Enable Selection through Choice Controls Check and List Boxes 2022-2026

IRS Guidelines

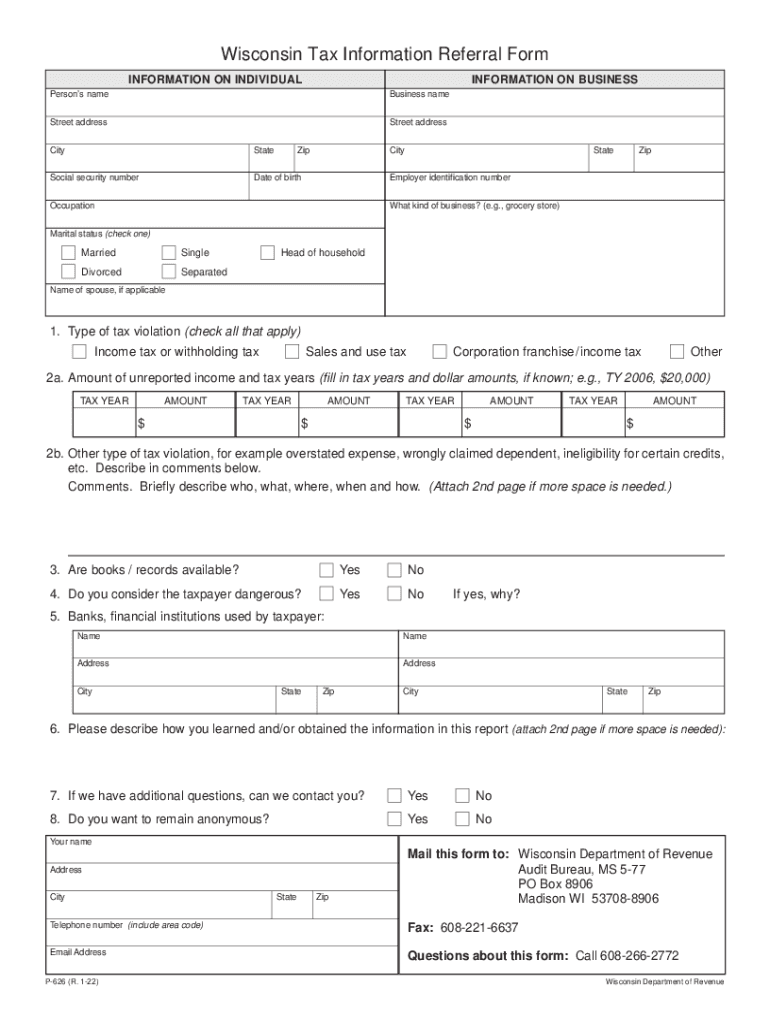

The IRS provides specific guidelines for filling out the 2022 P626 form, which is essential for ensuring compliance with tax regulations. This form is primarily used for reporting certain tax-related information and must be filled out accurately to avoid penalties. Taxpayers should refer to the IRS instructions for the P626 form, which detail the necessary information required, including income sources, deductions, and credits applicable to the reporting year. Understanding these guidelines helps in accurately completing the form and can facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 2022 P626 form are crucial for taxpayers to note. Typically, the deadline for submitting this form aligns with the general tax filing deadline, which is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific extensions that may apply, as well as the implications of late submissions, including potential penalties and interest on unpaid taxes.

Required Documents

To accurately complete the 2022 P626 form, taxpayers need to gather several required documents. These may include W-2 forms from employers, 1099 forms for additional income, and any relevant documentation supporting deductions or credits claimed. Having these documents ready can streamline the process of filling out the form and ensure that all necessary information is accurately reported. It is advisable to keep copies of all submitted documents for personal records and future reference.

Form Submission Methods (Online / Mail / In-Person)

The 2022 P626 form can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to file online, which can expedite processing times and reduce the risk of errors. Alternatively, taxpayers can mail their completed forms to the appropriate IRS address, ensuring that they use the correct postage and allow adequate time for delivery. In-person submission may also be an option at certain IRS offices, although this is less common. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Eligibility Criteria

Eligibility criteria for the 2022 P626 form vary based on individual circumstances. Generally, taxpayers must meet specific income thresholds and filing status requirements to be eligible to use this form. Understanding these criteria is essential for determining whether the P626 form is the correct choice for reporting tax information. Taxpayers should assess their financial situation and consult IRS resources to confirm their eligibility before proceeding with the form.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the 2022 P626 form can lead to significant penalties. These may include fines for late filing, inaccuracies in reporting, or failure to submit the form altogether. It is important for taxpayers to understand the potential consequences of non-compliance, as these penalties can add up quickly and affect overall tax liability. Staying informed about filing requirements and deadlines can help mitigate these risks.

Quick guide on how to complete enable selection through choice controls check and list boxes

Effortlessly Complete Enable Selection Through Choice Controls check And List Boxes on Any Device

Online document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Enable Selection Through Choice Controls check And List Boxes on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Enable Selection Through Choice Controls check And List Boxes with Ease

- Find Enable Selection Through Choice Controls check And List Boxes and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Edit and eSign Enable Selection Through Choice Controls check And List Boxes and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enable selection through choice controls check and list boxes

Create this form in 5 minutes!

People also ask

-

What is the 2022 p626 search feature in airSlate SignNow?

The 2022 p626 search feature in airSlate SignNow allows users to quickly locate and retrieve specific documents using advanced search parameters. This functionality enhances efficiency by ensuring that important documents are easily accessible. With this feature, you can streamline your workflow and save time during the eSigning process.

-

How does airSlate SignNow support the 2022 p626 search for document management?

AirSlate SignNow integrates the 2022 p626 search functionality to facilitate effective document management. Users can effortlessly search through their documents based on various criteria, ensuring they find what they need without hassle. This robust search capability makes document organization and retrieval more efficient.

-

What are the pricing plans available for airSlate SignNow in 2022?

In 2022, airSlate SignNow offers several pricing plans to accommodate varying business needs. Each plan provides access to essential features, including the efficient 2022 p626 search. Users can select a plan that best fits their budget and document signing requirements.

-

What features come with airSlate SignNow's eSigning solution?

The eSigning solution from airSlate SignNow includes a variety of features, such as customizable templates and the 2022 p626 search capability. These features enhance user experience by enabling efficient document preparation and signing. Additionally, it ensures compliance with legal standards, making it a reliable choice.

-

How can I benefit from using airSlate SignNow for my business?

By using airSlate SignNow, businesses can improve their document workflow through fast and secure electronic signatures. The integration of features like the 2022 p626 search allows users to manage documents more effectively. This results in saving time, reducing operational costs, and enhancing overall productivity.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Workspace and Salesforce. This enhances the functionality of the 2022 p626 search, allowing users to link documents across platforms. The integration capabilities help streamline workflows and improve collaboration.

-

Is support available for users of the 2022 p626 search functionality?

Absolutely! airSlate SignNow provides dedicated support for users utilizing the 2022 p626 search feature. Whether you have questions about usage or troubleshooting, their support team is ready to assist you. This ensures you can make the most of the document management tools available.

Get more for Enable Selection Through Choice Controls check And List Boxes

- Roofing contract for contractor new hampshire form

- Electrical contract for contractor new hampshire form

- Sheetrock drywall contract for contractor new hampshire form

- Flooring contract for contractor new hampshire form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new hampshire form

- Notice of intent to enforce forfeiture provisions of contact for deed new hampshire form

- Final notice of forfeiture and request to vacate property under contract for deed new hampshire form

- Buyers request for accounting from seller under contract for deed new hampshire form

Find out other Enable Selection Through Choice Controls check And List Boxes

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now