Notice 797 Rev December Possible Federal Tax Refund Due to the Earned Income Credit EIC 2022

Understanding Notice 797 for Earned Income Credit

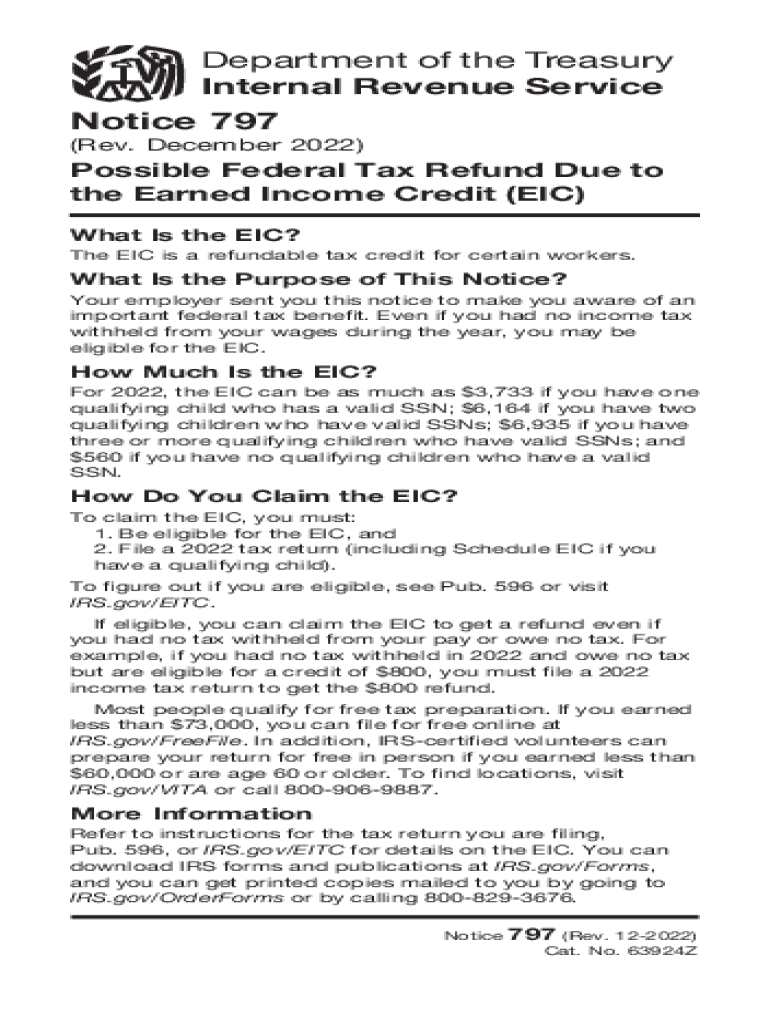

The Notice 797 Rev December is an important document issued by the Internal Revenue Service (IRS) that informs taxpayers about their potential eligibility for a federal tax refund due to the Earned Income Credit (EIC). This notice outlines the criteria for qualifying for the EIC, which is designed to benefit low to moderate-income working individuals and families. Understanding this notice can help taxpayers navigate their tax filings more effectively and ensure they do not miss out on potential refunds.

Steps to Use Notice 797 for Tax Filing

To utilize Notice 797 effectively, follow these steps:

- Review the notice carefully to understand your eligibility for the Earned Income Credit.

- Gather necessary documentation, such as proof of income and family size, to support your claim.

- Complete the relevant tax forms, ensuring you include the information indicated in Notice 797.

- Submit your tax return by the appropriate deadline, either electronically or via mail.

Obtaining Notice 797

Taxpayers can obtain Notice 797 from the IRS website or by contacting the IRS directly. It is typically mailed to eligible taxpayers who may qualify for the Earned Income Credit after they file their tax returns. If you believe you qualify and have not received the notice, it is advisable to check your eligibility through the IRS resources or consult a tax professional.

Key Elements of Notice 797

Notice 797 contains several key elements that are essential for understanding your potential tax refund:

- Eligibility Criteria: Details on income limits and qualifying dependents.

- Refund Amount: Information on the possible refund amount based on your income and family size.

- Filing Instructions: Guidelines on how to claim the EIC on your tax return.

Legal Use of Notice 797

Notice 797 serves a legal purpose in the tax filing process. It provides official communication from the IRS regarding potential refunds and eligibility for the Earned Income Credit. Taxpayers should retain this notice with their tax records as it may be required for future reference or in the event of an audit.

IRS Guidelines for Filing

The IRS provides specific guidelines regarding the filing of tax returns that include claims for the Earned Income Credit. These guidelines cover important aspects such as:

- Filing deadlines to ensure timely submission.

- Required documentation to substantiate claims for the credit.

- Methods for submitting tax returns, including online options.

Quick guide on how to complete notice 797 rev december 2022 possible federal tax refund due to the earned income credit eic

Prepare Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC with ease

- Obtain Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice 797 rev december 2022 possible federal tax refund due to the earned income credit eic

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for businesses dealing with the internal revenue service federal?

airSlate SignNow offers competitive pricing plans tailored for businesses needing to manage documentation effectively, especially for those interacting with the internal revenue service federal. Our plans are designed to fit various budgets, allowing you to send, eSign, and manage documents effortlessly. You can choose from monthly or annual subscriptions, which can lead to substantial savings.

-

How does airSlate SignNow ensure compliance with the internal revenue service federal regulations?

airSlate SignNow prioritizes compliance with all relevant laws, including the internal revenue service federal regulations. Our platform employs robust security measures tied to electronic signatures, ensuring that your transactions meet federal standards. Additionally, we offer features that help you maintain organized records for all interactions with the IRS.

-

What features does airSlate SignNow offer that are beneficial for federal tax documentation?

airSlate SignNow provides a variety of features useful for federal tax documentation, particularly for requirements set by the internal revenue service federal. Our platform allows for seamless document preparation, easy eSigning, and secure storage, ensuring that all your federal tax documents are handled with precision. You can also add fields for compliance and track the signing process.

-

Can I integrate airSlate SignNow with other tools related to the internal revenue service federal?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software tools that cater to businesses interacting with the internal revenue service federal. You can connect it with CRMs, accounting software, and document management systems, allowing for streamlined document workflows while ensuring compliance and efficiency.

-

How does airSlate SignNow enhance the efficiency of handling documents for the internal revenue service federal?

airSlate SignNow boosts efficiency for businesses managing documents with the internal revenue service federal by facilitating fast, digital processes. By enabling electronic signatures and instant document sharing, our platform reduces the time spent on paperwork, allowing you to focus on core tasks. This efficiency is crucial for timely submissions to the IRS and other federal requirements.

-

What benefits does using airSlate SignNow offer for businesses engaging with the internal revenue service federal?

Utilizing airSlate SignNow provides several benefits for businesses dealing with the internal revenue service federal. It simplifies the eSigning process, ensuring that agreements are finalized quickly and efficiently, which is essential for meeting federal deadlines. Furthermore, our user-friendly interface and robust support enhance the overall experience.

-

Is airSlate SignNow secure for managing documents related to the internal revenue service federal?

Yes, airSlate SignNow is highly secure for managing documents associated with the internal revenue service federal. We implement advanced encryption and secure access protocols to protect sensitive information. This ensures that your eSigned documents and tax-related files are kept confidential and secure.

Get more for Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC

- New mexico tenant landlord form

- New mexico letter demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles new mexico form

- Letter from tenant to landlord about landlords failure to make repairs new mexico form

- Letter landlord notice rent 497319963 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession new mexico form

- Letter from tenant to landlord about illegal entry by landlord new mexico form

- Letter from landlord to tenant about time of intent to enter premises new mexico form

Find out other Notice 797 Rev December Possible Federal Tax Refund Due To The Earned Income Credit EIC

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile