request a change in their language preference when interacting with the Internal Revenue Service (IRS). This form is particularly important for individuals who may require assistance in a language other than English. By submitting this form, taxpayers can ensure that their communications with the IRS are conducted in a language they are comfortable with, facilitating better understanding and compliance with tax obligations.

How to use the Schedule LEP Form 1040 Rev December Request For Change In Language Preference

Using the Schedule LEP Form 1040 Rev December involves several straightforward steps. First, taxpayers should obtain the form, which is available through the IRS website or by contacting the IRS directly. Once in possession of the form, individuals need to fill it out with their personal information, including their name, address, and the preferred language. After completing the form, it should be submitted to the IRS as instructed, either by mail or electronically, depending on the options provided by the IRS.

Steps to complete the Schedule LEP Form 1040 Rev December Request For Change In Language Preference

Completing the Schedule LEP Form 1040 Rev December requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the IRS website or by contacting the IRS.

- Fill in your personal information accurately, including your name and address.

- Indicate your preferred language for communication.

- Review the completed form for accuracy.

- Submit the form as directed by the IRS, either by mail or electronically.

Key elements of the Schedule LEP Form 1040 Rev December Request For Change In Language Preference

Key elements of the Schedule LEP Form 1040 Rev December include the taxpayer's identification information, the current language preference, and the requested new language preference. Additionally, the form may require a signature to verify the request. It is essential to provide accurate and complete information to avoid any delays in processing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Schedule LEP Form 1040 Rev December. Taxpayers should ensure they are familiar with these guidelines to avoid any potential issues. The IRS emphasizes the importance of submitting the form in a timely manner and following all instructions carefully. This ensures that the request for a language preference change is processed efficiently.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Schedule LEP Form 1040 Rev December. The form can be submitted online through the IRS e-filing system, if available. Alternatively, individuals may choose to mail the completed form to the designated IRS address. In-person submissions may also be possible at local IRS offices, although it is advisable to check for specific availability and requirements before visiting.

Create this form in 5 minutes or less

Find and fill out the correct schedule lep form 1040 rev december request for change in language preference

Create this form in 5 minutes!

How to create an eSignature for the schedule lep form 1040 rev december request for change in language preference

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

The Schedule LEP Form 1040 Rev December Request For Change In Language Preference is a form that allows individuals to request a change in their preferred language for communication with the IRS. This form ensures that taxpayers receive important information in a language they understand, enhancing their overall experience with tax processes.

-

How can airSlate SignNow help with the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

airSlate SignNow provides a seamless platform for electronically signing and sending the Schedule LEP Form 1040 Rev December Request For Change In Language Preference. Our user-friendly interface simplifies the process, ensuring that you can complete and submit your form quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your documents, including the Schedule LEP Form 1040 Rev December Request For Change In Language Preference, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all of which enhance the management of the Schedule LEP Form 1040 Rev December Request For Change In Language Preference. These tools streamline the signing process and ensure that your documents are always accessible.

-

Can I integrate airSlate SignNow with other applications for the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the Schedule LEP Form 1040 Rev December Request For Change In Language Preference alongside your existing tools. This flexibility helps you maintain a smooth workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

Using airSlate SignNow for the Schedule LEP Form 1040 Rev December Request For Change In Language Preference provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and that you can focus on what matters most.

-

How secure is airSlate SignNow when handling the Schedule LEP Form 1040 Rev December Request For Change In Language Preference?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your data while processing the Schedule LEP Form 1040 Rev December Request For Change In Language Preference, ensuring that your information remains confidential and secure.

Get more for Schedule LEP Form 1040 Rev December Request For Change In Language Preference

Find out other Schedule LEP Form 1040 Rev December Request For Change In Language Preference

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors