Wi Referral Form 2016

What is the Wi Referral Form

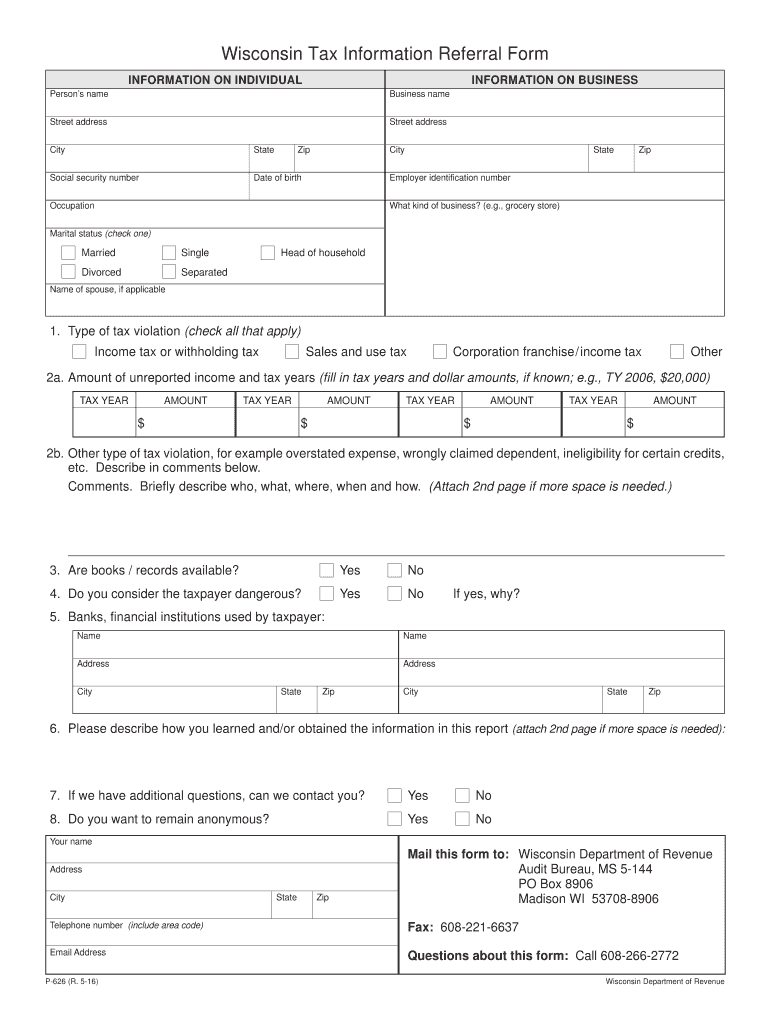

The Wisconsin Referral Form, commonly referred to as the P 626 form, is a crucial document used for tax purposes in the state of Wisconsin. This form is primarily utilized to report various types of income and deductions, ensuring that taxpayers comply with state tax regulations. The P 626 form serves as a means for individuals and businesses to provide necessary financial information to the Wisconsin Department of Revenue. By accurately completing this form, taxpayers can facilitate the assessment of their tax obligations and ensure compliance with state laws.

Steps to complete the Wi Referral Form

Completing the Wisconsin P 626 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant deduction records. Next, follow these steps:

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, self-employment income, and any other taxable sources.

- Claim applicable deductions and credits, ensuring you have documentation to support each claim.

- Review your completed form for accuracy before submission.

Once completed, the form can be submitted electronically or by mail, depending on your preference and the guidelines provided by the Wisconsin Department of Revenue.

Legal use of the Wi Referral Form

The legal use of the Wisconsin P 626 form is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. It is essential to provide truthful information, as any discrepancies can lead to penalties or legal repercussions. The form is designed to ensure that taxpayers fulfill their obligations while also allowing for the proper assessment of tax liabilities. Understanding the legal implications of using the P 626 form can help taxpayers navigate their responsibilities effectively.

Who Issues the Form

The Wisconsin Department of Revenue is the authoritative body responsible for issuing the P 626 form. This state agency oversees tax administration and compliance, ensuring that all forms and regulations align with current tax laws. The Department of Revenue provides resources and support for taxpayers, including guidelines on how to complete the form and where to submit it. Taxpayers can access the P 626 form directly from the Department’s website or through authorized distribution channels.

Form Submission Methods

Taxpayers have several options for submitting the Wisconsin P 626 form. The primary methods include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Wisconsin Department of Revenue’s online portal. This method is often faster and provides immediate confirmation of receipt.

- Mail Submission: For those who prefer a paper format, the completed form can be printed and mailed to the appropriate address provided by the Department of Revenue. Ensure that sufficient postage is applied to avoid delays.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated Department of Revenue offices, where staff can assist with any questions or concerns.

Eligibility Criteria

To use the Wisconsin P 626 form, individuals must meet specific eligibility criteria. Generally, this form is intended for residents of Wisconsin who have taxable income or deductions to report. Eligibility may include:

- Individuals who are employed or self-employed and earn income subject to Wisconsin state tax.

- Taxpayers claiming deductions or credits related to Wisconsin tax laws.

- Residents who have received income from sources outside of Wisconsin but are required to report it to the state.

Understanding these criteria helps ensure that the form is used correctly and that taxpayers comply with state regulations.

Quick guide on how to complete wi referral form

Finish Wi Referral Form effortlessly on any gadget

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the right template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Handle Wi Referral Form on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Wi Referral Form without effort

- Find Wi Referral Form and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in a few clicks from any device of your choice. Modify and eSign Wi Referral Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi referral form

Create this form in 5 minutes!

How to create an eSignature for the wi referral form

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is p 626 and how does it relate to airSlate SignNow?

P 626 is a crucial identifier for businesses looking to understand specific features and functionalities of airSlate SignNow. This designation helps users explore the platform's capabilities for eSigning and document management effectively.

-

What pricing plans does airSlate SignNow offer for p 626?

airSlate SignNow provides flexible pricing plans tailored to different business needs associated with p 626 functionalities. These plans are designed to offer cost-effective solutions for eSigning and document workflows, ensuring value for your investment.

-

What features of airSlate SignNow involve p 626 integration?

The p 626 designation includes features like document templates, advanced eSignature options, and workflow automation in airSlate SignNow. These features enhance efficiency and streamline processes for businesses looking to optimize their document management.

-

How can p 626 improve my document signing process?

Integrating p 626 into your workflow with airSlate SignNow enhances the document signing process by providing a seamless and user-friendly experience. This leads to faster turnaround times and increased productivity for teams.

-

Are there any special benefits associated with utilizing p 626 in airSlate SignNow?

Utilizing p 626 in airSlate SignNow offers businesses benefits such as improved compliance and security features. These tools safeguard your documents while ensuring that all signatures are legally binding, which is critical in today’s digital landscape.

-

Can I integrate p 626 functionalities with other software solutions?

Yes, airSlate SignNow supports p 626 functionalities that can be integrated with numerous other software solutions. This interoperability allows for enhanced workflows, enabling users to connect their favorite tools for better efficiency.

-

Is p 626 suitable for small businesses using airSlate SignNow?

Absolutely, p 626 is particularly beneficial for small businesses leveraging airSlate SignNow. Its cost-effective pricing and scalable features make it an ideal choice for companies looking to streamline document management and eSigning.

Get more for Wi Referral Form

- Chapter 10 the theory of evolution worksheets answer key form

- Court ordered community service timesheet form

- 98 form

- Rent certificate form 540201320

- Ams formulare download

- Michigan vehicle dealer closeout statement cloudfront net form

- Notice of seizure of motor vehicle form

- Parenting time holiday schedule mi template form

Find out other Wi Referral Form

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself