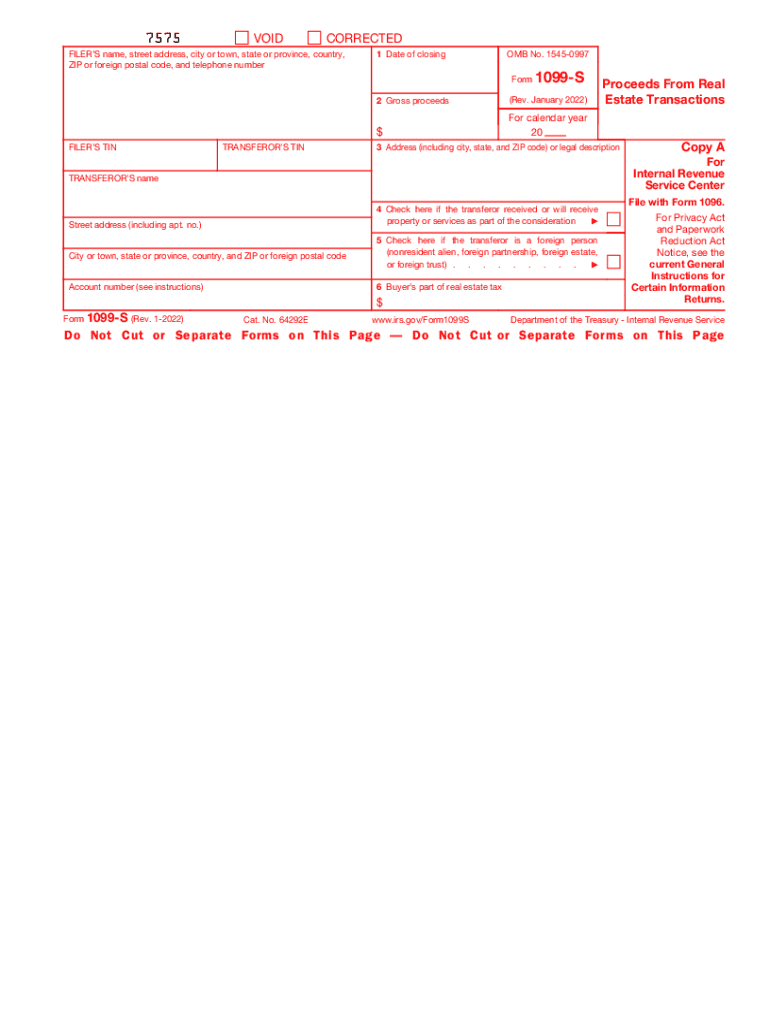

Form 1099 S Rev January Proceeds from Real Estate Transactions

What is the Form 1099-S?

The Form 1099-S is a tax document used to report proceeds from real estate transactions. This form is essential for individuals and businesses involved in selling or transferring real estate properties. It provides the Internal Revenue Service (IRS) with information about the sale, including the gross proceeds from the transaction. The form is typically issued by the settlement agent or the person responsible for closing the transaction. Understanding the purpose and requirements of the 1099-S is crucial for accurate tax reporting and compliance.

How to Use the Form 1099-S

Using the Form 1099-S involves several steps to ensure proper reporting of real estate transactions. First, the seller must provide necessary information, including their taxpayer identification number (TIN) and details about the property sold. The settlement agent will then complete the form, detailing the gross proceeds from the sale. Once filled out, copies of the form must be distributed to the seller and the IRS. It is important to keep a copy for personal records as well. Accurate completion and timely submission are vital to avoid potential penalties.

Steps to Complete the Form 1099-S

Completing the Form 1099-S requires attention to detail. Follow these steps:

- Gather necessary information, including the seller's TIN, property address, and sale date.

- Determine the gross proceeds from the sale, which should include all amounts received.

- Fill out the form accurately, ensuring all fields are completed, including the seller's information and transaction details.

- Review the form for accuracy before submission to prevent errors that could lead to penalties.

- Submit the completed form to the IRS and provide copies to the seller.

IRS Guidelines for Form 1099-S

The IRS has specific guidelines regarding the use of Form 1099-S. It is essential to understand the reporting requirements, including who must file the form and under what circumstances. Generally, the form must be filed when the gross proceeds from the sale of real estate are $600 or more. The IRS also outlines deadlines for submission, which typically fall at the end of January for the previous tax year. Familiarizing oneself with these guidelines ensures compliance and helps avoid potential issues with the IRS.

Filing Deadlines for Form 1099-S

Filing deadlines for the Form 1099-S are critical to ensure timely reporting. The form must be submitted to the IRS by January thirty-first of the year following the transaction. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Additionally, copies of the form must be provided to the seller by the same deadline. Adhering to these deadlines helps avoid penalties and ensures that all parties involved in the transaction are informed.

Penalties for Non-Compliance with Form 1099-S

Failure to comply with the reporting requirements for the Form 1099-S can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. The penalties can vary based on how late the form is submitted, with higher fines for more significant delays. It is crucial for individuals and businesses to understand these penalties and ensure timely and accurate reporting to avoid unnecessary financial burdens.

Quick guide on how to complete form 1099 s rev january 2022 proceeds from real estate transactions

Effortlessly Prepare Form 1099 S Rev January Proceeds From Real Estate Transactions on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruption. Manage Form 1099 S Rev January Proceeds From Real Estate Transactions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Steps to Edit and eSign Form 1099 S Rev January Proceeds From Real Estate Transactions with Ease

- Find Form 1099 S Rev January Proceeds From Real Estate Transactions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or conceal sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to send your document, via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tiresome form searching, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1099 S Rev January Proceeds From Real Estate Transactions to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1099 s form and when do I need to use it?

The 1099 s form is used to report proceeds from real estate transactions and is required by the IRS. You need to use this form if you have sold or exchanged real estate, including the sale of a house or vacant land, in a given tax year. It's important to ensure accurate filing to avoid penalties.

-

How can airSlate SignNow help with the 1099 s form process?

airSlate SignNow simplifies the eSigning and sending of the 1099 s form for various real estate transactions. Our platform allows users to quickly fill out forms and send them for signatures electronically, ensuring compliance and efficiency. With easy tracking and templates, completing the process is seamless.

-

Is airSlate SignNow cost-effective for handling 1099 s forms?

Yes, airSlate SignNow offers a cost-effective solution for managing 1099 s forms. Our pricing plans are designed to accommodate businesses of different sizes, ensuring you can manage your documentation expenses effectively. The value of eSigning and document management far outweighs the costs involved.

-

What features does airSlate SignNow offer for managing 1099 s forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage options for 1099 s forms. These tools help streamline the process, minimize errors, and keep your documents organized. Additionally, real-time notifications keep you updated on the signing status.

-

Are there any integrations available for the 1099 s form with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various popular applications, including CRM systems and accounting software, to enhance the management of your 1099 s forms. These integrations allow for seamless data transfer and improved workflow efficiency. This means you can manage your forms without duplicating efforts across platforms.

-

Can I track the status of my 1099 s form submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor the status of your 1099 s form submissions in real-time. You will receive notifications when documents are viewed, signed, or require your attention. This transparency helps ensure nothing slips through the cracks.

-

Is there customer support available if I have questions about the 1099 s form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any inquiries related to the 1099 s form. Our team is equipped to provide guidance on using the platform effectively, ensuring you can navigate the complexities of 1099 forms with ease. We're here to help you every step of the way.

Get more for Form 1099 S Rev January Proceeds From Real Estate Transactions

- Nj letter tenant 497319257 form

- New jersey waiver form

- New jersey waiver form

- Notice pay rent 497319262 form

- Notice to pay rent or lease terminates for nonresidential or commercial property days of advance notice variable new jersey form

- 3 day form

- Notice termination lease form

- Nj assignment mortgage form

Find out other Form 1099 S Rev January Proceeds From Real Estate Transactions

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online